Alternative Fuel Tax Credit K 62 Kansas Department of Revenue Form

What is the Alternative Fuel Tax Credit K-62 Kansas Department Of Revenue

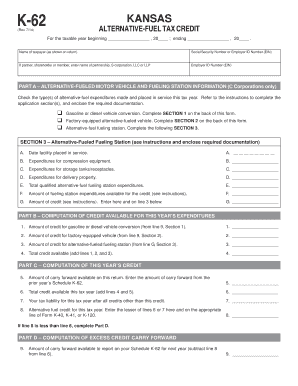

The Alternative Fuel Tax Credit K-62 is a tax incentive provided by the Kansas Department of Revenue aimed at promoting the use of alternative fuels. This credit is available to individuals and businesses that utilize alternative fuel vehicles or invest in alternative fuel infrastructure. The primary goal of this credit is to encourage the adoption of cleaner, more sustainable energy sources, thereby reducing reliance on traditional fossil fuels.

Eligible alternative fuels include compressed natural gas, liquefied natural gas, propane, and electricity used for vehicle operation. The credit can significantly lower the overall tax burden for those who qualify, making it a valuable option for environmentally conscious consumers and businesses.

How to use the Alternative Fuel Tax Credit K-62 Kansas Department Of Revenue

To utilize the Alternative Fuel Tax Credit K-62, taxpayers must first determine their eligibility based on the type of alternative fuel used and the intended application. Once eligibility is confirmed, individuals or businesses can complete the K-62 form, which requires detailed information about the alternative fuel used and any associated expenses.

After filling out the form, it should be submitted to the Kansas Department of Revenue along with any required documentation. This may include receipts or proof of purchase for the alternative fuel or related equipment. It is essential to keep copies of all submitted documents for future reference and potential audits.

Steps to complete the Alternative Fuel Tax Credit K-62 Kansas Department Of Revenue

Completing the Alternative Fuel Tax Credit K-62 involves several key steps:

- Gather necessary documentation, including proof of alternative fuel purchases and expenses.

- Obtain the K-62 form from the Kansas Department of Revenue website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documents that validate your claims.

- Submit the completed form and documents to the Kansas Department of Revenue by mail or electronically, if applicable.

Following these steps carefully will help ensure that the application process goes smoothly and that you receive any eligible tax credits.

Eligibility Criteria

To qualify for the Alternative Fuel Tax Credit K-62, applicants must meet specific criteria set forth by the Kansas Department of Revenue. Eligibility generally includes:

- Usage of approved alternative fuels, such as compressed natural gas, liquefied natural gas, propane, or electricity.

- Ownership or lease of an alternative fuel vehicle or investment in alternative fuel infrastructure.

- Compliance with all local, state, and federal regulations regarding alternative fuel usage.

It is crucial to review the detailed eligibility guidelines provided by the Kansas Department of Revenue to ensure compliance and maximize potential benefits.

Required Documents

When applying for the Alternative Fuel Tax Credit K-62, certain documents are necessary to support your application. These may include:

- Receipts or invoices for the purchase of alternative fuels.

- Documentation of any associated costs, such as installation of fueling infrastructure.

- Proof of vehicle ownership or lease agreements for alternative fuel vehicles.

Having these documents prepared and organized can facilitate a smoother application process and help substantiate your claims for the tax credit.

Form Submission Methods

The Alternative Fuel Tax Credit K-62 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to:

- File the form electronically, if available, through the Kansas Department of Revenue's online portal.

- Mail the completed form and supporting documents to the appropriate address provided on the form.

- Submit the form in person at a local Kansas Department of Revenue office.

Each submission method has its advantages, so taxpayers should select the one that best fits their needs and ensures timely processing of their application.

Quick guide on how to complete alternative fuel tax credit k 62 kansas department of revenue

Effortlessly Prepare [SKS] on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your updates.

- Choose your preferred method to share the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the alternative fuel tax credit k 62 kansas department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

The Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue is a tax incentive designed to encourage the use of alternative fuels in vehicles. This credit allows businesses to reduce their tax liability when they invest in alternative fuel technologies. Understanding this credit can help businesses save money while contributing to environmental sustainability.

-

How can I apply for the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

To apply for the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue, you need to complete the appropriate forms provided by the Kansas Department of Revenue. Ensure that you have all necessary documentation regarding your alternative fuel usage. Submitting your application on time is crucial to receiving the credit.

-

What types of alternative fuels qualify for the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

The Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue typically covers a range of alternative fuels, including compressed natural gas, liquefied natural gas, and electricity. Each fuel type has specific eligibility criteria, so it's important to review the guidelines provided by the Kansas Department of Revenue. This ensures that your business can maximize its tax benefits.

-

What are the benefits of using the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

Utilizing the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue can signNowly reduce your business's tax burden. This credit not only promotes the use of cleaner fuels but also supports cost savings that can be reinvested into your operations. Additionally, it enhances your company's sustainability profile, appealing to environmentally conscious consumers.

-

Is there a limit to the amount I can claim under the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

Yes, there are limits to the amount you can claim under the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue. The specific limits depend on the type of alternative fuel used and the volume consumed. It's essential to consult the Kansas Department of Revenue's guidelines to understand these limits and ensure compliance.

-

How does the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue integrate with other tax incentives?

The Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue can often be combined with other federal and state tax incentives for alternative fuel usage. This integration can maximize your overall savings and enhance the financial viability of your alternative fuel investments. Always check with a tax professional to ensure you are leveraging all available incentives.

-

What documentation do I need for the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue?

To claim the Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue, you will need to provide documentation that verifies your alternative fuel usage. This may include receipts, invoices, and records of fuel consumption. Keeping accurate records is essential for a successful application and to avoid potential audits.

Get more for Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue

Find out other Alternative Fuel Tax Credit K 62 Kansas Department Of Revenue

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy