Forms and Applications Retirement Planning American Funds

Understanding the Forms and Applications for Retirement Planning with American Funds

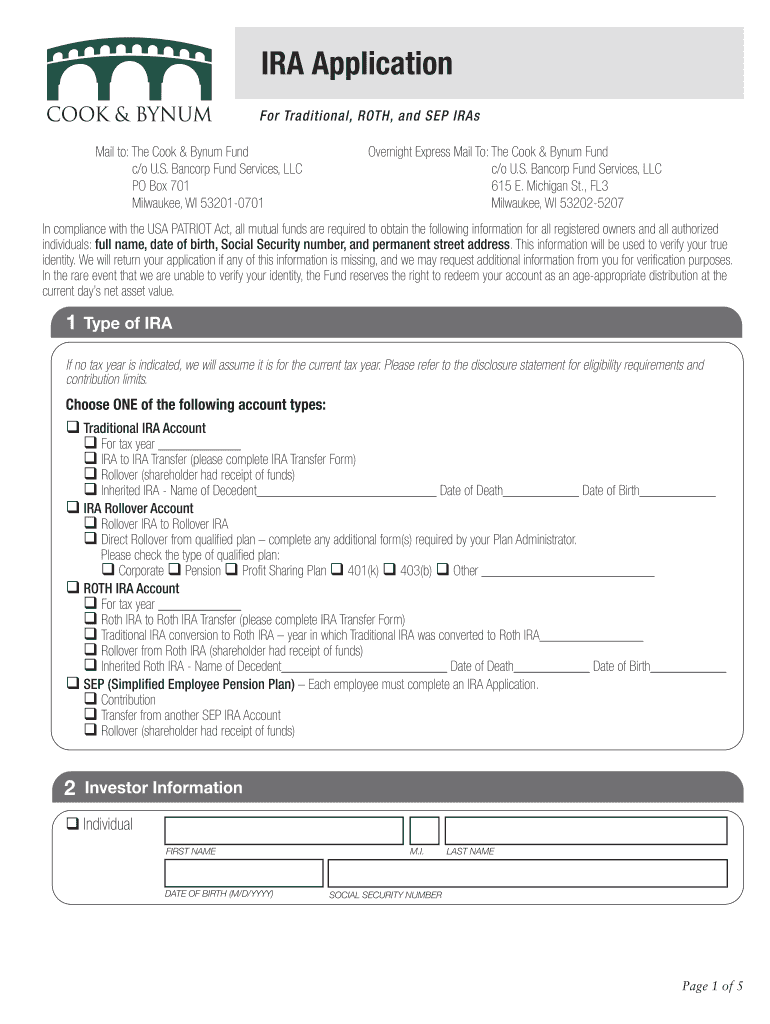

The Forms and Applications for Retirement Planning with American Funds serve as essential tools for individuals looking to manage their retirement savings effectively. These documents facilitate various processes, including account setup, fund transfers, and investment choices. Understanding the purpose and function of these forms helps ensure that users can navigate their retirement planning with confidence.

How to Use the Forms and Applications for Retirement Planning

Using the Forms and Applications for Retirement Planning involves several straightforward steps. First, identify the specific form required for your needs, such as a contribution form or a distribution request. Next, gather the necessary information, including personal identification details and account numbers. Once you have completed the form, you can submit it electronically or via mail, depending on the submission options provided by American Funds.

Steps to Complete the Forms and Applications for Retirement Planning

Completing the Forms and Applications for Retirement Planning requires careful attention to detail. Begin by reading the instructions thoroughly to understand what information is needed. Fill out each section accurately, ensuring that you provide all required signatures and dates. After reviewing the form for any errors, submit it according to the specified guidelines. Keeping a copy of the submitted form for your records is advisable.

Required Documents for Retirement Planning Forms

When filling out the Forms and Applications for Retirement Planning, certain documents may be necessary to support your application. These typically include:

- Government-issued identification (e.g., driver's license, passport)

- Social Security number

- Proof of residency (e.g., utility bill, lease agreement)

- Previous account statements if applicable

Having these documents ready can streamline the process and help avoid delays.

Eligibility Criteria for Retirement Planning Forms

Eligibility for using the Forms and Applications for Retirement Planning with American Funds generally depends on your age, employment status, and type of retirement account you wish to establish. For example, individuals must typically be at least eighteen years old to open an account. Additionally, certain forms may only be applicable to specific account types, such as IRAs or 401(k)s. It is essential to review the eligibility requirements associated with each form to ensure compliance.

Form Submission Methods for Retirement Planning

American Funds provides multiple submission methods for their Forms and Applications for Retirement Planning. Users can choose to submit their forms online through a secure portal, which allows for quick processing. Alternatively, forms can be mailed to the designated address provided on the form. In some cases, in-person submissions may also be accepted at local offices. Each method has its advantages, so consider your preferences when deciding how to submit your documents.

Legal Use of the Forms and Applications for Retirement Planning

The Forms and Applications for Retirement Planning are legally binding documents that must be completed accurately to ensure compliance with federal and state regulations. Misrepresentation or incomplete submissions can lead to delays in processing or potential penalties. It is crucial to understand the legal implications of these forms and to seek assistance if any uncertainties arise during the completion process.

Quick guide on how to complete forms and applications retirement planning american funds

Complete [SKS] effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Employ the tools available to finalize your document.

- Emphasize pertinent portions of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Forge your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at every phase of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms and applications retirement planning american funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for Forms And Applications Retirement Planning American Funds?

airSlate SignNow offers a range of features tailored for Forms And Applications Retirement Planning American Funds, including customizable templates, secure eSignature capabilities, and automated workflows. These features streamline the document management process, making it easier for users to handle retirement planning forms efficiently.

-

How does airSlate SignNow ensure the security of my Forms And Applications Retirement Planning American Funds?

Security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and comply with industry standards to protect your Forms And Applications Retirement Planning American Funds. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What is the pricing structure for using airSlate SignNow for Forms And Applications Retirement Planning American Funds?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while effectively managing Forms And Applications Retirement Planning American Funds.

-

Can I integrate airSlate SignNow with other tools for managing Forms And Applications Retirement Planning American Funds?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow for Forms And Applications Retirement Planning American Funds. This allows you to connect with tools you already use, making document management more efficient and streamlined.

-

What benefits does airSlate SignNow provide for Forms And Applications Retirement Planning American Funds?

Using airSlate SignNow for Forms And Applications Retirement Planning American Funds offers numerous benefits, including increased efficiency, reduced turnaround times, and improved accuracy in document handling. These advantages help you focus more on strategic planning rather than administrative tasks.

-

Is there a mobile app available for airSlate SignNow to manage Forms And Applications Retirement Planning American Funds?

Yes, airSlate SignNow provides a mobile app that allows you to manage Forms And Applications Retirement Planning American Funds on the go. This app ensures that you can send, sign, and track documents from anywhere, making it convenient for busy professionals.

-

How can I get started with airSlate SignNow for Forms And Applications Retirement Planning American Funds?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore the features tailored for Forms And Applications Retirement Planning American Funds. Once you're ready, choose a pricing plan that fits your needs and start streamlining your document processes.

Get more for Forms And Applications Retirement Planning American Funds

- No will no way if you die intestate which is select real estate selectrealestate com form

- Charles bacon blue gene form

- When theres no will richardnavarro ca form

- Medlawplus forminfo wills sample georgiawill

- Welcome to jamaica form

- Genetic counseling format

- Sexual harassment frequently asked questions form

- Macomb county michigan dba form

Find out other Forms And Applications Retirement Planning American Funds

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast