Social Security and Medicare Exemption CSULB Foundation Form

What is the Social Security and Medicare Exemption CSULB Foundation

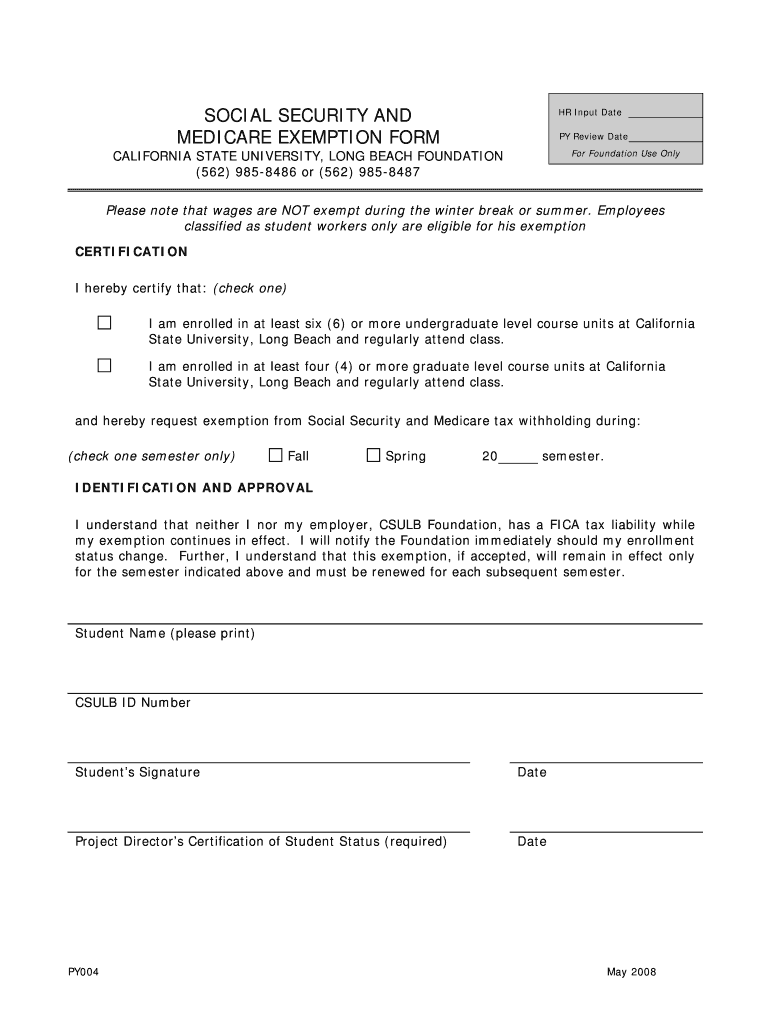

The Social Security and Medicare Exemption for the CSULB Foundation is a specific provision that allows certain employees or contractors associated with the California State University, Long Beach (CSULB) Foundation to be exempt from Social Security and Medicare taxes. This exemption is typically applicable to individuals who are not considered employees under the traditional definitions set by the IRS. Understanding this exemption is crucial for both the foundation and its associates to ensure compliance with federal tax regulations.

How to Obtain the Social Security and Medicare Exemption CSULB Foundation

To obtain the Social Security and Medicare Exemption from the CSULB Foundation, individuals must first determine their eligibility based on their employment status. Eligible parties usually include those working in specific capacities that do not fall under standard employee classifications. Interested individuals should contact the foundation’s human resources or payroll department to receive detailed instructions on the application process and any necessary documentation required to apply for the exemption.

Steps to Complete the Social Security and Medicare Exemption CSULB Foundation

Completing the Social Security and Medicare Exemption involves several key steps:

- Verify eligibility for the exemption based on employment status.

- Gather required documentation, which may include proof of employment type and tax identification.

- Fill out the necessary forms as instructed by the CSULB Foundation’s human resources department.

- Submit the completed forms along with any supporting documents to the appropriate office within the foundation.

- Await confirmation of the exemption status from the foundation.

Legal Use of the Social Security and Medicare Exemption CSULB Foundation

The legal use of the Social Security and Medicare Exemption is governed by IRS regulations and specific guidelines set forth by the CSULB Foundation. It is essential for individuals to understand the legal implications of this exemption, including any responsibilities they may have in terms of reporting and compliance. Misuse of the exemption can lead to penalties, so it is advisable to consult with a tax professional or the foundation’s legal counsel if there are any uncertainties regarding eligibility or compliance.

Eligibility Criteria for the Social Security and Medicare Exemption CSULB Foundation

Eligibility for the Social Security and Medicare Exemption typically hinges on the individual’s employment classification. Generally, the following criteria must be met:

- The individual must be associated with the CSULB Foundation in a capacity that does not classify them as a traditional employee.

- They must provide documentation that supports their claim for exemption.

- The individual should not have previously been classified as an employee for Social Security and Medicare purposes.

Required Documents for the Social Security and Medicare Exemption CSULB Foundation

When applying for the Social Security and Medicare Exemption, applicants must prepare several documents to support their application. These typically include:

- A completed exemption application form.

- Proof of employment status, such as contracts or letters from the CSULB Foundation.

- Tax identification information, such as a Social Security number or Employer Identification Number (EIN).

Quick guide on how to complete social security and medicare exemption csulb foundation

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your files quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to finalize your modifications.

- Decide how you wish to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Edit and eSign [SKS] to guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Social Security And Medicare Exemption CSULB Foundation

Create this form in 5 minutes!

How to create an eSignature for the social security and medicare exemption csulb foundation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Social Security And Medicare Exemption CSULB Foundation?

The Social Security And Medicare Exemption CSULB Foundation refers to specific exemptions related to Social Security and Medicare contributions for eligible employees. This exemption can signNowly impact payroll calculations and benefits for those associated with the CSULB Foundation.

-

How can airSlate SignNow assist with the Social Security And Medicare Exemption CSULB Foundation?

airSlate SignNow provides a streamlined platform for managing documents related to the Social Security And Medicare Exemption CSULB Foundation. With our eSigning capabilities, you can easily send, sign, and store essential documents securely, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for Social Security And Medicare Exemption CSULB Foundation documentation?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of organizations handling Social Security And Medicare Exemption CSULB Foundation documents. Our plans are designed to be cost-effective, ensuring you get the best value for your investment in document management.

-

What features does airSlate SignNow offer for managing Social Security And Medicare Exemption CSULB Foundation documents?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to simplify the management of Social Security And Medicare Exemption CSULB Foundation documents. These tools enhance productivity and ensure that all necessary documentation is easily accessible.

-

Are there any benefits to using airSlate SignNow for Social Security And Medicare Exemption CSULB Foundation processes?

Using airSlate SignNow for Social Security And Medicare Exemption CSULB Foundation processes can lead to increased efficiency and reduced paperwork. Our solution allows for faster document turnaround times and improved accuracy, which can ultimately save your organization time and resources.

-

Can airSlate SignNow integrate with other tools for managing Social Security And Medicare Exemption CSULB Foundation?

Yes, airSlate SignNow offers integrations with various tools and platforms that can help manage Social Security And Medicare Exemption CSULB Foundation documentation. This ensures that you can seamlessly incorporate our eSigning solution into your existing workflows and systems.

-

Is airSlate SignNow secure for handling Social Security And Medicare Exemption CSULB Foundation documents?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Social Security And Medicare Exemption CSULB Foundation documents. Our platform employs advanced encryption and security protocols to protect sensitive information.

Get more for Social Security And Medicare Exemption CSULB Foundation

- Individual life insurance quote request form flexible benefit

- 2regular mailing address state board of med form

- Authorization for release of pennsylvania emergenc form

- The center for functional healththe rehab group of form

- Virginia medication consent form

- Case report consent form 227414741

- National housing relief and assistance to help people form

- Patient screening form 13854360

Find out other Social Security And Medicare Exemption CSULB Foundation

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template