Roth IRA Distribution Request First Investors Form

Understanding the Roth IRA Distribution Request for First Investors

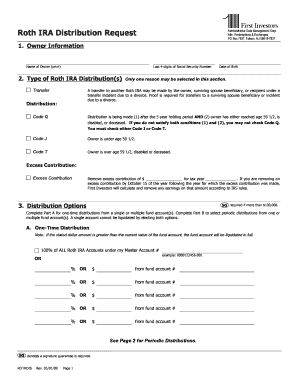

The Roth IRA Distribution Request for First Investors is a formal document used by account holders to request distributions from their Roth Individual Retirement Accounts. This form is essential for individuals looking to withdraw funds from their retirement savings while adhering to the specific guidelines set forth by the IRS. It is important to understand the implications of a distribution, including tax consequences and eligibility requirements.

Steps to Complete the Roth IRA Distribution Request for First Investors

Completing the Roth IRA Distribution Request involves several key steps:

- Gather necessary personal information, including your account number and Social Security number.

- Determine the type of distribution you wish to request, such as a full withdrawal, partial withdrawal, or conversion.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your request.

Required Documents for the Roth IRA Distribution Request

When submitting the Roth IRA Distribution Request, certain documents may be required to process your request efficiently. These typically include:

- A copy of your identification, such as a driver's license or passport.

- Any additional forms that may be specific to your distribution type, such as a hardship withdrawal form if applicable.

- Proof of eligibility for the distribution, if necessary.

Form Submission Methods for the Roth IRA Distribution Request

There are various methods to submit your completed Roth IRA Distribution Request. These methods include:

- Online submission through the First Investors website, if available.

- Mailing the form to the designated address provided by First Investors.

- In-person submission at a local branch or office, if applicable.

IRS Guidelines for Roth IRA Distributions

The IRS has established specific guidelines regarding Roth IRA distributions. Key points include:

- Distributions are generally tax-free if the account has been open for at least five years and the account holder is at least 59½ years old.

- Early withdrawals may incur penalties unless they meet certain criteria, such as a first-time home purchase or qualified education expenses.

- It is crucial to report any distributions on your tax return, even if they are tax-free.

Eligibility Criteria for Roth IRA Distributions

To qualify for a distribution from a Roth IRA, certain eligibility criteria must be met:

- The account holder must be at least 59½ years old.

- The Roth IRA must have been established for at least five years.

- Specific exceptions may apply for early withdrawals, such as disability or death.

Quick guide on how to complete roth ira distribution request first investors

Prepare [SKS] effortlessly on any device

Online document management has become widely embraced by organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Roth IRA Distribution Request First Investors

Create this form in 5 minutes!

How to create an eSignature for the roth ira distribution request first investors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Roth IRA Distribution Request for First Investors?

A Roth IRA Distribution Request for First Investors is a formal document that allows account holders to withdraw funds from their Roth IRA. This request is essential for ensuring that distributions are processed correctly and in compliance with IRS regulations. By using airSlate SignNow, you can easily eSign and submit your distribution request online.

-

How do I initiate a Roth IRA Distribution Request for First Investors?

To initiate a Roth IRA Distribution Request for First Investors, you need to complete the required form, which can be accessed through your First Investors account. Once filled out, you can use airSlate SignNow to eSign the document securely. This streamlined process ensures that your request is submitted quickly and efficiently.

-

Are there any fees associated with a Roth IRA Distribution Request for First Investors?

Fees for a Roth IRA Distribution Request for First Investors may vary based on your account type and the specific terms set by First Investors. It's important to review your account agreement or contact customer service for detailed information. Using airSlate SignNow can help minimize costs by providing a cost-effective solution for document management.

-

What are the benefits of using airSlate SignNow for my Roth IRA Distribution Request?

Using airSlate SignNow for your Roth IRA Distribution Request offers several benefits, including ease of use, security, and speed. The platform allows you to eSign documents from anywhere, reducing the time spent on paperwork. Additionally, airSlate SignNow ensures that your sensitive information is protected throughout the process.

-

Can I track the status of my Roth IRA Distribution Request for First Investors?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Roth IRA Distribution Request for First Investors. You will receive notifications when your document is viewed and signed, giving you peace of mind. This transparency helps you stay informed throughout the distribution process.

-

What integrations does airSlate SignNow offer for managing Roth IRA Distribution Requests?

airSlate SignNow integrates seamlessly with various platforms, enhancing your ability to manage Roth IRA Distribution Requests for First Investors. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your workflow. These integrations simplify document management and improve overall efficiency.

-

Is airSlate SignNow compliant with regulations for Roth IRA Distribution Requests?

Yes, airSlate SignNow is designed to comply with industry regulations, ensuring that your Roth IRA Distribution Request for First Investors meets all necessary legal requirements. The platform employs advanced security measures to protect your data and maintain compliance with IRS guidelines. This commitment to compliance helps safeguard your financial transactions.

Get more for Roth IRA Distribution Request First Investors

Find out other Roth IRA Distribution Request First Investors

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document