IRA Transfer Request Form Green Century Funds

What is the IRA Transfer Request Form Green Century Funds

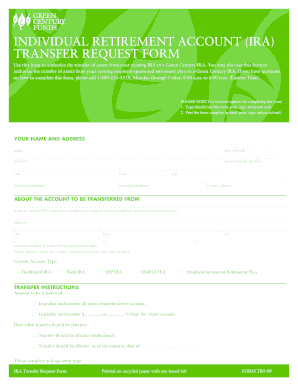

The IRA Transfer Request Form for Green Century Funds is a specific document used to facilitate the transfer of assets from one Individual Retirement Account (IRA) to another. This form is essential for individuals looking to move their retirement savings without incurring tax penalties. It ensures that the transfer process adheres to IRS regulations, maintaining the tax-deferred status of the funds throughout the transition.

How to use the IRA Transfer Request Form Green Century Funds

Using the IRA Transfer Request Form involves several straightforward steps. First, obtain the form from the Green Century Funds website or through their customer service. Next, fill in the required personal information, including your current IRA details and the account you wish to transfer to. After completing the form, submit it to your current IRA custodian for processing. It is important to ensure that all information is accurate to avoid delays in the transfer.

Steps to complete the IRA Transfer Request Form Green Century Funds

Completing the IRA Transfer Request Form requires careful attention to detail. Follow these steps:

- Download the form from Green Century Funds.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the type of IRA you are transferring from and to.

- Specify the amount or percentage of your IRA to be transferred.

- Sign and date the form to authorize the transfer.

Once completed, send the form to your current IRA custodian to initiate the transfer process.

Key elements of the IRA Transfer Request Form Green Century Funds

The key elements of the IRA Transfer Request Form include personal identification details, account information, and transfer instructions. Essential fields typically include:

- Your full name and contact information.

- The account numbers of both the current and receiving IRAs.

- The type of transfer (full or partial).

- Your signature to authorize the transaction.

Accurate completion of these elements is crucial for a smooth transfer process.

Required Documents

To complete the IRA Transfer Request Form, you may need to provide additional documentation. Commonly required documents include:

- A copy of your current IRA statement.

- Identification, such as a driver's license or Social Security card.

- Any specific forms or information requested by your current IRA custodian.

Having these documents ready can expedite the transfer process and ensure compliance with regulatory requirements.

Form Submission Methods

The IRA Transfer Request Form can typically be submitted through various methods, depending on the policies of your current IRA custodian. Common submission methods include:

- Online submission through the custodian's website.

- Mailing the completed form to the custodian's address.

- In-person delivery at the custodian's branch office.

Choosing the most convenient method can help facilitate a timely transfer.

Quick guide on how to complete ira transfer request form green century funds

Complete [SKS] effortlessly on any device

Digital document administration has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can access the necessary form and securely archive it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRA Transfer Request Form Green Century Funds

Create this form in 5 minutes!

How to create an eSignature for the ira transfer request form green century funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA Transfer Request Form Green Century Funds?

The IRA Transfer Request Form Green Century Funds is a document that allows investors to transfer their Individual Retirement Accounts (IRAs) to Green Century Funds. This form simplifies the process, ensuring that your funds are moved securely and efficiently. By using this form, you can manage your investments with a focus on sustainability.

-

How do I complete the IRA Transfer Request Form Green Century Funds?

To complete the IRA Transfer Request Form Green Century Funds, you need to provide your personal information, account details, and the amount you wish to transfer. Ensure that all information is accurate to avoid delays. Once completed, submit the form to your current IRA custodian for processing.

-

Are there any fees associated with the IRA Transfer Request Form Green Century Funds?

Typically, there are no fees for completing the IRA Transfer Request Form Green Century Funds, but it's essential to check with your current IRA custodian. Some custodians may charge a transfer fee, while Green Century Funds does not impose additional costs for the transfer process. Always review the terms before initiating the transfer.

-

What are the benefits of using the IRA Transfer Request Form Green Century Funds?

Using the IRA Transfer Request Form Green Century Funds allows you to consolidate your retirement savings into a sustainable investment option. This form streamlines the transfer process, making it easier to manage your investments. Additionally, Green Century Funds focuses on environmentally responsible investing, aligning your financial goals with your values.

-

Can I track the status of my IRA Transfer Request Form Green Century Funds?

Yes, you can track the status of your IRA Transfer Request Form Green Century Funds by contacting your current IRA custodian. They will provide updates on the transfer process and any necessary actions you may need to take. Green Century Funds also offers customer support to assist you with any inquiries.

-

What types of accounts can use the IRA Transfer Request Form Green Century Funds?

The IRA Transfer Request Form Green Century Funds can be used for various types of retirement accounts, including Traditional IRAs, Roth IRAs, and SEP IRAs. This flexibility allows you to transfer different types of retirement savings into Green Century Funds. Ensure that your account type is eligible for transfer before proceeding.

-

Is the IRA Transfer Request Form Green Century Funds secure?

Yes, the IRA Transfer Request Form Green Century Funds is designed with security in mind. The form is processed through secure channels to protect your personal and financial information. Green Century Funds prioritizes the safety of your data throughout the transfer process.

Get more for IRA Transfer Request Form Green Century Funds

- Online fillable will testament form

- W x t web it hiof form

- Computational self assembly hal archives ouvertes form

- As pdf autochthonous form

- Aarp will forms

- Avis daugmentation de loyer et de modification dune autre form

- A1 beginner student book lets talk english smartclass form

- Barbados tourist visa application barbados visa visahq form

Find out other IRA Transfer Request Form Green Century Funds

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online