Form Filing Assistance Program 9452 Department of the Treasury Internal Revenue Service OMB No

What is the Form Filing Assistance Program 9452 Department Of The Treasury Internal Revenue Service OMB No

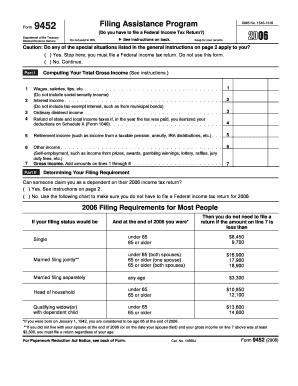

The Form Filing Assistance Program 9452, issued by the Department of the Treasury Internal Revenue Service (IRS), serves as a resource for taxpayers seeking guidance on completing their tax forms. This program is designed to assist individuals and businesses in understanding the requirements and processes associated with filing their taxes accurately and efficiently. The OMB No indicates that this form has been reviewed and approved by the Office of Management and Budget, ensuring it meets federal standards for information collection.

How to use the Form Filing Assistance Program 9452 Department Of The Treasury Internal Revenue Service OMB No

Utilizing the Form Filing Assistance Program 9452 involves several steps aimed at simplifying the tax filing process. Taxpayers can access the program through the IRS website or designated support channels. The program provides detailed instructions on how to fill out various tax forms, including necessary documentation and submission guidelines. Users are encouraged to gather relevant financial information and consult the program's resources to ensure compliance with tax regulations.

Steps to complete the Form Filing Assistance Program 9452 Department Of The Treasury Internal Revenue Service OMB No

Completing the Form Filing Assistance Program 9452 involves a systematic approach:

- Gather necessary documents: Collect all relevant financial records, including income statements, previous tax returns, and any supporting documentation.

- Access the program: Visit the IRS website or contact the appropriate IRS office to obtain the program materials.

- Follow instructions: Carefully read the guidelines provided in the program to ensure all required information is accurately filled out.

- Review your submission: Double-check all entries for accuracy before submitting the form.

- Submit the form: Follow the specified submission methods, whether online, by mail, or in person, as outlined in the program.

Required Documents

To effectively utilize the Form Filing Assistance Program 9452, taxpayers must prepare specific documents. These typically include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Receipts for deductible expenses.

- Any other documentation related to income or deductions.

Eligibility Criteria

Eligibility for the Form Filing Assistance Program 9452 generally includes individuals and businesses required to file federal tax returns. Specific criteria may vary based on income levels, filing status, and other factors. Taxpayers should review the program guidelines to determine their eligibility and ensure they meet all necessary conditions before proceeding with their filings.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the Form Filing Assistance Program 9452 may result in penalties. These can include:

- Fines for late submissions.

- Interest on unpaid taxes.

- Potential audits by the IRS.

Understanding these penalties underscores the importance of accurately completing and submitting tax forms in a timely manner.

Quick guide on how to complete form filing assistance program 9452 department of the treasury internal revenue service omb no

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your amendments.

- Select your preferred delivery method for your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow attends to your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form filing assistance program 9452 department of the treasury internal revenue service omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 945 used for?

They tell you who must file Form 945, how to complete it line by line, and when and where to file it. Use Form 945 to report federal income tax withheld (or required to be withheld) from nonpayroll payments.

-

Why am I getting a letter from the IRS in 2024?

The IRS will issue these balance due notices and letters in gradual stages in 2024 to ensure taxpayers who have questions or need help are able to signNow an IRS assistor. This will also provide additional time for tax professionals assisting taxpayers.

-

What are the most common IRS notices?

IRS Notices CP 501 - Balance Due Reminder Notice. CP 504 - Urgent Notice - Balance Due. CP 523 - Notice of Intent to Levy - You Defaulted on Your Installment Agreement. CP 2000 - Notice of Underreported Income. Letter 531- Notice of Deficiency. Letter 525 - Examination Report. Letter 12C - Information Request.

-

Why would I get a letter from the Department of Treasury Internal Revenue Service?

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

-

Where do I send my IRS form 945?

The Remittance Advice shall show the payee name and address as: Internal Revenue Service, P.O. Box 932300, Louisville, KY 40293-2300.

-

How do I get IRS form and instructions?

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

-

Why would the IRS send me a letter from the Department of Treasury?

If you receive an IRS notice or letter We may send you a notice or letter if: You have a balance due. Your refund has changed. We have a question about your return.

-

Why am I getting a certified letter from the Department of Treasury?

Usually, the IRS sends certified letters to inform taxpayers of issues that need attention. Some common reasons for certified letters include an outstanding balance, refund issues, return questions, identification verification, missing information, return changes, and processing delays.

Get more for Form Filing Assistance Program 9452 Department Of The Treasury Internal Revenue Service OMB No

- Idaho legal form

- Planilla 481 1 25 may 17 departamento de hacienda de puerto form

- El3 form

- Cage questionnaire printable form

- Golden empire council form

- Prenuptial agreement elderly form

- Halachic prenuptial agreement mutual respect form

- Briefcase one inclusion essentials for middle and h s sample form

Find out other Form Filing Assistance Program 9452 Department Of The Treasury Internal Revenue Service OMB No

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement