Multi Family Partnership Program Cancellation Form Austin Energy

What is the Multi Family Partnership Program Cancellation Form Austin Energy

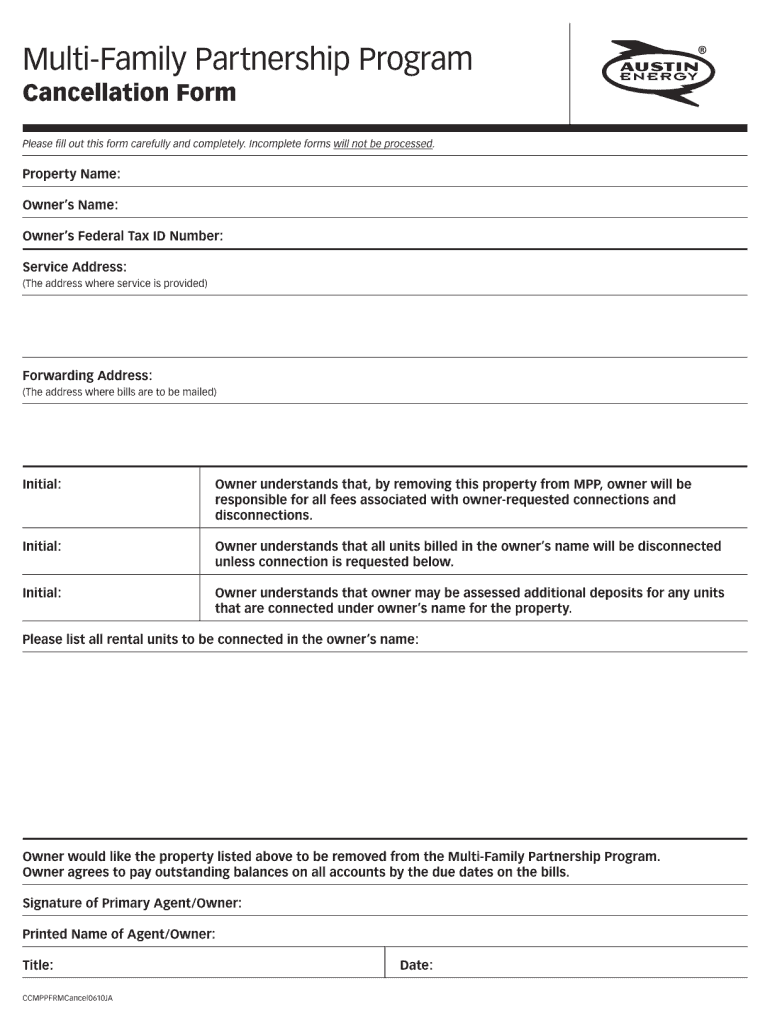

The Multi Family Partnership Program Cancellation Form Austin Energy is a document used by property owners or managers to formally withdraw from the Multi Family Partnership Program. This program is designed to provide energy efficiency services and incentives to multi-family housing units. Completing this form is essential for ensuring that the cancellation is processed correctly and that any obligations or benefits associated with the program are officially terminated.

Steps to complete the Multi Family Partnership Program Cancellation Form Austin Energy

To complete the Multi Family Partnership Program Cancellation Form Austin Energy, follow these steps:

- Download the form from the Austin Energy website or obtain a physical copy.

- Fill in your contact information, including your name, address, and phone number.

- Provide details about the property, such as the address and account number.

- Clearly state your intention to cancel your participation in the program.

- Sign and date the form to validate your request.

- Submit the completed form via the preferred submission method, such as online, by mail, or in person.

Legal use of the Multi Family Partnership Program Cancellation Form Austin Energy

The legal use of the Multi Family Partnership Program Cancellation Form Austin Energy is crucial for ensuring that the cancellation is recognized by the utility provider. When properly completed and submitted, the form acts as a formal notification of your decision to exit the program. It is important to retain a copy of the submitted form for your records, as this may be needed for future reference or in case of any disputes regarding your cancellation.

How to obtain the Multi Family Partnership Program Cancellation Form Austin Energy

The Multi Family Partnership Program Cancellation Form Austin Energy can be obtained through various means:

- Visit the official Austin Energy website to download a digital copy.

- Request a physical copy by contacting Austin Energy customer service.

- Check with local offices or community centers that may have copies available.

Key elements of the Multi Family Partnership Program Cancellation Form Austin Energy

When filling out the Multi Family Partnership Program Cancellation Form Austin Energy, be sure to include the following key elements:

- Your full name and contact information.

- The address of the property associated with the program.

- Your account number with Austin Energy.

- A clear statement indicating your request to cancel participation.

- Your signature and the date of submission.

Form Submission Methods (Online / Mail / In-Person)

The Multi Family Partnership Program Cancellation Form Austin Energy can be submitted through several methods to accommodate different preferences:

- Online: Submit the form through the Austin Energy online portal.

- Mail: Send the completed form to the designated mailing address provided on the form.

- In-Person: Deliver the form directly to an Austin Energy office during business hours.

Quick guide on how to complete multi family partnership program cancellation form austin energy

Effortlessly Prepare Multi Family Partnership Program Cancellation Form Austin Energy on Any Device

Managing documents online has gained traction among businesses and individuals. It presents an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Handle Multi Family Partnership Program Cancellation Form Austin Energy on any device with airSlate SignNow's Android or iOS apps and simplify any document-related procedure today.

The easiest way to modify and eSign Multi Family Partnership Program Cancellation Form Austin Energy without hassle

- Obtain Multi Family Partnership Program Cancellation Form Austin Energy and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Alter and eSign Multi Family Partnership Program Cancellation Form Austin Energy and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

How can people find the time, energy and funds to study programming while working a full time day job to pay for rent, bills, and help out with the family?

I applaud you for trying to improve professionally, in a skill set you believe will improve your career prospects. It isn't easy with all those other obligations, including raising and caring for a family. In fact, I suspect you have your family's best interests in mind, and you ponder programming as a career change.While it's challenging to do what you state, people do these kinds of things all the time. It takes some sacrifice on your part — you'll have to forgo downtime that you now enjoy.You'll likely need your spouse on board with your decision. She may have to take over some of the childcare and other household duties. Do you have some coursework in mind? I assume you'll continue to work at your current job while re-training for programming. Are your classes and other coursework available during your non-working hours?One final thought – it doesn't sound like you're pursuing a bachelor's degree. You should do some research to ensure the certification you plan to receive will translate into entry-level requirements for a job in programming. You'd hate to make these sacrifices, obtain your certificate, and then be unqualified for a job in programming or software development.

Create this form in 5 minutes!

How to create an eSignature for the multi family partnership program cancellation form austin energy

How to generate an electronic signature for your Multi Family Partnership Program Cancellation Form Austin Energy in the online mode

How to make an eSignature for the Multi Family Partnership Program Cancellation Form Austin Energy in Google Chrome

How to generate an electronic signature for putting it on the Multi Family Partnership Program Cancellation Form Austin Energy in Gmail

How to generate an eSignature for the Multi Family Partnership Program Cancellation Form Austin Energy from your smartphone

How to create an electronic signature for the Multi Family Partnership Program Cancellation Form Austin Energy on iOS devices

How to make an electronic signature for the Multi Family Partnership Program Cancellation Form Austin Energy on Android OS

People also ask

-

What is the Multi Family Partnership Program Cancellation Form Austin Energy?

The Multi Family Partnership Program Cancellation Form Austin Energy is a document used to formally cancel participation in the Multi Family Partnership Program. This form is essential for properties looking to withdraw from the program while ensuring compliance with Austin Energy's policies. Properly completing and submitting this form helps streamline the cancellation process.

-

How do I access the Multi Family Partnership Program Cancellation Form Austin Energy?

You can easily access the Multi Family Partnership Program Cancellation Form Austin Energy through the official Austin Energy website or directly from the airSlate SignNow platform. Our easy-to-use interface allows you to find and fill out the form quickly. Additionally, our solution supports electronic signatures, making submission hassle-free.

-

Is there a fee associated with the Multi Family Partnership Program Cancellation Form Austin Energy?

There are typically no fees directly associated with submitting the Multi Family Partnership Program Cancellation Form Austin Energy. However, businesses may incur costs related to processing or administrative tasks, especially if they require assistance with the paperwork. Using airSlate SignNow can help minimize these costs by streamlining the eSigning process.

-

What features does airSlate SignNow offer for managing the Multi Family Partnership Program Cancellation Form Austin Energy?

airSlate SignNow offers a range of features to facilitate the completion of the Multi Family Partnership Program Cancellation Form Austin Energy, including customizable templates, real-time collaboration, and secure eSigning capabilities. These features simplify document workflows while ensuring your sensitive information remains safe. The platform's cloud-based nature also allows you to access forms from anywhere.

-

Can I track the status of the Multi Family Partnership Program Cancellation Form Austin Energy?

Yes, airSlate SignNow allows you to track the status of your Multi Family Partnership Program Cancellation Form Austin Energy in real-time. You can receive notifications on the progress of the form and know when it has been viewed or signed. This feature enhances your management capabilities and keeps you informed throughout the process.

-

What are the benefits of using airSlate SignNow for the Multi Family Partnership Program Cancellation Form Austin Energy?

Using airSlate SignNow for your Multi Family Partnership Program Cancellation Form Austin Energy offers substantial benefits, including improved efficiency and reduced paperwork. Our platform enables users to complete documents faster and ensures a secure signature process. Additionally, you can integrate with other applications to enhance your overall management experience.

-

Are there integrations available with airSlate SignNow for the Multi Family Partnership Program Cancellation Form Austin Energy?

Yes, airSlate SignNow offers various integrations that can enhance the handling of the Multi Family Partnership Program Cancellation Form Austin Energy. You can connect with popular platforms such as Google Drive, Dropbox, and others to streamline your document management processes. These integrations make it easy to import and export documents as needed.

Get more for Multi Family Partnership Program Cancellation Form Austin Energy

- Witness certificate 2013 2019 form

- 1062004kg form

- Form travel history information

- A 0546 gf immigration diversit et inclusion qubec form

- Formulaire dengagement renseignements gnraux immigration

- Ciao mondobirra castello form

- Imm 5556 e document checklist worker in itscanadatime form

- Imm 5467 e document checklist atlantic intermediate canadaca form

Find out other Multi Family Partnership Program Cancellation Form Austin Energy

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation