Schedule K 1 Form 1120S

What is the Schedule K-1 Form 1120S

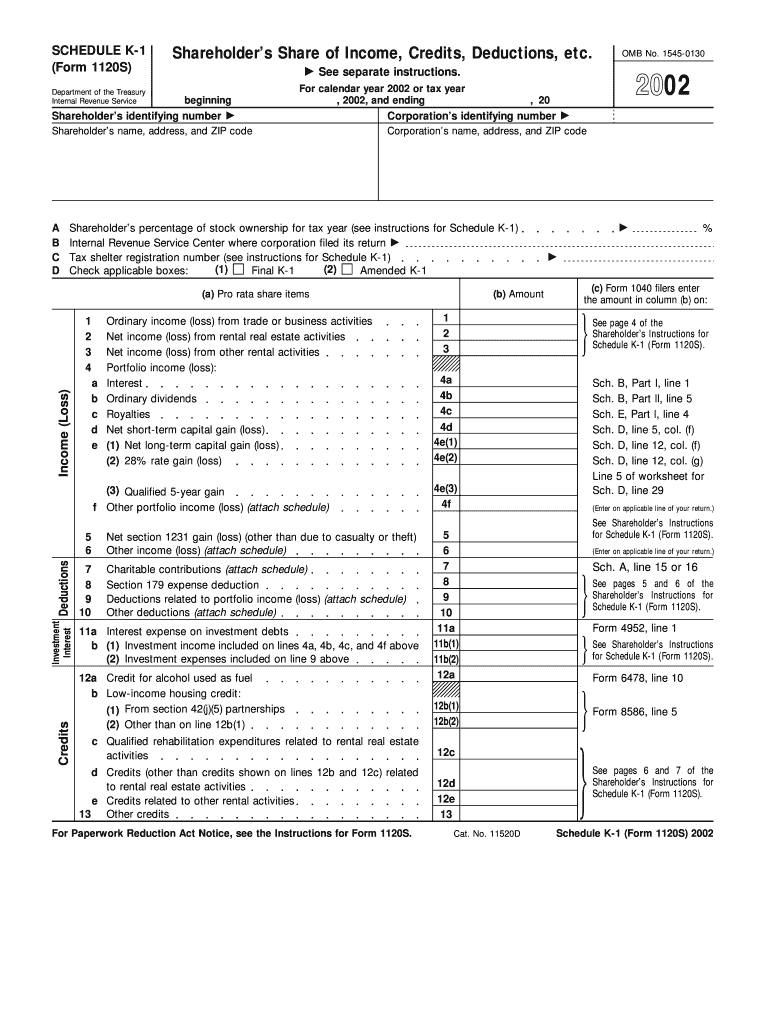

The Schedule K-1 Form 1120S is a tax document used by S corporations to report income, deductions, and credits to shareholders. This form provides detailed information about each shareholder's share of the corporation's income, losses, and distributions. It is essential for shareholders to accurately report this information on their personal tax returns, as it affects their overall tax liability. The Schedule K-1 is typically issued annually and must be provided to each shareholder by the S corporation.

How to use the Schedule K-1 Form 1120S

Using the Schedule K-1 Form 1120S involves several steps. First, shareholders need to receive their K-1 from the S corporation, which outlines their share of income, deductions, and credits. Once received, shareholders should review the form for accuracy. The information on the K-1 must then be reported on the shareholder's personal tax return, specifically on Form 1040. It is crucial to ensure that the amounts reported match those on the K-1 to avoid discrepancies with the IRS.

Steps to complete the Schedule K-1 Form 1120S

Completing the Schedule K-1 Form 1120S requires careful attention to detail. Here are the main steps:

- Gather the necessary financial information from the S corporation's financial statements.

- Fill in the corporation's name, address, and Employer Identification Number (EIN).

- Provide the shareholder's name, address, and identifying number.

- Report the shareholder's share of income, deductions, and credits in the appropriate sections.

- Review the completed form for accuracy before distributing it to shareholders.

Filing Deadlines / Important Dates

The Schedule K-1 Form 1120S must be filed by the S corporation by the 15th day of the third month after the end of its tax year. For corporations that operate on a calendar year, this means the deadline is March 15. Shareholders should receive their K-1 forms by this deadline to ensure they can accurately report the information on their personal tax returns, which are typically due on April 15.

Key elements of the Schedule K-1 Form 1120S

Several key elements make up the Schedule K-1 Form 1120S. These include:

- Shareholder information: Name, address, and identifying number.

- Corporation information: Name, address, and EIN.

- Income items: Ordinary business income, rental income, and capital gains.

- Deductions: Items such as business expenses and charitable contributions.

- Credits: Any applicable tax credits that the shareholder can claim.

Who Issues the Form

The Schedule K-1 Form 1120S is issued by S corporations to their shareholders. It is the responsibility of the corporation to prepare and distribute the K-1 forms accurately and in a timely manner. Each shareholder should receive their K-1 by the filing deadline to ensure compliance with tax reporting requirements.

Quick guide on how to complete schedule k 1 form 1120s

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Mark key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 Form 1120S

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule K 1 Form 1120S?

The Schedule K 1 Form 1120S is a tax document used by S corporations to report income, deductions, and credits to shareholders. It provides detailed information about each shareholder's share of the corporation's income, which is essential for personal tax returns. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with the Schedule K 1 Form 1120S?

airSlate SignNow simplifies the process of sending and eSigning the Schedule K 1 Form 1120S. With our user-friendly platform, you can easily prepare, send, and track your tax documents, ensuring that all shareholders receive their forms promptly and securely. This streamlines your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for the Schedule K 1 Form 1120S?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your Schedule K 1 Form 1120S and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Schedule K 1 Form 1120S?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Schedule K 1 Form 1120S. These tools enhance efficiency and ensure compliance, making it easier for businesses to manage their tax documents effectively.

-

Can I integrate airSlate SignNow with other software for the Schedule K 1 Form 1120S?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing you to seamlessly manage the Schedule K 1 Form 1120S alongside your other financial documents. This integration helps streamline your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the Schedule K 1 Form 1120S?

Using airSlate SignNow for the Schedule K 1 Form 1120S offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely signed and stored, while also simplifying the entire process of tax document management.

-

How does airSlate SignNow ensure the security of the Schedule K 1 Form 1120S?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Schedule K 1 Form 1120S and other sensitive documents. We prioritize your data security, ensuring that your tax information remains confidential and safe from unauthorized access.

Get more for Schedule K 1 Form 1120S

- Form no 10f information to be provided under sub section

- Application for a metered parking waiver for persons with severe disabilities form

- Division of motor vehicles disability parking placards office form

- Non commercial learners permit application to add form

- Imm 5669 f annexe a antcdentsdclaration imm5669f pdf form

- Form faa 8610 2 airman certificate andor rating

- Imm 5406 e additional family information imm5406e pdf

- Imm 5546 e details of military service imm5546e pdf form

Find out other Schedule K 1 Form 1120S

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple