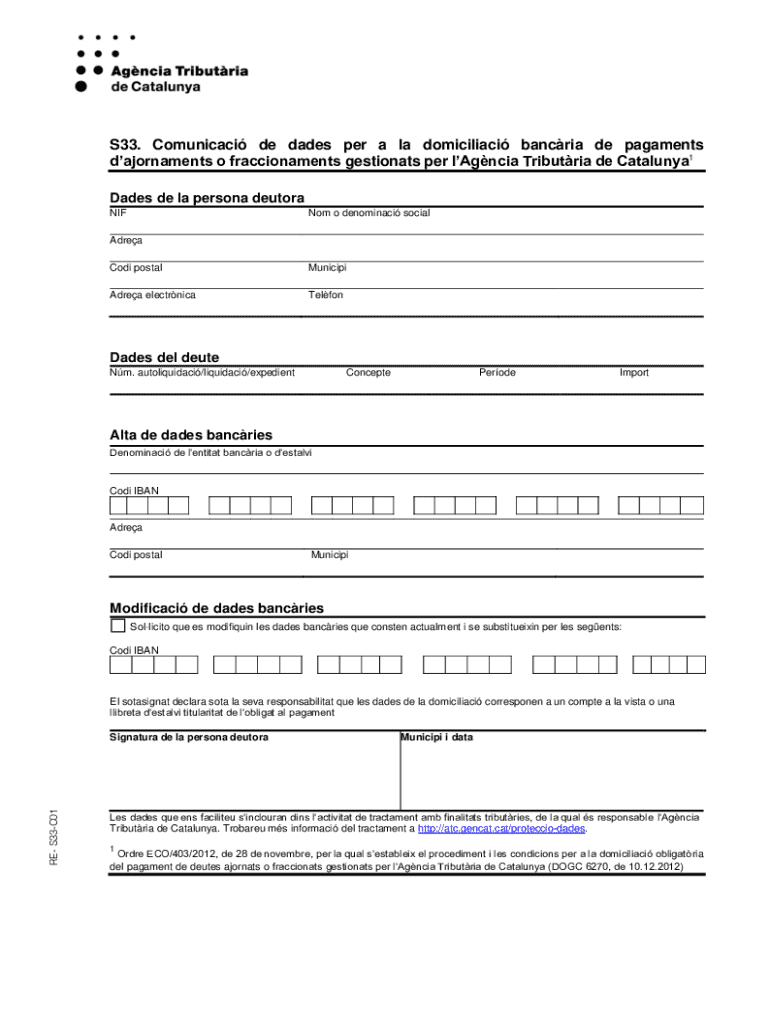

S33 Form

What is the S33

The S33 is a specific form used primarily for tax-related purposes in the United States. It serves as a declaration or application that individuals or businesses may need to submit to comply with federal or state regulations. Understanding the S33 is crucial for ensuring proper adherence to legal requirements and avoiding potential penalties.

How to use the S33

Using the S33 involves several steps that must be followed carefully. First, gather all necessary information and documentation required to complete the form accurately. This may include personal identification details, financial information, and any supporting documents relevant to the application. Next, fill out the form, ensuring that all sections are completed as required. Finally, submit the S33 through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on the specific requirements.

Steps to complete the S33

Completing the S33 requires attention to detail. Begin by reviewing the form to understand its structure and requirements. Follow these steps:

- Gather the necessary documents, such as tax returns, identification, and any other relevant paperwork.

- Carefully fill out each section of the form, ensuring that all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Sign and date the form where indicated.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the S33

The S33 must be used in accordance with applicable laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as submitting false information can lead to legal repercussions. Familiarity with state and federal guidelines regarding the use of the S33 will help individuals and businesses navigate compliance effectively.

Filing Deadlines / Important Dates

Filing deadlines for the S33 can vary based on the specific purpose of the form and the jurisdiction in which it is submitted. It is important to be aware of these deadlines to avoid late fees or penalties. Generally, forms related to tax filings have specific due dates that align with the overall tax calendar, so checking the relevant dates for the current tax year is advisable.

Required Documents

When preparing to submit the S33, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Financial statements or tax returns that support the information provided in the form.

- Any additional documentation specified in the instructions accompanying the S33.

Ensuring that all required documents are included with the submission will help facilitate a smoother processing experience.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s33

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is S33 and how does it benefit my business?

S33 is an innovative solution offered by airSlate SignNow that allows businesses to streamline their document signing process. By utilizing S33, companies can enhance efficiency, reduce turnaround times, and improve overall productivity. This user-friendly platform is designed to meet the needs of various industries, making it a versatile choice for any organization.

-

How much does S33 cost?

The pricing for S33 varies based on the specific needs of your business and the features you choose. airSlate SignNow offers flexible pricing plans that cater to different budgets, ensuring that you can find a solution that fits your financial requirements. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

What features are included in S33?

S33 includes a range of powerful features designed to simplify the eSigning process. Key features include customizable templates, real-time tracking, and secure cloud storage. Additionally, S33 supports multiple file formats, making it easy to work with various document types.

-

Can S33 integrate with other software?

Yes, S33 is designed to seamlessly integrate with a variety of third-party applications. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations enhance the functionality of S33, allowing for a more cohesive workflow.

-

Is S33 secure for sensitive documents?

Absolutely, S33 prioritizes security and compliance, ensuring that your sensitive documents are protected. The platform employs advanced encryption methods and adheres to industry standards to safeguard your data. With S33, you can confidently manage and sign documents without compromising security.

-

How can S33 improve my team's productivity?

S33 streamlines the document signing process, reducing the time spent on manual tasks. By automating workflows and providing easy access to documents, S33 allows your team to focus on more strategic initiatives. This increased efficiency can lead to signNow productivity gains across your organization.

-

What types of businesses can benefit from S33?

S33 is suitable for a wide range of businesses, from small startups to large enterprises. Any organization that requires efficient document management and eSigning can benefit from S33's features. Its versatility makes it an ideal solution for various industries, including finance, healthcare, and real estate.

Get more for S33

Find out other S33

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney