Form SS 4 Rev January Masscp

What is the Form SS-4 Rev January Masscp

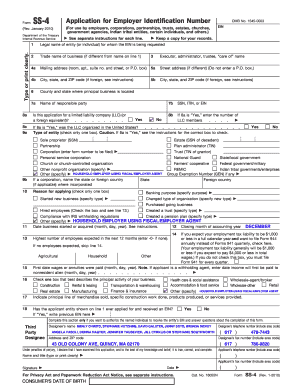

The Form SS-4 Rev January Masscp is an official document used by businesses and individuals in the United States to apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This form is essential for various tax-related purposes, including opening a business bank account, filing tax returns, and hiring employees. The form collects vital information about the entity applying for the EIN, such as its legal structure, ownership details, and the reason for applying.

How to use the Form SS-4 Rev January Masscp

To use the Form SS-4 Rev January Masscp, you need to complete it accurately with the required information. This includes providing details about the entity, such as its name, address, and type of business structure. Once completed, the form can be submitted to the IRS either online or by mail. It is important to ensure that all information is correct to avoid delays in processing your application for an EIN.

Steps to complete the Form SS-4 Rev January Masscp

Completing the Form SS-4 Rev January Masscp involves several key steps:

- Gather necessary information about your business or entity, including its legal name, address, and type of entity.

- Fill out the form, ensuring that each section is completed accurately. Pay attention to the specific requirements for your business type.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS either electronically or by mailing it to the appropriate address.

Legal use of the Form SS-4 Rev January Masscp

The legal use of the Form SS-4 Rev January Masscp is primarily for obtaining an Employer Identification Number (EIN), which is required for various tax responsibilities. This form must be used by all entities that are required to report taxes, including corporations, partnerships, and sole proprietorships. Using the form correctly ensures compliance with federal tax laws and facilitates proper reporting and payment of taxes.

Key elements of the Form SS-4 Rev January Masscp

Key elements of the Form SS-4 Rev January Masscp include:

- Entity Information: Legal name, trade name (if applicable), and entity type.

- Address: The physical address of the business or entity.

- Reason for applying: Indicating why the EIN is needed, such as starting a new business or hiring employees.

- Responsible party: Information about the individual who is responsible for the entity.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Form SS-4 Rev January Masscp, it is advisable to apply for an EIN as soon as you determine that you need one. This is particularly important if you plan to start hiring employees or need to open a business bank account. Early submission can help avoid delays in your business operations.

Quick guide on how to complete form ss 4 rev january masscp

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-based procedure today.

The Easiest Method to Alter and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form SS 4 Rev January Masscp

Create this form in 5 minutes!

How to create an eSignature for the form ss 4 rev january masscp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form SS 4 Rev January Masscp?

Form SS 4 Rev January Masscp is an essential document used to apply for an Employer Identification Number (EIN) from the IRS. This form is crucial for businesses looking to establish their tax identity and is often required for various business transactions. Understanding how to properly fill out and submit this form can streamline your business operations.

-

How can airSlate SignNow help with Form SS 4 Rev January Masscp?

airSlate SignNow simplifies the process of completing and eSigning Form SS 4 Rev January Masscp. With our user-friendly interface, you can easily fill out the form, add necessary signatures, and send it securely. This ensures that your application is processed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features that support the completion of documents like Form SS 4 Rev January Masscp, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and more, making it easier to manage documents such as Form SS 4 Rev January Masscp. These integrations help streamline your document management process.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including increased efficiency and reduced turnaround times. With our platform, you can quickly eSign Form SS 4 Rev January Masscp and other documents from anywhere, at any time. This flexibility helps businesses save time and improve productivity.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Form SS 4 Rev January Masscp. We utilize advanced encryption and security protocols to ensure that your information remains confidential and protected throughout the signing process.

-

Can I track the status of my Form SS 4 Rev January Masscp submission?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form SS 4 Rev January Masscp submission. You will receive notifications when the document is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

Get more for Form SS 4 Rev January Masscp

- Spas payment and initial disclosure agreement montreat college montreat form

- Registrar unl edustudentcommencementgraduation applicationoffice of the university registrar form

- Tsu fee waiver form

- Working letter form

- Www bppe ca govwebappsannualreport2018annual report bakersfield barber college inc bureau for form

- International education codes ncsbn form

- Fillable online mcnair application form dae uga edu fax email

- East tennessee state university profile rankings and dataus news form

Find out other Form SS 4 Rev January Masscp

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself