Form 4506T EZ Rev January Weebly

What is the Form 4506T EZ Rev January Weebly

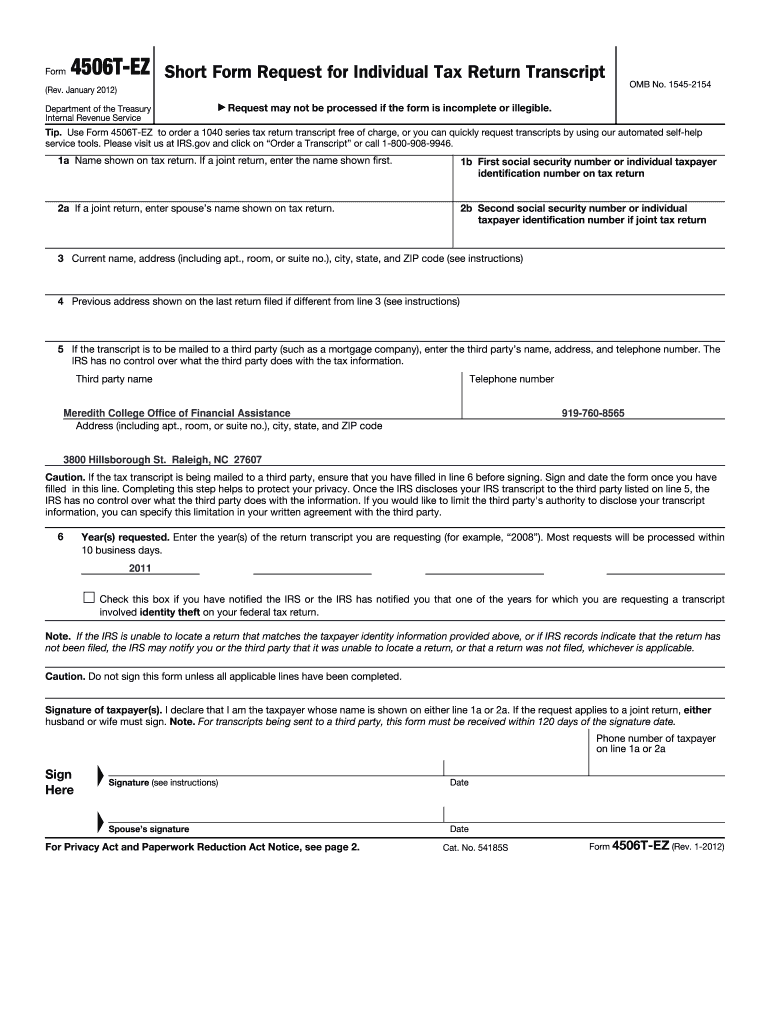

The Form 4506T EZ, also known as the Request for Transcript of Tax Return, is a simplified version designed for taxpayers who need to request a transcript of their tax information from the Internal Revenue Service (IRS). This form is particularly useful for individuals who may not have access to their tax returns or need verification for financial purposes, such as applying for loans or mortgages.

The "Rev January" indicates that this version of the form was revised in January, ensuring that it reflects the most current IRS guidelines and requirements. The Weebly reference suggests that users may find this form on a specific platform, making it easier for them to access and fill out the document digitally.

How to use the Form 4506T EZ Rev January Weebly

Using the Form 4506T EZ involves a straightforward process. First, users must download the form from the designated Weebly site or another reliable source. Once obtained, the form needs to be filled out with accurate personal information, including the taxpayer's name, Social Security number, and the address associated with the tax records.

After completing the form, it can be submitted to the IRS via mail. Users should ensure that they have included any required identification or documentation to avoid delays. The form can also be used to request transcripts for a specific tax year or multiple years, depending on the user's needs.

Steps to complete the Form 4506T EZ Rev January Weebly

Completing the Form 4506T EZ is a simple process that can be broken down into several key steps:

- Download the form from the Weebly site or the IRS website.

- Fill in the taxpayer's name, Social Security number, and address.

- Indicate the type of transcript requested and the tax years needed.

- Sign and date the form to verify the request.

- Mail the completed form to the appropriate IRS address listed in the instructions.

By following these steps, users can efficiently request their tax transcripts without unnecessary complications.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 4506T EZ. Taxpayers must ensure that they are eligible to request a transcript and that the information provided is accurate. The IRS typically processes requests within five to ten business days, but this can vary based on the volume of requests received.

It is important for users to be aware of any changes to IRS policies that may affect the submission and processing of the form. Keeping up to date with IRS announcements can help ensure compliance and timely receipt of requested documents.

Required Documents

When submitting the Form 4506T EZ, users may need to provide additional documentation to verify their identity. This may include a copy of a government-issued ID, such as a driver's license or passport, and any other documents that support the request for a tax transcript.

Ensuring that all required documents are included with the form can help prevent delays in processing and ensure that the IRS can accurately verify the taxpayer's identity and tax records.

Form Submission Methods

The Form 4506T EZ can be submitted to the IRS through traditional mail. Users should ensure that they send the form to the correct address as specified in the instructions. It is advisable to use a reliable mailing method, such as certified mail, to confirm that the form has been sent and received by the IRS.

Currently, there are no online submission options available for this form, so users must rely on postal services for their requests.

Quick guide on how to complete form 4506t ez rev january weebly

Complete [SKS] effortlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It offers a superb environmentally friendly substitute to traditional printed and signed paperwork, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Administer [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4506T EZ Rev January Weebly

Create this form in 5 minutes!

How to create an eSignature for the form 4506t ez rev january weebly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506T EZ Rev January Weebly?

The Form 4506T EZ Rev January Weebly is a simplified version of the IRS form used to request a transcript of tax return information. It is designed for individuals who need to obtain their tax information quickly and efficiently. By using airSlate SignNow, you can easily eSign and send this form directly from your Weebly site.

-

How can airSlate SignNow help with the Form 4506T EZ Rev January Weebly?

airSlate SignNow streamlines the process of completing and submitting the Form 4506T EZ Rev January Weebly. Our platform allows you to fill out the form electronically, add your eSignature, and send it securely. This saves time and reduces the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for the Form 4506T EZ Rev January Weebly?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and designed to provide value for users who frequently handle documents like the Form 4506T EZ Rev January Weebly. You can choose a plan that fits your budget and usage requirements.

-

What features does airSlate SignNow offer for the Form 4506T EZ Rev January Weebly?

airSlate SignNow provides a range of features for the Form 4506T EZ Rev January Weebly, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience and ensure that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with my Weebly website for the Form 4506T EZ Rev January?

Absolutely! airSlate SignNow can be easily integrated with your Weebly website, allowing you to embed the Form 4506T EZ Rev January Weebly directly on your site. This integration simplifies the process for your users, making it easy for them to access and submit the form.

-

What are the benefits of using airSlate SignNow for the Form 4506T EZ Rev January Weebly?

Using airSlate SignNow for the Form 4506T EZ Rev January Weebly offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and that you can track their status in real-time.

-

Is airSlate SignNow compliant with legal standards for the Form 4506T EZ Rev January Weebly?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. This means that when you use our platform for the Form 4506T EZ Rev January Weebly, you can be confident that your submissions are legally binding and secure.

Get more for Form 4506T EZ Rev January Weebly

- Law of superposition lab docx form

- Federal domestic assistance short form

- Georgia notice 495573648 form

- J d mugs still n grill addison restaurant reviews form

- Postnuptial agreement form 495571554

- Release of lis pendens texas form

- Retainer agreement sample form

- Release from liability waiver form iscf

Find out other Form 4506T EZ Rev January Weebly

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast