Tax Preparation United Way of the Wine Country Form

What is the Tax Preparation United Way Of The Wine Country

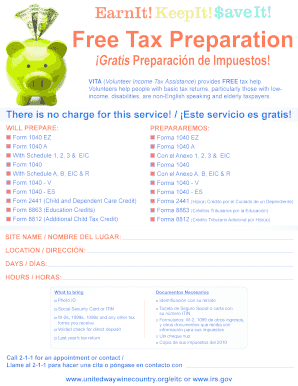

The Tax Preparation United Way Of The Wine Country is a community-focused initiative aimed at providing free tax preparation services to individuals and families in need. This program is designed to assist low- to moderate-income taxpayers in navigating the complexities of tax filing, ensuring they receive the maximum refunds and credits available to them. By leveraging trained volunteers, the program promotes financial literacy and empowers participants to understand their tax obligations and benefits.

How to use the Tax Preparation United Way Of The Wine Country

To utilize the Tax Preparation United Way Of The Wine Country services, individuals must first determine their eligibility based on income guidelines. Once eligibility is confirmed, participants can schedule an appointment through the United Way's website or by contacting their local office. During the appointment, clients should bring necessary documentation, including identification, income statements, and any relevant tax documents, to ensure a smooth filing process.

Required Documents

Gathering the appropriate documents is crucial for a successful tax preparation experience. Participants should prepare the following documents:

- Government-issued identification (e.g., driver's license, state ID)

- Social Security cards for all family members

- W-2 forms from employers

- 1099 forms for any additional income

- Proof of expenses (e.g., childcare, education costs)

- Bank account information for direct deposit of refunds

Having these documents ready will help streamline the tax preparation process and ensure all relevant information is considered.

Steps to complete the Tax Preparation United Way Of The Wine Country

Completing the tax preparation process through the United Way involves several key steps:

- Confirm eligibility based on income and family size.

- Gather all required documents as outlined above.

- Schedule an appointment with a local United Way tax preparation site.

- Attend the appointment with all necessary documentation.

- Review the completed tax return with the volunteer preparer to ensure accuracy.

- Submit the tax return electronically or via mail, as advised.

Following these steps will help ensure a smooth and efficient tax preparation experience.

IRS Guidelines

Participants in the Tax Preparation United Way Of The Wine Country program must adhere to IRS guidelines for filing taxes. This includes understanding eligibility for various tax credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). It is essential to ensure that all income is reported accurately and that deductions are claimed appropriately to avoid any issues with the IRS.

Filing Deadlines / Important Dates

Taxpayers should be aware of key filing deadlines to avoid penalties. The typical tax filing deadline is April 15th for individual taxpayers. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should note that extensions can be filed, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete tax preparation united way of the wine country

Complete [SKS] effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant portions of the documents or obscure sensitive data using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form browsing, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Alter and eSign [SKS] to ensure exceptional communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Preparation United Way Of The Wine Country

Create this form in 5 minutes!

How to create an eSignature for the tax preparation united way of the wine country

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Tax Preparation United Way Of The Wine Country offer?

The Tax Preparation United Way Of The Wine Country provides comprehensive tax services designed to meet the diverse needs of individuals and businesses. Our services include tax filing, assistance with tax credits, and expert advice to maximize your returns. We ensure that you understand the tax process while providing support every step of the way.

-

How can I benefit from Tax Preparation United Way Of The Wine Country?

Utilizing Tax Preparation United Way Of The Wine Country can help you save time and reduce stress during tax season. Our knowledgeable team is dedicated to finding deductions and credits that you may qualify for, ultimately maximizing your potential refund. With our services, you can rest assured that your taxes are handled correctly and efficiently.

-

What is the pricing structure for Tax Preparation United Way Of The Wine Country services?

The pricing for Tax Preparation United Way Of The Wine Country services varies depending on the complexity of your tax situation. We offer competitive rates and transparent pricing so that you know exactly what to expect. For a personalized quote, we encourage potential clients to signNow out for a consultation.

-

Are there any special features included in the Tax Preparation United Way Of The Wine Country program?

Yes, Tax Preparation United Way Of The Wine Country features an easy-to-navigate interface that simplifies the tax filing process. Additionally, our program includes dedicated support from experienced tax professionals and access to a wealth of resources and information tailored to your specific needs. This allows for a more informed and seamless tax preparation experience.

-

Can Tax Preparation United Way Of The Wine Country integrate with my existing accounting software?

Certainly! Tax Preparation United Way Of The Wine Country is designed to integrate seamlessly with many popular accounting software solutions. This ensures that your financial data is accurately reflected in your tax documents, streamlining the preparation process. Check with us to see which integrations are available.

-

How does Tax Preparation United Way Of The Wine Country ensure client data security?

At Tax Preparation United Way Of The Wine Country, we prioritize the security of our clients' data. We implement robust encryption and secure storage protocols, ensuring that your personal and financial information remains confidential. Our team is trained to follow best practices in data security to provide you with peace of mind.

-

What makes Tax Preparation United Way Of The Wine Country different from other tax services?

What sets Tax Preparation United Way Of The Wine Country apart is our commitment to community-focused services and personalized assistance. Our team not only provides expert tax preparation but also engages in ongoing training to stay updated on tax laws. We aim to build long-term relationships with our clients by delivering tailored solutions that meet their unique financial situations.

Get more for Tax Preparation United Way Of The Wine Country

- Nevada residency certification form

- 555 wright way carson city nv 897110700 renospar form

- Copy request form

- Www longisland combusinessgarden city policegarden city police department long island form

- City planning commission disposition sheet sara av form

- Service hours time sheet fill online printable fillable blank form

- Music therapy referral form 612662894

- Oh elections absent voters ballot form

Find out other Tax Preparation United Way Of The Wine Country

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free