Credit for Contributions Arizona Form to Qualifying Charitable

What is the Credit For Contributions Arizona Form To Qualifying Charitable

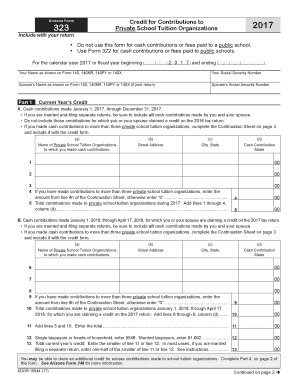

The Credit For Contributions Arizona Form To Qualifying Charitable is a state-specific tax form that allows Arizona taxpayers to claim a credit for contributions made to qualifying charitable organizations. This form is designed to encourage charitable giving by providing a tax incentive, reducing the overall tax liability for individuals and businesses. Eligible contributions can include donations made to specific charities that meet the criteria set forth by the Arizona Department of Revenue.

How to use the Credit For Contributions Arizona Form To Qualifying Charitable

Using the Credit For Contributions Arizona Form To Qualifying Charitable involves a few straightforward steps. First, ensure that the charitable organization you wish to contribute to is recognized as a qualifying entity by the state. Next, complete the form by providing necessary details such as your personal information, the amount contributed, and the name of the charity. After filling out the form, you may submit it along with your tax return, ensuring that you retain copies of all documentation for your records.

Steps to complete the Credit For Contributions Arizona Form To Qualifying Charitable

Completing the Credit For Contributions Arizona Form To Qualifying Charitable requires attention to detail. Follow these steps:

- Gather all relevant information about your contributions, including the name and address of the charity, as well as the amount donated.

- Obtain the form from the Arizona Department of Revenue website or through your tax preparation software.

- Fill in your personal information, including your Social Security number and filing status.

- Enter the total contributions made to qualifying charities during the tax year.

- Double-check your entries for accuracy and completeness.

- Attach the completed form to your state tax return before submission.

Key elements of the Credit For Contributions Arizona Form To Qualifying Charitable

The key elements of the Credit For Contributions Arizona Form To Qualifying Charitable include the taxpayer's identification information, the total amount of contributions made, and the list of qualifying charitable organizations. Additionally, the form requires the taxpayer to certify that the contributions were made to eligible entities, ensuring compliance with state regulations. Understanding these elements is crucial for accurately claiming the credit and maximizing tax benefits.

Eligibility Criteria

To be eligible for the Credit For Contributions Arizona Form To Qualifying Charitable, taxpayers must meet specific criteria. Contributions must be made to qualifying charitable organizations recognized by the Arizona Department of Revenue. There are limits on the amount that can be claimed, which may vary based on the taxpayer's filing status. Additionally, taxpayers must ensure that their contributions are made within the designated tax year to qualify for the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Credit For Contributions Arizona Form To Qualifying Charitable align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their state tax returns, including this form, by April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines to ensure timely submission and avoid penalties.

Quick guide on how to complete form 323

Effortlessly prepare form 323 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage form 323 on any device using airSlate SignNow apps for Android or iOS and streamline any document-based process today.

The easiest way to modify and eSign arizona form 323 instructions with ease

- Obtain az form 323 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that are specially provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in a few simple clicks from your chosen device. Modify and eSign topriate and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs topriate

-

Which code do I have to fill in NEET 2017 form for qualification s qualifying examination codes?

Code 2 - Students from CBSE/ICSE Board who has passed the 12th Examination as a dropper. Students from State Board where 10+2 structure is followed should also use this code if they have successfully passed the Examination.Code 3- A student who has passed PUC Examination i.e., Karnataka PUC Examination.So your code is 2.

-

Which is the last day to fill out the form for CPT December 2017?

Hi, Last date to register with ICAI for CPC course to appear in December 2017 exam is 01st October ‘2017. For more information about CA CPT exam, study material, past year question paper, sample paper and mock test you can visit Online classes for CA CPT, CA IPCC & CA Final from JK Shah Classes - CAPrep18

-

What is the last date to fill out the management form in BVM and GCET for B.tech admission 2017?

BVM, GCET and ADIT- all these three colleges have common form for management admissions. You can refer website of BVM or GCET or ADIT to get the form and details precisely!Even if you will make a call they will furnish information. (Get college’s contact number from website. )If nothing works out, drop me a message- I have personal contacts.:)

-

Which form other than NEET and AIIMS are going to be out for 2017 and I should fill?

There are many other options open for you if you have had MATHS as a subject along with the other three main subjects.PCMB - You can apply for B.Tech. in BIOTech., BIOMEDICAL, BIOCHEMISTRY.JEE MAINSJEE ADVANCEDTUPCB -JIPMER (MBBS / NMT / CVT)Indian Institute of Science Bangalore (B.S. in BIOLOGY)NEST (B.S. + M.S. in BIOLOGY)Manipal School of Allied Health Sciences (B.S. and M.S. in NMT and CVT)I will try to add more when I find them out.Hope that helped.Thanks for A2A.

Related searches to form 323

Create this form in 5 minutes!

How to create an eSignature for the arizona form 323 instructions

How to create an eSignature for the 2017 Credit For Contributions Arizona Form To Qualifying Charitable in the online mode

How to make an electronic signature for the 2017 Credit For Contributions Arizona Form To Qualifying Charitable in Google Chrome

How to generate an eSignature for putting it on the 2017 Credit For Contributions Arizona Form To Qualifying Charitable in Gmail

How to make an eSignature for the 2017 Credit For Contributions Arizona Form To Qualifying Charitable right from your smart phone

How to generate an electronic signature for the 2017 Credit For Contributions Arizona Form To Qualifying Charitable on iOS

How to generate an eSignature for the 2017 Credit For Contributions Arizona Form To Qualifying Charitable on Android

People also ask topriate

-

What is form 323?

Form 323 is a crucial document used for various regulatory purposes. Understanding its requirements is essential for businesses to ensure compliance. Using airSlate SignNow, you can efficiently create, send, and eSign form 323 to streamline your processes.

-

How does airSlate SignNow simplify the completion of form 323?

airSlate SignNow provides intuitive tools that make completing form 323 straightforward. Users can fill out the form electronically, ensuring accuracy and reducing the risk of errors. The platform also facilitates easy sharing among stakeholders for quicker approvals.

-

What are the pricing plans for using airSlate SignNow with form 323?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small startup or a large enterprise, there is a plan that can help you effectively manage form 323. Check our website for the latest pricing information and find the best fit for your organization.

-

Are there any specific features for managing form 323 in airSlate SignNow?

Yes, airSlate SignNow is equipped with features specifically designed for managing form 323. This includes customizable templates, real-time collaboration, and secure eSignature capabilities that ensure compliance and speed up the workflow.

-

What benefits does using airSlate SignNow for form 323 provide?

Using airSlate SignNow for form 323 streamlines your documentation process and enhances productivity. You benefit from reduced manual work, improved accuracy, and faster turnaround times for approvals and signatures. Additionally, it provides a secure environment for sensitive information.

-

Can form 323 be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports numerous integrations, allowing you to connect form 323 with your existing tools and systems. This ensures a seamless flow of information and helps you manage documents more efficiently across different platforms.

-

How does airSlate SignNow ensure the security of form 323?

Security is a top priority at airSlate SignNow, especially when handling critical documents like form 323. The platform employs advanced encryption, secure data storage, and user authentication measures to protect your documents from unauthorized access and ensure compliance.

Get more for form 323

Find out other arizona form 323 instructions

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document