Schedule 1299 B Illinois Department of Revenue Form

What is the Schedule 1299 B Illinois Department Of Revenue

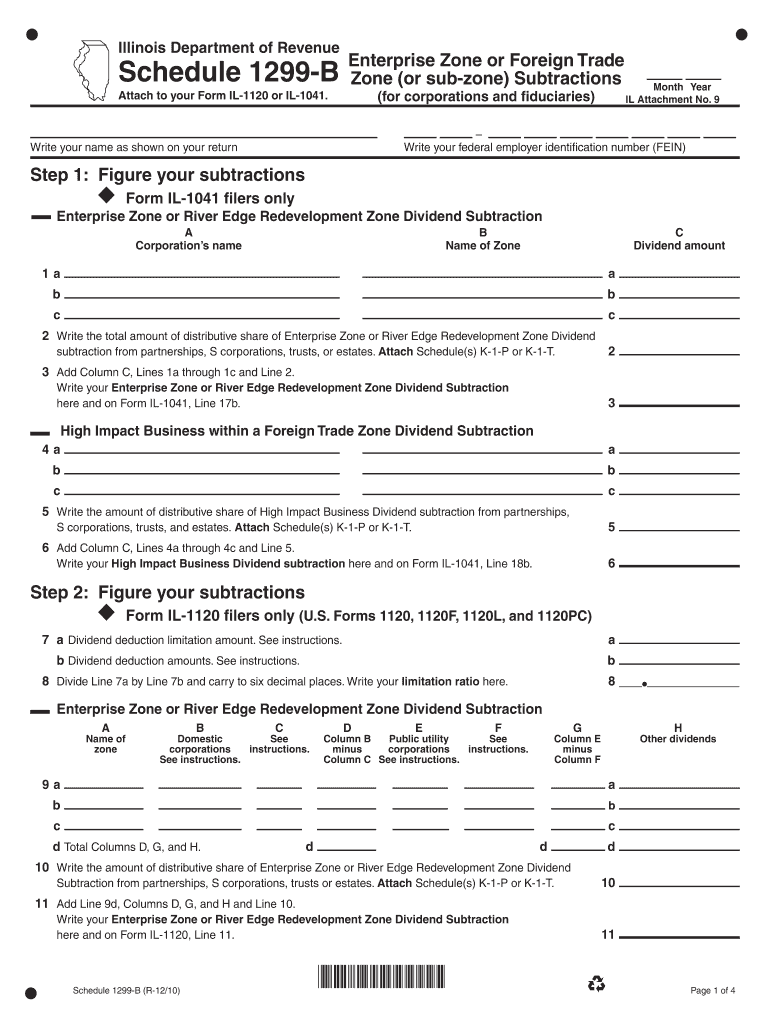

The Schedule 1299 B is a tax form issued by the Illinois Department of Revenue. It is primarily used by businesses to claim various tax credits and incentives available under Illinois tax law. This form is essential for taxpayers who want to reduce their tax liability by applying for credits related to investment, job creation, and other qualifying activities. Understanding the purpose of this form can help businesses maximize their tax benefits and ensure compliance with state regulations.

Steps to complete the Schedule 1299 B Illinois Department Of Revenue

Completing the Schedule 1299 B involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents and records related to your business activities. Next, follow these steps:

- Identify the specific tax credits you are eligible for and ensure you meet the requirements for each.

- Fill out the form accurately, providing all required information, including business details and credit calculations.

- Attach any supporting documentation that verifies your eligibility for the credits claimed.

- Review the completed form for any errors or omissions before submission.

Once completed, the form can be submitted according to the guidelines provided by the Illinois Department of Revenue.

How to obtain the Schedule 1299 B Illinois Department Of Revenue

The Schedule 1299 B can be obtained directly from the Illinois Department of Revenue's official website. It is typically available as a downloadable PDF file, which can be printed and filled out manually. Additionally, taxpayers can request a physical copy of the form by contacting the department's office. Ensure you have the latest version of the form to comply with current tax regulations.

Key elements of the Schedule 1299 B Illinois Department Of Revenue

Several key elements are essential to understand when completing the Schedule 1299 B. These include:

- Taxpayer Information: This section requires details about the business, including name, address, and identification numbers.

- Credit Calculation: Accurate calculations of the tax credits being claimed must be provided, along with the basis for those calculations.

- Supporting Documentation: Any necessary attachments that substantiate the claims made on the form must be included.

Familiarizing yourself with these elements can facilitate a smoother filing process and help ensure that all claims are valid.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1299 B are crucial for compliance with Illinois tax law. Generally, the form must be submitted along with your annual tax return. It is important to be aware of specific dates, such as:

- The due date for filing your Illinois tax return, which is typically April fifteenth.

- Any extensions that may apply, allowing additional time to file the form.

Missing these deadlines can result in penalties or the denial of claimed credits, making it essential to stay informed about important dates.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Schedule 1299 B can lead to several penalties. These may include:

- Denial of claimed tax credits, resulting in a higher tax liability.

- Fines or interest charges for late submissions or inaccuracies on the form.

- Potential audits by the Illinois Department of Revenue, which can lead to further scrutiny of your business's financial records.

Understanding these penalties can motivate timely and accurate filing, protecting your business from unnecessary financial repercussions.

Quick guide on how to complete schedule 1299 b illinois department of revenue

Complete [SKS] effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The simplest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal weight as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at any step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 1299 B Illinois Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the schedule 1299 b illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Are Walgreens dividends taxable in Illinois?

You may be permitted to subtract dividends that were paid to you on shares of Walgreens Boots Alliance, Inc. common stock between January 1, 2023 and December 31, 2023, and that were reported to you on Form 1099-DIV, from your base income for Illinois income tax purposes.

-

Is dividend income taxable in Illinois?

Dividend income you received, other than business dividend income, is not taxed by Illinois. Business dividend income you received as part of a business conducted in Illinois is taxed by Illinois.

-

What is the schedule 1299c in Illinois?

What Is the Illinois Form 1299 C? Form 1299 C is a tax schedule exclusive to the state of Illinois. It is required by residents who want to claim credits on their income tax. These credits may include property tax, education expense, or earned income credits.

-

Are Abbott dividends taxable in Illinois?

Caterpillar, Abbvie, Abbott Labs and Walgreens Boots Alliance stock each currently pay a dividend to their shareholders. If you pay taxes in Illinois, and you own one (or all) of these stocks you may be allowed to exclude the dividend(s) from your taxable income here in Illinois.

-

What comes from Illinois Department of Revenue?

The Illinois Department of Revenue (IDOR) is the code department of the Illinois state government that collects state taxes, operates the state lottery, oversees the state's industry, oversees the state's thoroughbred and harness horse racing industries, and regulates the distribution of alcoholic beverages ...

-

Are caterpillar dividends taxable in Illinois?

You may be permitted to subtract your Caterpillar Inc. dividends, as reported on Form 1099-DIV, from your base income for Illinois income tax purposes.

-

What is Illinois Department of Revenue replacement tax?

What are the rates? Corporations pay a 2.5 percent replacement tax on their net Illinois income. Partnerships, trusts, and S corporations pay a 1.5 percent replacement tax on their net Illinois income. Public utilities pay a 0.8 percent tax on invested capital.

-

Is my dividend income taxable?

They're paid out of the earnings and profits of the corporation. Dividends can be classified either as ordinary or qualified. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

Get more for Schedule 1299 B Illinois Department Of Revenue

- Retail power of attorney form

- Small business guide to provincial sales tax pst rev gov bc form

- Wreckers bill forms

- Kansas department of revenue bill of sale form

- Automobile wrecker tow car operator instruction guide nsla nevadaculture form

- Enf 12 search seizure fingerprinting and photographing form

- Motor vehicle and marinecraft titling manual section 7 dor mo form

- Fin413mv form

Find out other Schedule 1299 B Illinois Department Of Revenue

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure