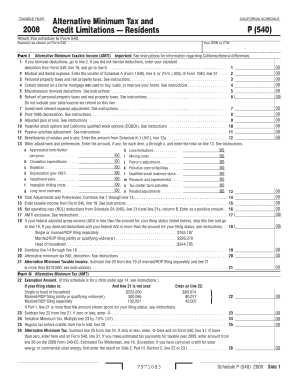

Schedule P 540 Alternative Minimum Tax and Credit Limitations Residents California Schedule P 540 Form

Understanding the Schedule P 540 Alternative Minimum Tax and Credit Limitations

The Schedule P 540 is a critical form for California residents who may be subject to the Alternative Minimum Tax (AMT). This form is specifically designed to help taxpayers calculate their AMT liability and any applicable credit limitations. The AMT is a separate tax calculation that ensures individuals with high incomes pay a minimum amount of tax, even if they qualify for various deductions and credits under the regular tax system. Understanding this form is essential for accurate tax reporting and compliance.

How to Complete the Schedule P 540

Completing the Schedule P 540 involves several steps to ensure accurate reporting of your AMT. Start by gathering all necessary financial documents, including income statements, deductions, and any credits you plan to claim. Follow the form's instructions closely, filling out each section methodically. Pay particular attention to the calculations for your AMT income and any adjustments required. It is crucial to double-check your figures to avoid errors that could lead to penalties or delays in processing.

Obtaining the Schedule P 540

California residents can obtain the Schedule P 540 through the California Department of Tax and Fee Administration (CDTFA) website or by visiting local tax offices. The form is available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. For those who prefer to file electronically, many tax preparation software programs include the Schedule P 540 as part of their offerings, making it easier to complete and submit your tax return.

Key Elements of the Schedule P 540

The Schedule P 540 includes several key elements that taxpayers must understand. These elements consist of income adjustments, allowable credits, and specific calculations for determining AMT liability. Taxpayers must report their total income, subtract any allowable deductions, and then make necessary adjustments to arrive at their AMT income. Additionally, the form provides guidance on various credits that may be limited due to AMT, which is crucial for accurate tax planning.

State-Specific Rules for the Schedule P 540

California has specific rules that govern the use of the Schedule P 540. These rules may differ from federal tax regulations, particularly concerning deductions and credits. It is important for residents to familiarize themselves with California's tax laws to ensure compliance and optimize their tax situation. This includes understanding how state-specific credits may be impacted by AMT and the implications for overall tax liability.

Filing Deadlines for the Schedule P 540

Taxpayers must be aware of the filing deadlines associated with the Schedule P 540 to avoid penalties. Typically, the deadline for submitting your California tax return, including the Schedule P 540, aligns with the federal tax return deadline. For most individuals, this is April 15. However, if you require an extension, it is essential to file the extension request by the original deadline to avoid late filing penalties.

Quick guide on how to complete schedule p 540 alternative minimum tax and credit limitations residents california schedule p 540

Accomplish [SKS] effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any interruptions. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule P 540 Alternative Minimum Tax And Credit Limitations Residents California Schedule P 540

Create this form in 5 minutes!

How to create an eSignature for the schedule p 540 alternative minimum tax and credit limitations residents california schedule p 540

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule P 540 Alternative Minimum Tax and Credit Limitations for California residents?

The Schedule P 540 Alternative Minimum Tax and Credit Limitations is a form used by California residents to calculate their alternative minimum tax. This form helps ensure that taxpayers pay a minimum amount of tax, regardless of deductions and credits. Understanding this form is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow assist with completing the Schedule P 540?

airSlate SignNow provides an easy-to-use platform for eSigning and managing documents, including tax forms like the Schedule P 540. With its intuitive interface, users can quickly fill out and send their Schedule P 540 Alternative Minimum Tax and Credit Limitations forms securely. This streamlines the tax filing process for California residents.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different needs, starting from a basic plan to more advanced options. Each plan includes features that facilitate the completion and signing of documents, including the Schedule P 540 Alternative Minimum Tax and Credit Limitations. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates with various tax preparation software and tools, enhancing your workflow. These integrations allow you to seamlessly manage your Schedule P 540 Alternative Minimum Tax and Credit Limitations alongside other tax documents. This connectivity simplifies the process for California residents.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Schedule P 540 Alternative Minimum Tax and Credit Limitations, offers numerous benefits. It provides a secure, efficient way to eSign and manage documents, reducing the time spent on paperwork. Additionally, it ensures compliance with legal standards, giving users peace of mind.

-

Is airSlate SignNow suitable for both individuals and businesses filing Schedule P 540?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses needing to file the Schedule P 540 Alternative Minimum Tax and Credit Limitations. Its user-friendly features make it accessible for anyone, regardless of their tax filing experience, ensuring a smooth process for all California residents.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the Schedule P 540 Alternative Minimum Tax and Credit Limitations. Users can trust that their information is safe while eSigning and managing their documents. This commitment to security is essential for California residents handling personal tax information.

Get more for Schedule P 540 Alternative Minimum Tax And Credit Limitations Residents California Schedule P 540

- Who form fl 142 california

- Ca dispositional dismissal with form

- Wv 200 info form

- 005 gc form

- California order transfer form

- Jv 470 findings and orders regarding prima facie showing judicial council forms courts ca

- Fl 694 form

- Jv 816 application for extension of time to file brief juvenile delinquency case appellate judicial council forms courts ca

Find out other Schedule P 540 Alternative Minimum Tax And Credit Limitations Residents California Schedule P 540

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document