Form 706 Rev August Fill in Capable United States Estate and Generation Skipping Transfer Tax Return

What is the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

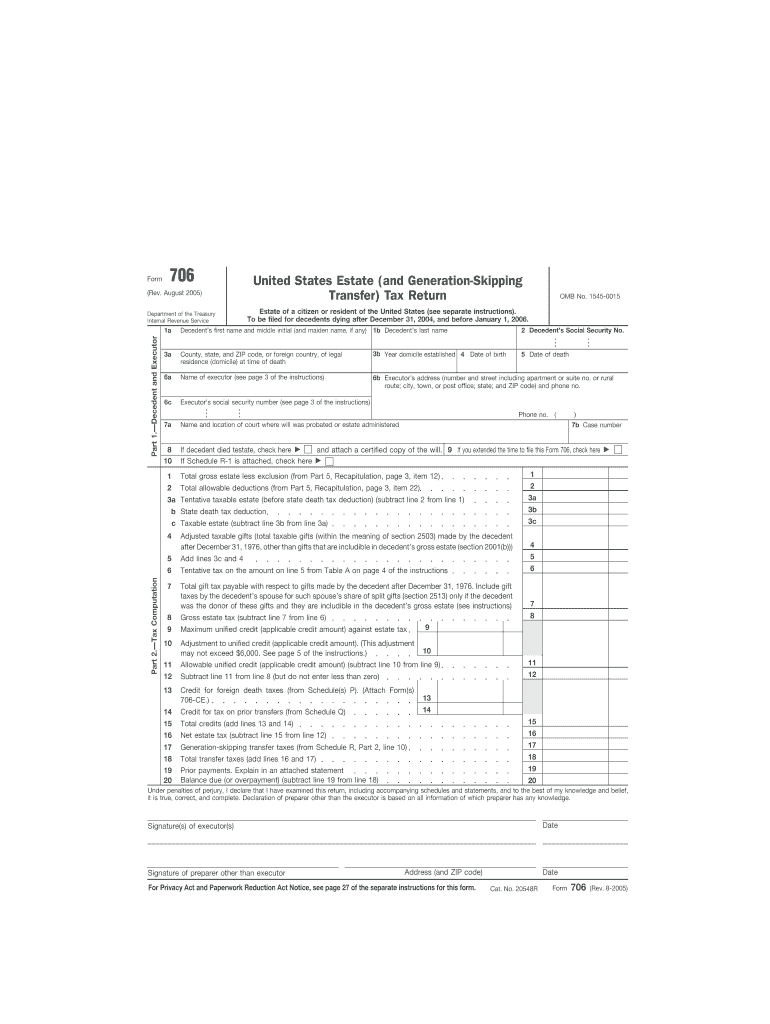

The Form 706 Rev August is a crucial document used in the United States for reporting estate and generation-skipping transfer taxes. This form is required for estates that exceed the federal exemption threshold, which is subject to change based on legislation. It serves as a comprehensive declaration of the decedent's assets, liabilities, and the overall value of the estate. The form also includes information regarding any generation-skipping transfers made during the decedent's lifetime, which can impact tax liabilities. Understanding this form is essential for executors and administrators tasked with settling an estate.

How to use the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Using the Form 706 Rev August involves several steps to ensure accurate reporting of estate and generation-skipping transfer taxes. First, gather all relevant financial documents, including property appraisals, bank statements, and any prior tax returns. Next, fill out the form by providing detailed information about the decedent's assets, debts, and any applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form must be signed by the executor and submitted to the IRS by the specified deadline.

Steps to complete the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Completing the Form 706 Rev August involves a series of methodical steps:

- Gather necessary documents, such as wills, trust agreements, and financial records.

- Determine the date of death and the fair market value of the estate's assets at that time.

- Complete the identification section with the decedent's information and the executor's details.

- List all assets, including real estate, stocks, and personal property, along with their values.

- Document any debts or liabilities that the estate must settle.

- Calculate the total taxable estate and any applicable deductions, such as funeral expenses and debts.

- Review the form for accuracy and completeness before signing and dating it.

Legal use of the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

The legal use of the Form 706 Rev August is mandated by the Internal Revenue Service (IRS) for estates that exceed the federal estate tax exemption limit. Executors are legally obligated to file this form within nine months of the decedent's death, unless an extension is granted. Failure to file can result in significant penalties, including interest on unpaid taxes. The information provided on this form is also subject to audits by the IRS, making accuracy essential for compliance with federal tax laws.

Filing Deadlines / Important Dates

The filing deadline for the Form 706 Rev August is typically nine months after the date of the decedent's death. Executors may request an automatic six-month extension by filing Form 4768, but this extension only applies to the filing of the form, not the payment of any taxes owed. It is crucial to be aware of these deadlines to avoid penalties and interest charges. Additionally, any estate tax due must be paid by the original due date of the Form 706, regardless of whether an extension has been filed.

Required Documents

To complete the Form 706 Rev August accurately, several documents are required:

- Death certificate of the decedent.

- Will and any trust documents.

- Financial statements for all assets, including bank accounts, real estate, and investments.

- Records of debts and liabilities, such as mortgages and loans.

- Previous tax returns, if applicable.

Having these documents organized and accessible will facilitate a smoother completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 706 rev august fill in capable united states estate and generation skipping transfer tax return 6123747

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to quickly create, edit, and eSign your documents without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to share your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 706 rev august fill in capable united states estate and generation skipping transfer tax return 6123747

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

The Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return is a tax form used to report the estate tax and generation-skipping transfer tax. This form is essential for estates exceeding the federal exemption limit, ensuring compliance with IRS regulations. Utilizing airSlate SignNow simplifies the process of filling out and submitting this form.

-

How does airSlate SignNow help with the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow provides an intuitive platform that allows users to easily fill in and eSign the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. The solution streamlines the document management process, making it efficient and user-friendly. With our platform, you can ensure that your forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our plans include various features that support the completion of the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You can choose a plan that fits your budget while ensuring you have access to all necessary tools.

-

Are there any integrations available with airSlate SignNow for the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms to enhance your workflow. These integrations allow you to manage the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return alongside your existing tools. This connectivity ensures a smooth experience when handling your estate and tax documents.

-

What features does airSlate SignNow offer for completing the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow offers a range of features designed to simplify the completion of the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. Key features include customizable templates, eSignature capabilities, and secure cloud storage. These tools help ensure that your documents are accurate, secure, and easily accessible.

-

Can I track the status of my Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You will receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is airSlate SignNow secure for handling the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while you complete the Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. You can trust that your sensitive information is safe with us.

Get more for Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- Special power of attorney us citizen doc special power form

- Jv 290 carefiver information form

- Any correction or alteration will void this form

- Pld 050 general denial form

- Www courtswv govfc106 financialstatementfinancial statement this form must be completed in all

- Imm 5483 e document checklist for a study permit form

- Httpsldh oph qualtraxcloud comshowdocument asp form

- Pension investment contract form

Find out other Form 706 Rev August Fill In Capable United States Estate and Generation Skipping Transfer Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors