To Report Multiple Grants, Use FFR Attachment Irs Form

Understanding the FFR Attachment for Reporting Multiple Grants

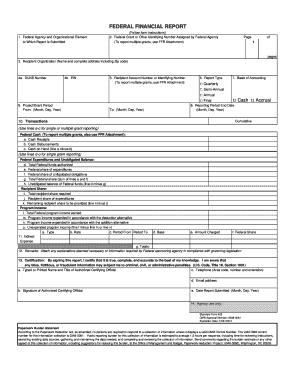

The FFR Attachment, or Federal Financial Report Attachment, is a crucial document for organizations that receive multiple grants from federal agencies. This form allows recipients to report their financial status and the use of funds across various grants in a consolidated manner. It ensures compliance with federal regulations and provides transparency in fund utilization. Understanding how to accurately complete this form is essential for maintaining good standing with grant providers.

Steps for Completing the FFR Attachment

Completing the FFR Attachment requires careful attention to detail. Here are the key steps to follow:

- Gather all relevant financial data for each grant, including expenditures, income, and matching funds.

- Ensure that you have the correct reporting period as specified by the grant agreements.

- Fill out the form with accurate figures, ensuring that totals are correctly calculated and aligned with your accounting records.

- Review the completed form for any discrepancies or missing information before submission.

- Submit the FFR Attachment according to the guidelines provided by the federal agency overseeing the grants.

Key Elements of the FFR Attachment

The FFR Attachment consists of several critical components that must be completed accurately:

- Recipient Information: This includes the name of the organization, DUNS number, and contact information.

- Grant Information: Details about each grant, including the grant number and project title.

- Financial Data: A breakdown of expenditures, income, and matching contributions for each grant.

- Certification: A declaration by an authorized representative confirming the accuracy of the reported information.

IRS Guidelines for the FFR Attachment

The Internal Revenue Service (IRS) provides specific guidelines for completing the FFR Attachment. These guidelines emphasize the importance of accurate reporting and compliance with federal regulations. Organizations must ensure that all financial data is reported in accordance with the IRS standards to avoid penalties or audits. Familiarizing yourself with these guidelines can help ensure that your submission meets all necessary requirements.

Filing Deadlines for the FFR Attachment

Timely submission of the FFR Attachment is crucial. Each federal agency may have different deadlines for reporting, typically aligned with the grant's reporting schedule. It is essential to check the specific deadlines for each grant to ensure compliance. Missing a deadline can result in penalties or delays in funding, so maintaining a calendar of important dates is advisable.

Required Documents for FFR Attachment Submission

When preparing to submit the FFR Attachment, certain documents may be required to support your financial reporting. These may include:

- Detailed financial statements for the reporting period.

- Invoices and receipts related to expenditures.

- Documentation of income and matching funds.

- Any correspondence with the federal agency regarding the grants.

Common Penalties for Non-Compliance

Failing to comply with the requirements of the FFR Attachment can lead to several penalties. These may include:

- Financial penalties imposed by the federal agency.

- Ineligibility for future grants.

- Increased scrutiny or audits by federal agencies.

- Legal repercussions depending on the severity of the non-compliance.

Quick guide on how to complete to report multiple grants use ffr attachment irs

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among enterprises and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to procure the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, a process that takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to To Report Multiple Grants, Use FFR Attachment Irs

Create this form in 5 minutes!

How to create an eSignature for the to report multiple grants use ffr attachment irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to report multiple grants using the FFR attachment?

To report multiple grants, use FFR attachment IRS by following the guidelines provided in the airSlate SignNow platform. This feature allows you to consolidate your reporting into a single document, making it easier to manage multiple grants efficiently. Ensure that all necessary data is accurately filled out to comply with IRS requirements.

-

How does airSlate SignNow help in managing grant reports?

airSlate SignNow simplifies the management of grant reports by providing a user-friendly interface for document creation and eSigning. To report multiple grants, use FFR attachment IRS to streamline your reporting process. This ensures that your documents are organized and easily accessible, saving you time and effort.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that support document management and eSigning, including the ability to report multiple grants using the FFR attachment IRS. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your workflow. By integrating with tools you already use, you can easily manage your documents and reporting processes, including how to report multiple grants using the FFR attachment IRS. This flexibility allows for a seamless experience across platforms.

-

What are the benefits of using airSlate SignNow for grant reporting?

Using airSlate SignNow for grant reporting offers numerous benefits, including increased efficiency and reduced paperwork. To report multiple grants, use FFR attachment IRS to consolidate your submissions, ensuring compliance and accuracy. This not only saves time but also minimizes the risk of errors in your reports.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance measures. When you report multiple grants using the FFR attachment IRS, you can trust that your sensitive information is protected. Our platform adheres to industry standards to ensure your data remains confidential.

-

How can I get support if I have questions about using airSlate SignNow?

airSlate SignNow provides comprehensive customer support to assist you with any questions or issues. Whether you need help with how to report multiple grants using the FFR attachment IRS or other features, our support team is available to guide you. You can signNow out via chat, email, or phone for prompt assistance.

Get more for To Report Multiple Grants, Use FFR Attachment Irs

- Hi summons form

- Document checklist for uncontested civil union divorce with children courts state hi form

- Cyberdriveillinois form

- Hawaii summons form

- 1 form 8 certificate of non standard accommodation

- Iowa form 101

- Bail idaho form

- Motor vehicle accident affidavit involving personal injuryfatality form

Find out other To Report Multiple Grants, Use FFR Attachment Irs

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy