Form 706 Rev August Fill in Capable United States Estate and Generation Skipping Transfer Tax Return

What is the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

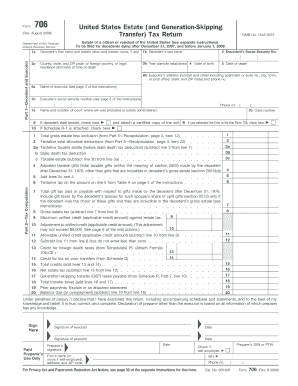

The Form 706 Rev August is a crucial document used in the United States for reporting the estate and generation-skipping transfer taxes. This form is required for estates that exceed a certain value threshold, which is adjusted periodically by the IRS. It allows executors to calculate the tax owed based on the value of the deceased's assets, including real estate, investments, and other properties. The form also addresses generation-skipping transfers, which involve transferring assets to beneficiaries who are two or more generations below the transferor.

How to use the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Using the Form 706 Rev August involves several steps to ensure accurate reporting of estate and generation-skipping transfer taxes. Executors must first gather all relevant financial information regarding the deceased's estate, including asset valuations and debts. Once the necessary data is compiled, the form can be filled out, detailing the gross estate, deductions, and the tax computation. It is essential to follow the IRS instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Completing the Form 706 Rev August involves a systematic approach:

- Gather all financial documents related to the estate, including appraisals and debt statements.

- Calculate the total value of the gross estate, including all assets and property.

- Identify and apply any applicable deductions, such as funeral expenses and debts owed by the estate.

- Complete the form by entering the calculated values in the appropriate sections.

- Review the form for accuracy, ensuring that all required information is included.

- Sign and date the form before submission.

Legal use of the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

The legal use of Form 706 Rev August is mandated by the Internal Revenue Code, which requires estates exceeding a specified value to file this return. Failure to file can result in significant penalties, including interest on unpaid taxes. It is essential for executors to understand the legal obligations associated with this form, including the deadlines for submission and the potential consequences of non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706 Rev August are critical for compliance. Generally, the form must be filed within nine months after the date of death of the decedent. However, extensions may be available under certain circumstances. Executors should be aware of these deadlines to avoid penalties and ensure timely processing of the estate's tax obligations.

Required Documents

To complete the Form 706 Rev August, several documents are required. These typically include:

- Death certificate of the decedent.

- Appraisals of all assets within the estate.

- Records of debts and liabilities owed by the estate.

- Documentation of any prior gifts made by the decedent that may affect the generation-skipping transfer calculations.

Quick guide on how to complete form 706 rev august fill in capable united states estate and generation skipping transfer tax return

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest method to edit and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 706 rev august fill in capable united states estate and generation skipping transfer tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

The Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return is a tax form used to report the estate tax and generation-skipping transfer tax. This form is essential for estates exceeding the federal exemption limit, ensuring compliance with IRS regulations. Utilizing airSlate SignNow simplifies the process of filling out and submitting this form.

-

How can airSlate SignNow help with the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow provides an intuitive platform for completing the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. With features like fillable fields and eSignature capabilities, users can efficiently manage their estate tax documentation. This streamlines the process, reducing the time and effort required to file.

-

What are the pricing options for using airSlate SignNow for the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow offers flexible pricing plans tailored to different user needs, including options for individuals and businesses. Each plan provides access to features that facilitate the completion of the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You can choose a plan that best fits your budget and requirements.

-

Is airSlate SignNow secure for handling the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return is handled safely. The platform employs advanced encryption and security protocols to protect sensitive information. You can trust that your data is secure while using our services.

-

Can I integrate airSlate SignNow with other software for the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. This allows you to connect with tools you already use, making it easier to manage your documents and streamline your processes.

-

What features does airSlate SignNow offer for completing the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and real-time collaboration tools. These features make it easier to complete the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return efficiently. Users can also track document status and receive notifications for added convenience.

-

How does airSlate SignNow improve the efficiency of filing the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

By using airSlate SignNow, you can signNowly improve the efficiency of filing the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. The platform's user-friendly interface and automation features reduce manual errors and save time. This allows you to focus on other important aspects of estate management.

Get more for Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- Whitley county sheriff departmentdedicated to excellence form

- Side lot program request form trumbull county land bank

- Codelibrary amlegal comcodeseuclid1759 07 requirements for certificate of inspection form

- Ohio rental application form

- Preapplication for low rent public housing macoupin county housing form

- Www yelp combiznorthsteppe realty columbusnorthsteppe realty 24 photos ampamp 65 reviews property form

- Idfpr illinois department of form

- Lease addendum for crime housing form

Find out other Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- eSignature Mississippi Banking Executive Summary Template Later

- Can I eSignature Michigan Banking Lease Agreement Template

- eSignature Michigan Banking Lease Agreement Template Safe

- eSignature Michigan Banking Lease Agreement Template Easy

- eSignature Mississippi Banking Executive Summary Template Myself

- How To eSignature Mississippi Banking Residential Lease Agreement

- How Do I eSignature Mississippi Banking Residential Lease Agreement

- Help Me With eSignature Mississippi Banking Residential Lease Agreement

- How Can I eSignature Mississippi Banking Residential Lease Agreement

- eSignature Mississippi Banking Executive Summary Template Free

- Can I eSignature Mississippi Banking Residential Lease Agreement

- How Do I eSignature Mississippi Banking Executive Summary Template

- How To eSignature Mississippi Banking Executive Summary Template

- Help Me With eSignature Mississippi Banking Executive Summary Template

- eSignature California Business Operations Last Will And Testament Online

- How Can I eSignature Mississippi Banking Executive Summary Template

- Can I eSignature Mississippi Banking Executive Summary Template

- eSignature Mississippi Banking Executive Summary Template Secure

- eSignature California Business Operations Last Will And Testament Computer

- eSignature California Business Operations Last Will And Testament Mobile