Form 4506T EZ October

What is the Form 4506T EZ October

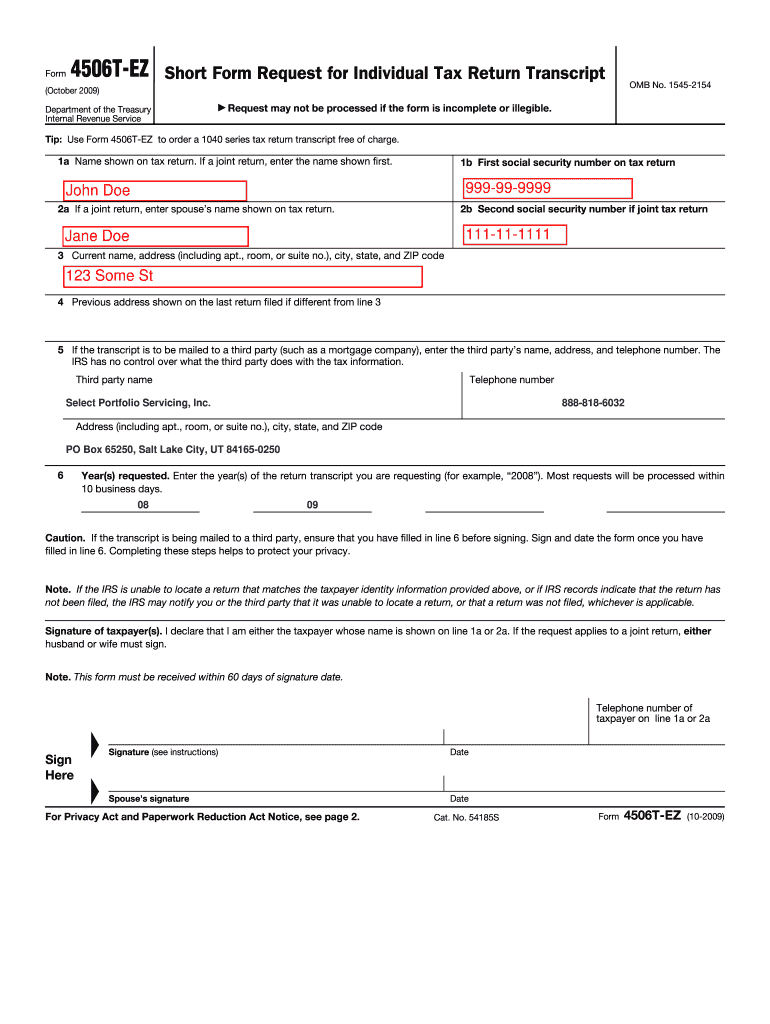

The Form 4506T EZ is a simplified version of the standard Form 4506-T, which is used to request a transcript of tax return information from the Internal Revenue Service (IRS). This specific form allows taxpayers to obtain a limited set of information, making it a quicker option for those who do not need the full details provided by the standard form. The EZ version is particularly useful for individuals seeking to verify income or tax information for purposes such as loan applications or financial aid.

How to use the Form 4506T EZ October

To effectively use the Form 4506T EZ, individuals must first ensure they meet the eligibility criteria, which typically includes being an individual taxpayer. The form can be filled out online or printed for manual completion. After filling out the necessary information, including personal details and the specific tax years requested, the form can be submitted directly to the IRS. It is important to follow the instructions carefully to ensure accurate processing and to avoid delays.

Steps to complete the Form 4506T EZ October

Completing the Form 4506T EZ involves several straightforward steps:

- Begin by entering your name and Social Security number at the top of the form.

- Provide your current address and any previous addresses if applicable.

- Indicate the specific tax years for which you are requesting transcripts.

- Sign and date the form to authorize the IRS to release your information.

- Submit the completed form to the IRS via mail or fax, as indicated in the instructions.

Legal use of the Form 4506T EZ October

The Form 4506T EZ is legally recognized by the IRS as a valid request for tax return information. It is commonly used in various legal and financial contexts, including loan applications, mortgage processes, and income verification for government assistance programs. Proper use of this form ensures compliance with IRS regulations while facilitating access to necessary tax information.

Filing Deadlines / Important Dates

While there are no specific filing deadlines for submitting the Form 4506T EZ, it is important to consider the timing of your request based on your needs. For instance, if you require tax transcripts for a loan application, it is advisable to submit the form well in advance of any deadlines set by the lender. Additionally, processing times can vary, so allowing ample time for the IRS to fulfill your request is essential.

Required Documents

When submitting the Form 4506T EZ, no additional documents are typically required. However, it is important to ensure that the form is completed accurately, as any discrepancies may lead to processing delays. Keeping a copy of the completed form for your records is also recommended, as it can serve as proof of your request.

Quick guide on how to complete form 4506t ez october

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and ease any document-related tasks today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4506T EZ October

Create this form in 5 minutes!

How to create an eSignature for the form 4506t ez october

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506T EZ October and how can it benefit my business?

The Form 4506T EZ October is a simplified version of the IRS form used to request tax return information. By utilizing airSlate SignNow, businesses can easily eSign and send this form, streamlining the process and saving time. This efficient solution helps ensure that your requests are processed quickly and accurately.

-

How does airSlate SignNow ensure the security of my Form 4506T EZ October?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your Form 4506T EZ October. Our platform is designed to keep your sensitive information safe while allowing for seamless eSigning. You can trust that your documents are secure throughout the entire process.

-

What are the pricing options for using airSlate SignNow with the Form 4506T EZ October?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those who frequently use the Form 4506T EZ October. Our cost-effective solutions ensure that you only pay for what you need, making it accessible for businesses of all sizes. Visit our pricing page for detailed information on available plans.

-

Can I integrate airSlate SignNow with other software for processing the Form 4506T EZ October?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow when processing the Form 4506T EZ October. This allows you to connect with CRM systems, document management tools, and more, ensuring a smooth experience. Check our integrations page for a full list of compatible applications.

-

Is it easy to eSign the Form 4506T EZ October using airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive interface that makes eSigning the Form 4506T EZ October quick and easy. Users can simply upload the form, add their signature, and send it off without any hassle, making the process efficient and user-friendly.

-

What features does airSlate SignNow offer for managing the Form 4506T EZ October?

airSlate SignNow includes a variety of features designed to simplify the management of the Form 4506T EZ October. These features include document templates, automated workflows, and real-time tracking, allowing you to monitor the status of your requests. This comprehensive approach helps ensure that your forms are handled efficiently.

-

How can airSlate SignNow help reduce turnaround time for the Form 4506T EZ October?

By using airSlate SignNow, businesses can signNowly reduce the turnaround time for the Form 4506T EZ October. Our platform allows for instant eSigning and document sharing, eliminating the delays associated with traditional methods. This efficiency can lead to faster processing and improved customer satisfaction.

Get more for Form 4506T EZ October

Find out other Form 4506T EZ October

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast