New York State Department of Taxation and Finance Nonresident and Part Year Resident for Office Use Only Income Tax Return Attac Form

What is the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attach Label If Available Tax Ny

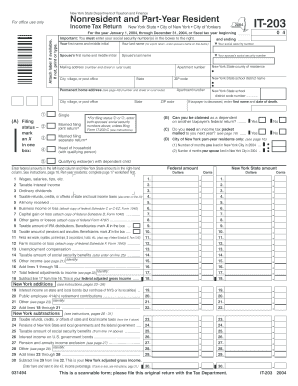

The New York State Department of Taxation and Finance Nonresident and Part Year Resident Income Tax Return is a specific form designed for individuals who do not reside in New York for the entire year but have earned income from New York sources. This form is essential for reporting income accurately and ensuring compliance with state tax laws. It is particularly relevant for those who may have moved in or out of New York during the tax year, allowing them to report only the income earned while they were residents or nonresidents.

How to use the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attach Label If Available Tax Ny

Using the New York State Nonresident and Part Year Resident Income Tax Return involves several steps. First, gather all necessary documentation, including W-2 forms and any 1099s for income earned in New York. Next, accurately fill out the form by reporting your income and deductions based on your residency status. Ensure that you attach any required labels or additional documentation as indicated. Finally, review the completed form for accuracy before submitting it either online or via mail, depending on your preference.

Steps to complete the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attach Label If Available Tax Ny

Completing the New York State Nonresident and Part Year Resident Income Tax Return involves a clear set of steps:

- Collect all income documents, including W-2s and 1099s.

- Determine your residency status for the tax year.

- Fill out the form accurately, reporting only the income earned while a resident or nonresident.

- Include any deductions or credits you are eligible for.

- Attach any necessary labels or additional documentation as required.

- Review the form for accuracy and completeness.

- Submit the form either online or by mail.

Required Documents

When completing the New York State Nonresident and Part Year Resident Income Tax Return, certain documents are essential:

- W-2 forms for income earned in New York.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Proof of residency status, if applicable.

- Documentation for any deductions or credits claimed.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the New York State Nonresident and Part Year Resident Income Tax Return. Typically, the deadline aligns with the federal tax filing deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check for any updates or changes to ensure timely filing and avoid penalties.

Penalties for Non-Compliance

Failure to file the New York State Nonresident and Part Year Resident Income Tax Return can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is important to file accurately and on time to avoid these consequences and maintain good standing with the state tax authority.

Quick guide on how to complete new york state department of taxation and finance nonresident and part year resident for office use only income tax return

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attac

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance nonresident and part year resident for office use only income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return?

The New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return is a tax form designed for individuals who do not reside in New York for the entire year but have income sourced from New York. It allows taxpayers to accurately report their income and determine their tax obligations while ensuring compliance with state regulations.

-

How can airSlate SignNow help with the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return?

airSlate SignNow streamlines the process of preparing and submitting the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return by offering easy document management and eSigning features. Users can collaborate in real-time, ensuring all necessary documents are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax returns?

airSlate SignNow provides robust features such as customizable templates, document sharing, and in-app signing which are essential for managing tax returns like the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return. These features help simplify the document workflow, enhancing efficiency and reducing potential errors.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. Depending on the features you require for handling documents, including the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return, you can choose a plan that fits your budget.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, which can help you manage your documents related to the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return. This integration allows you to maintain a smooth workflow and ensure that all your financial data is synchronized effortlessly.

-

What benefits do users gain from using airSlate SignNow for tax preparation?

Users of airSlate SignNow benefit from an intuitive interface, efficient document management, and secure eSigning capabilities. These benefits are crucial when dealing with important documents like the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return, ensuring a hassle-free tax preparation experience.

-

How secure is my information with airSlate SignNow?

airSlate SignNow prioritizes user security by employing advanced encryption technologies and compliance with data protection regulations. This ensures that your sensitive information related to the New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return is protected against unauthorized access.

Get more for New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attac

- Water city of black diamond form

- Tn change address notary public form

- Food delivery receipt dphhs mt form

- Covenant agreement definition ampamp sample contractscounsel form

- Other languages wisconsin court system circuit court forms

- La act donation form

- County provides septic tank pump out for residents form

- Www biggs ca govdocumentsfence permitfence permit application biggs ca gov form

Find out other New York State Department Of Taxation And Finance Nonresident And Part Year Resident For Office Use Only Income Tax Return Attac

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract