Schedule H EZ, Wisconsin Homestead Credit PDF Fillable Format Schedule H EZ Revenue Wi

What is the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format

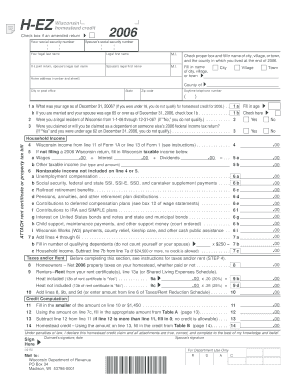

The Schedule H EZ is a simplified form used by Wisconsin residents to apply for the Homestead Credit. This credit is designed to provide financial relief to eligible homeowners and renters based on their property taxes or rent paid. The form is available in a fillable PDF format, making it easy for users to complete and submit electronically. The Schedule H EZ is specifically tailored for individuals who meet certain income criteria and have a straightforward tax situation, allowing for a more efficient application process.

How to use the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format

Using the Schedule H EZ involves several straightforward steps. First, download the fillable PDF from the appropriate state revenue website. Open the form in a PDF reader that supports fillable fields. Next, enter your personal information, including your name, address, and Social Security number. Follow the prompts to input your income details and any property tax or rental information. Once completed, review your entries for accuracy. Finally, save the document and submit it according to the instructions provided, either electronically or by mail.

Steps to complete the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format

Completing the Schedule H EZ requires careful attention to detail. Begin by gathering necessary documents, such as proof of income and property tax statements. Next, fill out the form by providing your personal information in the designated fields. Make sure to accurately report your income and any applicable deductions. After entering all required information, double-check for any errors or omissions. Once satisfied, save your completed form and follow the submission guidelines to ensure it reaches the appropriate state department.

Eligibility Criteria for the Schedule H EZ, Wisconsin Homestead Credit

To qualify for the Schedule H EZ, applicants must meet specific eligibility criteria. Generally, you must be a resident of Wisconsin and either a homeowner or renter. Your income must fall below a certain threshold, which is adjusted annually. Additionally, you must have paid property taxes or rent during the tax year for which you are applying. It is important to review the detailed eligibility requirements on the Wisconsin Department of Revenue website to ensure you meet all conditions before submitting your application.

Required Documents for the Schedule H EZ, Wisconsin Homestead Credit

When completing the Schedule H EZ, several documents are essential for a successful application. These typically include proof of income, such as pay stubs or tax returns, and documentation of property taxes paid or rent receipts. If applicable, you may also need to provide information about any dependents. Having these documents ready will streamline the completion process and help ensure that your application is accurate and complete.

Form Submission Methods for the Schedule H EZ, Wisconsin Homestead Credit

The Schedule H EZ can be submitted through various methods, catering to different preferences. Applicants have the option to file electronically by submitting the completed PDF through the Wisconsin Department of Revenue's online portal. Alternatively, you may print the form and mail it to the designated address provided in the instructions. In-person submissions may also be possible at local revenue offices, depending on their policies. Be sure to check the latest guidelines for submission methods to ensure compliance.

Quick guide on how to complete schedule h ez wisconsin homestead credit pdf fillable format schedule h ez revenue wi

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to commence.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule h ez wisconsin homestead credit pdf fillable format schedule h ez revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

The Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format is a simplified form designed for Wisconsin residents to apply for the Homestead Credit. This fillable format allows users to easily complete and submit their applications online, ensuring a smooth process for claiming their credits.

-

How can I access the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

You can access the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format directly from the Revenue Wisconsin website or through various tax preparation software that supports this form. Simply search for the Schedule H EZ form, and you will find options to download or fill it out online.

-

Is there a cost associated with using the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

Using the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format is typically free if you access it through the official Revenue Wisconsin website. However, some tax preparation services may charge a fee for their assistance in completing the form.

-

What are the benefits of using the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

The Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format simplifies the application process, making it easier for residents to claim their credits. It reduces the likelihood of errors and ensures that all necessary information is included, which can expedite the approval process.

-

Can I save my progress while filling out the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

Yes, when using the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format, you can save your progress if you are using a compatible PDF editor. This feature allows you to return to your application later without losing any information.

-

What information do I need to complete the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format?

To complete the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format, you will need personal information such as your name, address, and Social Security number, as well as details about your property and income. Having all necessary documents on hand will help streamline the process.

-

Does the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format integrate with other tax software?

Yes, the Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format is compatible with various tax software programs. Many of these programs allow you to import data directly from the form, making it easier to complete your overall tax return.

Get more for Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format Schedule H EZ Revenue Wi

- Bank of nt butterfield ampamp son ltd form s 8 received

- Bail forms archives financial casualty ampamp surety

- Instructions for anti money laundering training adams moore form

- Chapter 348 motor vehicle installment sales form

- Plano texas 75075 form

- Abm direct deposit simple safe secure abm is en form

- Form 1005 credit application ced greentech bakersfield

- We are excited to announce that we are accepting applications for form

Find out other Schedule H EZ, Wisconsin Homestead Credit pdf Fillable Format Schedule H EZ Revenue Wi

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document