Form 8822 Rev December the Mail Archive

Understanding Form 8822 Rev December

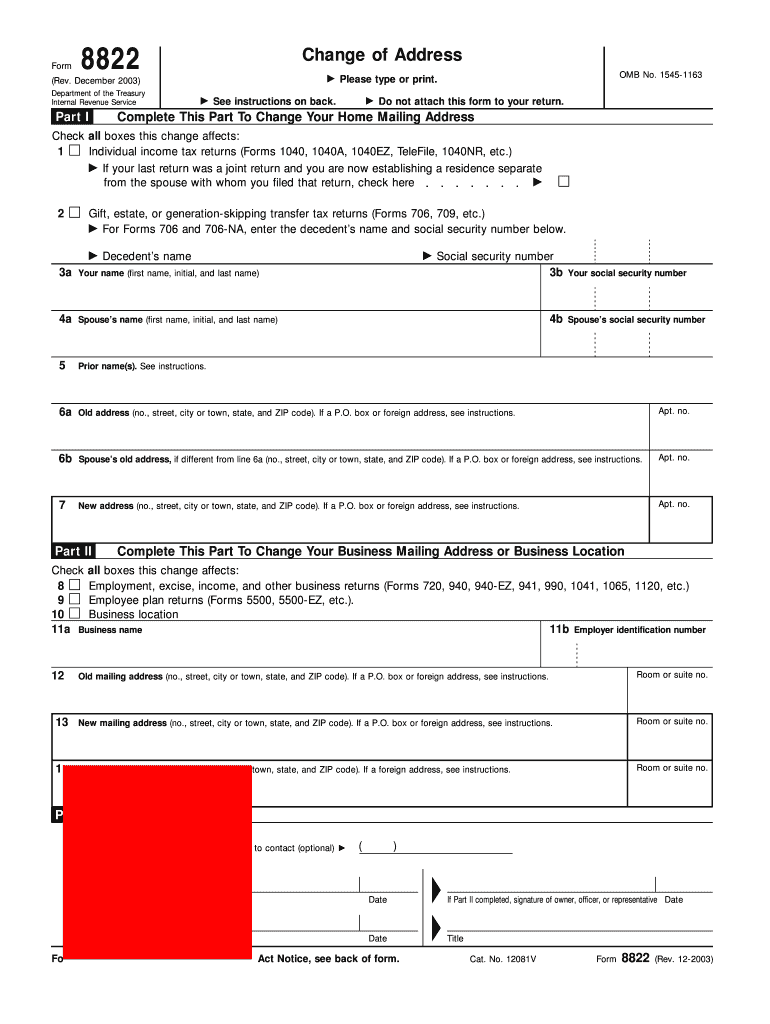

Form 8822, titled "Change of Address," is a crucial document used by taxpayers in the United States to notify the Internal Revenue Service (IRS) of a change in their mailing address. This form is particularly important for ensuring that taxpayers receive timely correspondence from the IRS, including tax refunds, notices, and other important documents. The revised version from December includes updated instructions and guidelines to facilitate the address change process.

How to Complete Form 8822 Rev December

Filling out Form 8822 involves several straightforward steps. First, taxpayers need to provide their personal information, including their name and Social Security number. Next, they should indicate their old address and the new address where they wish to receive IRS correspondence. It is essential to ensure that all information is accurate to avoid any delays or issues with the IRS. After completing the form, taxpayers must sign and date it before submission.

Obtaining Form 8822 Rev December

Taxpayers can obtain Form 8822 Rev December from the IRS website or by contacting the IRS directly. It is available in a printable format, allowing individuals to fill it out by hand or electronically. For those who prefer digital options, many tax preparation software programs also include this form, making it easy to complete and submit as part of the overall tax filing process.

Filing Methods for Form 8822 Rev December

Form 8822 can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form to the address specified in the instructions. Alternatively, if they are using tax preparation software, they may be able to submit the form electronically as part of their tax return. It is important to check the specific submission guidelines to ensure compliance with IRS requirements.

IRS Guidelines for Form 8822 Rev December

The IRS provides specific guidelines for completing and submitting Form 8822. Taxpayers should ensure they are using the most recent version of the form, as older versions may not be accepted. Additionally, it is advisable to file the form as soon as possible after moving to avoid any potential issues with receiving important tax documents. The IRS recommends submitting the form at least four weeks before the filing deadline to ensure the address change is processed in time.

Penalties for Non-Compliance with Form 8822 Rev December

Failing to submit Form 8822 when changing addresses can lead to several complications. Taxpayers may miss important correspondence from the IRS, including notices about tax liabilities or refunds. While there are no direct penalties for not filing this form, the consequences of not receiving critical information can result in missed deadlines or incorrect tax filings, which may incur penalties or interest charges.

Quick guide on how to complete form 8822 rev december the mail archive

Accomplish [SKS] seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, since you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8822 Rev December The Mail Archive

Create this form in 5 minutes!

How to create an eSignature for the form 8822 rev december the mail archive

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8822 Rev December The Mail Archive?

Form 8822 Rev December The Mail Archive is a document used by individuals to notify the IRS of a change in their address. It ensures that taxpayers receive important documents and correspondence at their new address. Understanding its importance can help you maintain compliance and avoid issues with your tax filings.

-

How does airSlate SignNow simplify the process of using Form 8822 Rev December The Mail Archive?

airSlate SignNow offers an easy-to-use platform that allows users to complete, sign, and send Form 8822 Rev December The Mail Archive electronically. With its intuitive interface, users can streamline the paperwork process and ensure timely submission. This saves time and reduces the hassle of traditional paper forms.

-

What are the pricing options for airSlate SignNow when handling Form 8822 Rev December The Mail Archive?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of different users, starting from affordable monthly subscriptions. The pricing allows users to manage documents like Form 8822 Rev December The Mail Archive without breaking the bank. Additional features can enhance the user experience at competitive rates.

-

What features does airSlate SignNow offer for Form 8822 Rev December The Mail Archive?

Key features of airSlate SignNow include eSignature capabilities, document templates, and secure cloud storage. These features allow users to efficiently manage Form 8822 Rev December The Mail Archive and other documents. Additionally, real-time collaboration makes it easy to gather necessary information from multiple parties.

-

How secure is the airSlate SignNow platform for handling Form 8822 Rev December The Mail Archive?

airSlate SignNow prioritizes user privacy and document security with high-level encryption and compliance with industry standards. This ensures that your Form 8822 Rev December The Mail Archive and any other sensitive information remain confidential. Users can trust that their documents are safeguarded against unauthorized access.

-

Can I integrate airSlate SignNow with other software for processing Form 8822 Rev December The Mail Archive?

Yes, airSlate SignNow offers integrations with various software applications to enhance workflow efficiency. By connecting with tools like Google Drive, Dropbox, and more, you can easily manage Form 8822 Rev December The Mail Archive within your existing ecosystem. This flexibility allows for a more streamlined document management process.

-

What benefits can businesses expect from using airSlate SignNow for Form 8822 Rev December The Mail Archive?

Businesses using airSlate SignNow for Form 8822 Rev December The Mail Archive can benefit from increased efficiency, reduced turnaround times, and cost savings. The ability to sign and send documents electronically speeds up the process signNowly. Additionally, businesses can improve compliance and record-keeping, resulting in fewer errors.

Get more for Form 8822 Rev December The Mail Archive

- Mdotjboss form

- Limousine form

- Analysis of impediments to fair housing choice city of saginaw form

- Piling record form 521805601

- Thetechcenter form

- Pdf royal oak dog park application downtown royal oak form

- Vp 249 affidavit of acknowlegement for a power of attorney form

- Vp 015 vehicle inspection certificate 650585839 form

Find out other Form 8822 Rev December The Mail Archive

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself