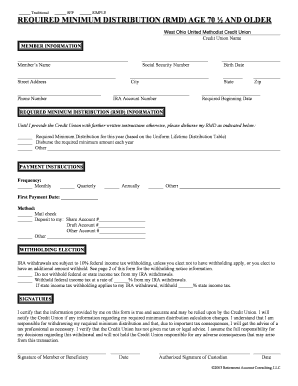

REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 and OLDER Form

Understanding Required Minimum Distribution (RMD) for Individuals Age 70 and Older

The Required Minimum Distribution (RMD) refers to the minimum amount that individuals must withdraw from their retirement accounts once they reach a certain age. For individuals aged seventy and older, the RMD rules apply to various types of retirement accounts, including traditional IRAs, 401(k)s, and other tax-deferred plans. The purpose of the RMD is to ensure that individuals begin to withdraw funds from their retirement savings, thus paying taxes on those distributions. The IRS mandates that these withdrawals start by April first of the year following the individual’s seventieth birthday.

Steps to Calculate Your RMD

Calculating your RMD involves a few straightforward steps:

- Determine your account balance: Find the balance of your retirement account as of December thirty-first of the previous year.

- Find your life expectancy factor: Use the IRS Uniform Lifetime Table to find the life expectancy factor corresponding to your age.

- Calculate your RMD: Divide your account balance by the life expectancy factor. This result is your RMD for the year.

Legal Considerations for RMD Compliance

It is essential to comply with RMD regulations to avoid penalties. The IRS imposes a hefty penalty of fifty percent on any amount that is not withdrawn as required. This penalty underscores the importance of understanding and adhering to RMD rules. Additionally, individuals should be aware of any state-specific regulations that may affect their distributions.

IRS Guidelines on RMDs

The IRS provides detailed guidelines regarding RMDs, which include the age at which withdrawals must begin, the calculation methods, and the types of accounts affected. It is crucial for individuals to stay informed about any changes in IRS regulations, as these can impact their retirement planning. The IRS also offers resources to assist individuals in understanding their RMD obligations.

Required Documents for RMD Processing

To process your RMD, you will typically need the following documents:

- Your retirement account statements.

- The IRS Uniform Lifetime Table for life expectancy factors.

- Any relevant tax forms that may be required for reporting your distributions.

Examples of RMD Scenarios

Understanding how RMDs work in practical scenarios can be helpful. For instance, if an individual has a traditional IRA with a balance of one hundred thousand dollars and is seventy-two years old, they would look up the life expectancy factor for their age, which might be twenty-five. Dividing one hundred thousand by twenty-five results in a required distribution of four thousand dollars for that year. This example illustrates how RMD calculations can vary based on account balance and age.

Quick guide on how to complete required minimum distribution rmd age 70 and older

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delay. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically available from airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that require new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER

Create this form in 5 minutes!

How to create an eSignature for the required minimum distribution rmd age 70 and older

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER?

The REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER refers to the age at which individuals must begin withdrawing a minimum amount from their retirement accounts. This rule is crucial for ensuring that retirement savings are utilized during retirement years. Understanding this age requirement helps individuals plan their finances effectively.

-

How does airSlate SignNow assist with documents related to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER?

airSlate SignNow provides a seamless platform for eSigning and managing documents related to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER. Users can easily create, send, and sign necessary forms, ensuring compliance with IRS regulations. This simplifies the process of managing retirement distributions.

-

What features does airSlate SignNow offer for managing REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER. These features enhance efficiency and ensure that all necessary documentation is completed accurately and on time. Users can also integrate with various applications for a streamlined experience.

-

Is there a cost associated with using airSlate SignNow for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including those related to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER. The pricing is competitive and designed to provide value for businesses looking to manage their document workflows efficiently. A free trial is also available to explore the features.

-

Can airSlate SignNow integrate with other financial software for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER?

Absolutely! airSlate SignNow integrates seamlessly with various financial software solutions, making it easier to manage documents related to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER. This integration allows for a more cohesive workflow, ensuring that all financial data and documentation are aligned and accessible.

-

What are the benefits of using airSlate SignNow for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER?

Using airSlate SignNow for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER offers numerous benefits, including time savings, enhanced security, and improved compliance. The platform simplifies the eSigning process, allowing users to focus on their financial planning rather than paperwork. Additionally, it ensures that all documents are securely stored and easily retrievable.

-

How secure is airSlate SignNow for handling REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect documents related to REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER. Users can trust that their sensitive information is safeguarded throughout the signing process. Regular security audits and updates further enhance the platform's reliability.

Get more for REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER

- Poinsettia order form 52195126

- St jacobs farmers market fill online printable fillable form

- Existing patient registration northside hospital form

- Delegation of signing authority form template

- Shoppers flu shot form

- Palliative radiation oncology program prop form

- Direct deposit authorization form

- H0050 notification of claim form

Find out other REQUIRED MINIMUM DISTRIBUTION RMD AGE 70 AND OLDER

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template