Form 5471 Schedule J Rev December Accumulated Earnings and Profits E&amp

What is the Form 5471 Schedule J Rev December Accumulated Earnings And Profits

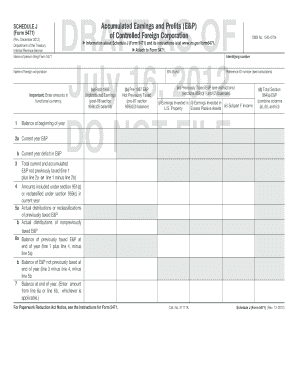

The Form 5471 Schedule J Rev December is a tax form used by U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This schedule is specifically designed to report the accumulated earnings and profits (E&P) of these foreign entities. Understanding accumulated earnings and profits is crucial as it helps determine the tax implications for U.S. shareholders when dividends are distributed. The form is part of the broader Form 5471, which is required to disclose information about foreign corporations and their financial activities to the IRS.

How to use the Form 5471 Schedule J Rev December Accumulated Earnings And Profits

Using the Form 5471 Schedule J Rev December involves accurately reporting the accumulated earnings and profits of a foreign corporation. Taxpayers must first gather the necessary financial information from the corporation's records. This includes detailed financial statements that reflect the corporation's income, expenses, and distributions. Once the relevant data is collected, it can be entered into the appropriate sections of the form. It is essential to ensure that all figures are accurate and comply with IRS guidelines to avoid penalties.

Steps to complete the Form 5471 Schedule J Rev December Accumulated Earnings And Profits

Completing the Form 5471 Schedule J Rev December requires several methodical steps:

- Gather financial statements of the foreign corporation, including balance sheets and income statements.

- Calculate the total accumulated earnings and profits as of the end of the tax year.

- Fill out the form by entering the calculated figures in the designated sections.

- Review the completed form for accuracy and compliance with IRS requirements.

- Submit the form along with the complete Form 5471 by the due date.

Key elements of the Form 5471 Schedule J Rev December Accumulated Earnings And Profits

Key elements of the Form 5471 Schedule J Rev December include:

- Accumulated Earnings and Profits Calculation: This section requires a detailed calculation of the corporation's E&P, including income and distributions.

- Reporting Requirements: Taxpayers must provide specific details about the foreign corporation, including its name, address, and tax identification number.

- Signature and Verification: The form must be signed by the taxpayer or an authorized representative, verifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5471 Schedule J Rev December are critical to avoid penalties. Generally, the form must be filed with the taxpayer's income tax return by the due date of that return, including extensions. For most individuals, this means the form is due on April fifteenth, but it may vary based on specific circumstances or extensions. It is advisable to keep track of any changes in IRS regulations regarding filing dates to ensure compliance.

Penalties for Non-Compliance

Failure to file the Form 5471 Schedule J Rev December can result in significant penalties. The IRS imposes a penalty for each month the form is late, with a maximum penalty that can accumulate quickly. Additionally, non-compliance may lead to increased scrutiny from the IRS, resulting in audits or further legal implications. It is essential for taxpayers to understand these risks and ensure timely and accurate filing to avoid penalties.

Quick guide on how to complete form 5471 schedule j rev december accumulated earnings and profits eampamp

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize critical sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp

Create this form in 5 minutes!

How to create an eSignature for the form 5471 schedule j rev december accumulated earnings and profits eampamp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&. is a tax form used by U.S. citizens and residents to report the accumulated earnings and profits of foreign corporations. This form is essential for ensuring compliance with IRS regulations and helps in accurately calculating tax liabilities.

-

How can airSlate SignNow help with Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

airSlate SignNow provides a streamlined platform for businesses to prepare, send, and eSign documents, including Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&. Our user-friendly interface simplifies the process, ensuring that you can complete your tax forms efficiently and accurately.

-

What features does airSlate SignNow offer for managing Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

With airSlate SignNow, you can access features like customizable templates, secure eSigning, and document tracking specifically for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&. These tools enhance your workflow and ensure that all necessary documentation is handled seamlessly.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using our platform for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&., you can save time and reduce costs associated with traditional document management and filing processes.

-

Can I integrate airSlate SignNow with other software for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow when dealing with Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&. This ensures that all your data is synchronized and easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

Using airSlate SignNow for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&. offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform helps you stay compliant while making the document management process more efficient.

-

How secure is airSlate SignNow when handling Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp.?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your sensitive information related to Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&., ensuring that your data remains confidential and safe from unauthorized access.

Get more for Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp

- Australian standard transfer form with blank address field use this form for a change in ownership

- Status report on the protection against form

- Parish priest reference form st john the baptist catholic primary sjbwoywoy org

- Application for a person to be police nsw gov au form

- Diabetes assessment form pdf

- Proof of aboriginalityaiatsisconfirmation of aboriginality or torres strait islander proof of aboriginalityaiatsisconfirmation form

- Form 29aa interim intervention order courts sa gov au

- Alrp 66 form fill online printable fillable blank

Find out other Form 5471 Schedule J Rev December Accumulated Earnings And Profits E&amp

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter