Exemption or Tax Credit under the North Dakota Form

What is the Exemption Or Tax Credit Under The North Dakota

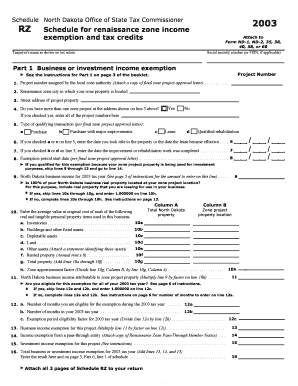

The Exemption Or Tax Credit Under The North Dakota refers to specific tax benefits available to eligible individuals and businesses within the state. These exemptions or credits can reduce the overall tax liability for taxpayers, providing financial relief and encouraging economic activity. The criteria for eligibility can vary based on income, type of business, and other factors, making it essential for taxpayers to understand their specific situation.

How to use the Exemption Or Tax Credit Under The North Dakota

Utilizing the Exemption Or Tax Credit Under The North Dakota involves a straightforward process. Taxpayers must first determine their eligibility based on the established criteria. Once eligibility is confirmed, individuals or businesses can apply for the exemption or credit during the tax filing process. This typically requires completing the appropriate forms and providing any necessary documentation to substantiate the claim.

Steps to complete the Exemption Or Tax Credit Under The North Dakota

Completing the Exemption Or Tax Credit Under The North Dakota involves several key steps:

- Review eligibility requirements to ensure compliance.

- Gather necessary documentation, including income statements and business records.

- Complete the relevant tax forms accurately, ensuring all information is correct.

- Submit the forms electronically or via mail, depending on the preferred method.

- Keep copies of all submitted documents for personal records.

Eligibility Criteria

Eligibility for the Exemption Or Tax Credit Under The North Dakota is determined by various factors, including income levels, business type, and specific circumstances such as age or disability. Individuals and businesses must meet these criteria to qualify for the tax benefits. It is advisable to consult the official guidelines or a tax professional to ensure all conditions are met before applying.

Required Documents

To successfully apply for the Exemption Or Tax Credit Under The North Dakota, taxpayers need to prepare several documents. These may include:

- Proof of income, such as W-2 forms or tax returns.

- Business documentation, if applicable, including registration and financial statements.

- Identification documents to verify personal information.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods

Taxpayers can submit their applications for the Exemption Or Tax Credit Under The North Dakota through various methods. These include:

- Online submission via the state’s tax portal, which is often the fastest method.

- Mailing the completed forms to the appropriate tax office.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Each method has its own processing times, so it is essential to choose the one that best fits individual needs.

Quick guide on how to complete exemption or tax credit under the north dakota

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, enabling you to locate the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Exemption Or Tax Credit Under The North Dakota

Create this form in 5 minutes!

How to create an eSignature for the exemption or tax credit under the north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Exemption Or Tax Credit Under The North Dakota?

The Exemption Or Tax Credit Under The North Dakota refers to specific tax benefits available to eligible individuals and businesses. These exemptions can signNowly reduce tax liabilities, making it essential for residents to understand their qualifications. By leveraging these credits, taxpayers can optimize their financial responsibilities.

-

How can airSlate SignNow help with the Exemption Or Tax Credit Under The North Dakota?

airSlate SignNow provides a streamlined platform for managing documents related to the Exemption Or Tax Credit Under The North Dakota. Users can easily create, send, and eSign necessary forms, ensuring compliance and efficiency. This simplifies the process of applying for and maintaining tax credits.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for those seeking assistance with the Exemption Or Tax Credit Under The North Dakota. Each plan provides access to essential features, ensuring that users can find a solution that fits their budget. Additionally, a free trial is available to explore the platform.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing documents related to the Exemption Or Tax Credit Under The North Dakota. These tools enhance productivity and ensure that all necessary paperwork is handled efficiently. Users can also track document status in real-time.

-

Is airSlate SignNow compliant with North Dakota tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to the Exemption Or Tax Credit Under The North Dakota. The platform ensures that all documents meet legal standards, providing peace of mind for users. This compliance is crucial for businesses and individuals navigating tax credits.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage the Exemption Or Tax Credit Under The North Dakota. These integrations streamline workflows and enhance data accuracy, allowing users to focus on their core business activities. This flexibility is a key benefit for many users.

-

What benefits does airSlate SignNow provide for small businesses regarding tax credits?

For small businesses, airSlate SignNow simplifies the process of applying for the Exemption Or Tax Credit Under The North Dakota, saving time and reducing errors. The platform's user-friendly interface allows for quick document preparation and submission. This efficiency can lead to signNow cost savings and improved cash flow for small enterprises.

Get more for Exemption Or Tax Credit Under The North Dakota

- Fort eustis jble eustis department of public health form

- Lcd parenteral nutrition l38953 centers for medicare ampamp medicaid form

- Appendix c 11 sample fgp scp tb test form fill out ampamp sign online

- Pharmacy technician competency checklist form

- Subjective history vestibular drayer physical therapy institute form

- Southeastrans standing order form 574602717

- Aetna dental claim form ampamp instructions accessible pdf aetna dental claim form ampamp instructions

- U n i v er si t y of v i rgi n i a he a lt h syst e m 0100000 place label here virginia form

Find out other Exemption Or Tax Credit Under The North Dakota

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT