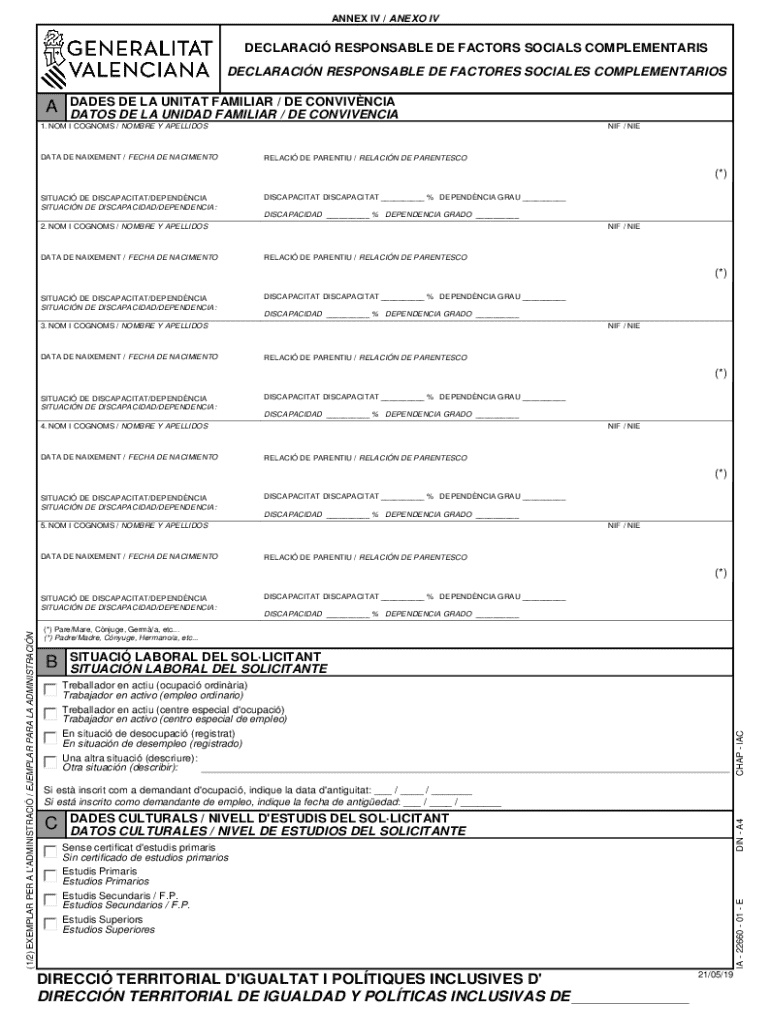

Annex Iv Anexo Iv Form

Understanding the Annex IV Anexo IV

The Annex IV Anexo IV is a crucial document used primarily in tax reporting and compliance within the United States. It serves as an attachment to various tax forms, helping to provide detailed information about specific financial activities or transactions. This form is essential for individuals and businesses to accurately report their income, deductions, and credits to the Internal Revenue Service (IRS).

Typically, the Annex IV is utilized by taxpayers who need to disclose additional information that is not covered in the main tax forms. Understanding its purpose and requirements is vital for ensuring compliance with federal tax laws.

Steps to Complete the Annex IV Anexo IV

Completing the Annex IV Anexo IV requires careful attention to detail. Here are the general steps to follow:

- Gather necessary information, including financial records and previous tax returns.

- Review the instructions provided with the main tax form to understand how the Annex IV fits into your overall tax filing.

- Fill out the form accurately, ensuring that all relevant financial data is included.

- Double-check your entries for accuracy and completeness.

- Attach the completed Annex IV to your main tax form before submission.

Following these steps will help ensure that you provide the necessary information for your tax filing and comply with IRS requirements.

Legal Use of the Annex IV Anexo IV

The Annex IV Anexo IV is legally required for certain taxpayers to report specific financial information. Its use is governed by IRS regulations, which outline the circumstances under which this form must be filed. Failure to include the Annex IV when required can lead to penalties, including fines and interest on unpaid taxes.

It is important for taxpayers to understand their legal obligations regarding this form to avoid potential non-compliance issues. Consulting a tax professional can provide clarity on the legal requirements associated with the Annex IV.

Required Documents for the Annex IV Anexo IV

To complete the Annex IV Anexo IV, you will need several key documents:

- Previous tax returns to reference past financial data.

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits you plan to claim.

- Documentation of any specific transactions that require disclosure on the Annex IV.

Having these documents ready will streamline the process of filling out the Annex IV and help ensure accuracy in your reporting.

Examples of Using the Annex IV Anexo IV

There are various scenarios where the Annex IV Anexo IV is applicable. For instance:

- A self-employed individual may use the form to report income from freelance work that exceeds a certain threshold.

- A business entity might need to disclose information about foreign transactions or investments.

- Taxpayers claiming specific deductions, such as those related to business expenses, often attach the Annex IV to provide detailed explanations.

These examples illustrate the form's versatility in addressing diverse financial situations and compliance requirements.

Filing Deadlines for the Annex IV Anexo IV

Filing deadlines for the Annex IV Anexo IV align with the main tax form it accompanies. Typically, individual tax returns are due on April 15, while businesses may have different deadlines based on their structure. It is essential to be aware of these deadlines to avoid late filing penalties.

In some cases, taxpayers may apply for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annex iv anexo iv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Annex Iv Anexo Iv and how does it relate to airSlate SignNow?

Annex Iv Anexo Iv refers to specific documentation requirements that can be efficiently managed using airSlate SignNow. Our platform allows businesses to create, send, and eSign these documents seamlessly, ensuring compliance and ease of use.

-

How does airSlate SignNow handle pricing for services related to Annex Iv Anexo Iv?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring Annex Iv Anexo Iv documentation. Our pricing is transparent, with no hidden fees, allowing you to choose a plan that fits your budget while accessing essential features.

-

What features does airSlate SignNow provide for managing Annex Iv Anexo Iv documents?

With airSlate SignNow, you can easily create, edit, and manage Annex Iv Anexo Iv documents. Our platform includes features like templates, automated workflows, and secure eSigning, making it simple to handle all your documentation needs efficiently.

-

What are the benefits of using airSlate SignNow for Annex Iv Anexo Iv?

Using airSlate SignNow for Annex Iv Anexo Iv offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution streamlines the signing process, allowing you to focus on your core business activities while ensuring compliance.

-

Can airSlate SignNow integrate with other tools for managing Annex Iv Anexo Iv?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to manage Annex Iv Anexo Iv documents. This integration capability allows you to connect with CRM systems, cloud storage, and other tools to streamline your workflow.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with Annex Iv Anexo Iv?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, whether you're a small startup or a large enterprise dealing with Annex Iv Anexo Iv. Our scalable solution adapts to your needs, ensuring you have the right tools for effective document management.

-

How secure is airSlate SignNow when handling Annex Iv Anexo Iv documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your Annex Iv Anexo Iv documents, ensuring that your sensitive information remains safe throughout the signing process.

Get more for Annex Iv Anexo Iv

- Phoenix health plans prior authorization form

- Mdh tb risk assessment form

- 4187 reduction in rank example form

- Api 510 pdf download form

- As1 form example

- Creating asthma friendly schools in montana form

- F i r e d e pa r t m e n t form

- Tdh rider 27 child abuse reporting form child abuse reporting form

Find out other Annex Iv Anexo Iv

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form