13 Verification Worksheet Family and Tax Information Mappingyourfuture

What is the 13 Verification Worksheet Family And Tax Information Mappingyourfuture

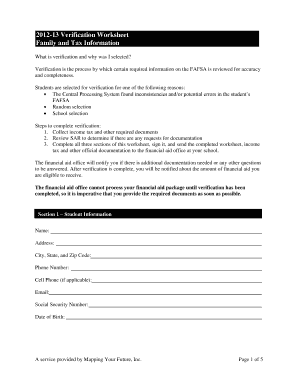

The 13 Verification Worksheet Family And Tax Information Mappingyourfuture is a critical document used primarily in the context of financial aid and tax information verification. This worksheet helps institutions confirm the accuracy of the financial information provided by students and their families when applying for federal student aid. It ensures that the financial data aligns with IRS records, which is essential for maintaining the integrity of the financial aid process.

How to use the 13 Verification Worksheet Family And Tax Information Mappingyourfuture

To effectively use the 13 Verification Worksheet, individuals must first gather all necessary financial documents, including tax returns and W-2 forms. Once these documents are collected, users can fill out the worksheet by providing accurate information regarding household size, income, and tax details. It is important to ensure that all entries match the information reported to the IRS to avoid discrepancies that could delay the financial aid process.

Steps to complete the 13 Verification Worksheet Family And Tax Information Mappingyourfuture

Completing the 13 Verification Worksheet involves several key steps:

- Gather required documents such as tax returns, W-2 forms, and any other relevant financial information.

- Fill in personal information, including the names and ages of family members.

- Report income details accurately, ensuring alignment with IRS records.

- Review all entries for accuracy and completeness before submission.

- Submit the completed worksheet to the appropriate financial aid office or institution.

Required Documents

When completing the 13 Verification Worksheet, specific documents are necessary to ensure accuracy and compliance. These typically include:

- Most recent federal tax return (Form 1040).

- W-2 forms from all employers for the relevant tax year.

- Records of any untaxed income, such as child support or welfare benefits.

- Verification of any additional income sources, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the information required on the 13 Verification Worksheet. It is essential to follow these guidelines to ensure that the data submitted aligns with federal tax regulations. Users should refer to the IRS website or consult a tax professional for detailed instructions on how to report income and other financial information accurately.

Penalties for Non-Compliance

Failing to accurately complete and submit the 13 Verification Worksheet can lead to significant penalties. Institutions may deny financial aid if discrepancies are found between the worksheet and IRS records. Additionally, individuals may face legal repercussions for providing false information, including fines or loss of eligibility for future financial aid. It is crucial to ensure all information is truthful and complete to avoid these consequences.

Quick guide on how to complete 13 verification worksheet family and tax information mappingyourfuture

Finalize 13 Verification Worksheet Family And Tax Information Mappingyourfuture with ease on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle 13 Verification Worksheet Family And Tax Information Mappingyourfuture on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign 13 Verification Worksheet Family And Tax Information Mappingyourfuture effortlessly

- Find 13 Verification Worksheet Family And Tax Information Mappingyourfuture and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Produce your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Stop worrying about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign 13 Verification Worksheet Family And Tax Information Mappingyourfuture and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13 verification worksheet family and tax information mappingyourfuture

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I complete FAFSA verification?

The verification process involves submitting documents such as tax transcripts and W-2 forms so the financial aid office at your college can see that the information on these documents matches your FAFSA application.

-

Why does the FAFSA ask for parents information?

Important: If you submit your FAFSA form without parent information, you will not receive a Student Aid Index (SAI). Some state- or school-based aid programs look at the SAI in order to determine your eligibility for their funds; because you won't have an SAI, you won't be considered for those financial aid programs.

-

How to avoid FAFSA verification?

A: The best way to avoid being selected for verification is to complete your FAFSA using the IRS Data retrieval tool, if possible. IRS data retrieval isn't an option for every applicant, but this one step will signNowly reduce the likelihood of your application being selected.

-

What is a verification worksheet for FAFSA?

The Verification Worksheet is a document the Financial Aid Office sends to you if you've been selected for a process called “verification.” The U.S. Department of Education selects applicants for this process when it wants us to confirm the information submitted on a FAFSA.

-

What is verification sheet?

A verification form helps verify and confirm the status of an individual. If you're looking for verification form templates to identify the information of a client, employee, or student, you're in the right place.

-

What is a verification statement for college?

Description: Required for prospective and First-year students in order to verify household information and tax filing status.

Get more for 13 Verification Worksheet Family And Tax Information Mappingyourfuture

- Form 5500 city of chula vista ci chula vista ca

- City of fowler business license application the city of fowler fowlercity form

- Pay business tax certificate form

- Dan mckenzie community garden form

- Business license tax appl pg 1 revised 2013 city of lawndale form

- Modesto fire explorer program form

- Glen eira busking permit form

- Suicide and self harm risk assessment form

Find out other 13 Verification Worksheet Family And Tax Information Mappingyourfuture

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form