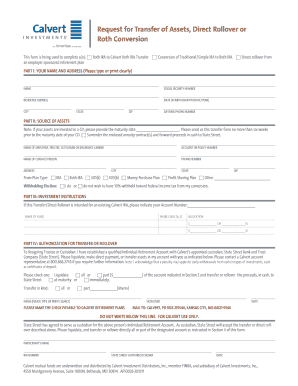

Request for Transfer of Assets, Direct Rollover or Roth Conversion Form

Understanding the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

The Request For Transfer Of Assets, Direct Rollover Or Roth Conversion is a crucial form used by individuals to move funds from one retirement account to another. This process is essential for maintaining tax advantages and ensuring that retirement savings continue to grow without interruption. The form facilitates various transactions, including direct rollovers from traditional IRAs to Roth IRAs or other qualified plans. Understanding the purpose and implications of this form is vital for effective retirement planning.

Steps to Complete the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

Completing the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion involves several important steps:

- Gather necessary information about your current retirement account and the account you wish to transfer to.

- Fill out the form accurately, ensuring that all details match your account information.

- Indicate the type of transfer you are requesting, whether it is a direct rollover or a Roth conversion.

- Review the form for accuracy before submission to avoid delays.

- Submit the completed form to your current financial institution and the receiving institution, if required.

Required Documents for the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

To successfully complete the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion, you will need to provide certain documents:

- Your current retirement account statement.

- Identification documents, such as a driver's license or Social Security number.

- Any additional forms required by the receiving institution.

Having these documents ready will streamline the process and help ensure compliance with all requirements.

IRS Guidelines for the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

The Internal Revenue Service (IRS) provides specific guidelines regarding the transfer of assets between retirement accounts. It is essential to follow these guidelines to avoid tax penalties:

- Direct rollovers are not subject to withholding taxes, while indirect rollovers may be.

- Roth conversions may have tax implications, as funds moved from a traditional IRA to a Roth IRA are subject to income tax.

- Ensure that the transfer is completed within sixty days to avoid penalties for indirect rollovers.

Eligibility Criteria for the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

Not everyone is eligible to use the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion. Eligibility generally includes:

- Individuals with existing retirement accounts, such as IRAs or 401(k)s.

- Those looking to consolidate retirement savings or change account types.

- Participants in employer-sponsored plans who meet specific criteria set by their employer.

Understanding these criteria can help individuals determine their options for retirement account management.

Form Submission Methods for the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

Submitting the Request For Transfer Of Assets, Direct Rollover Or Roth Conversion can be done through various methods:

- Online submission via the financial institution's website, if available.

- Mailing the completed form to the appropriate address provided by your current retirement account holder.

- In-person submission at a local branch of the financial institution.

Choosing the right submission method can help expedite the transfer process.

Quick guide on how to complete request for transfer of assets direct rollover or roth conversion

Effortlessly prepare [SKS] on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Efficiently edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Decide how you'd like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

Create this form in 5 minutes!

How to create an eSignature for the request for transfer of assets direct rollover or roth conversion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between a transfer of assets and a direct rollover?

An IRA transfer involves moving retirement assets from an IRA at one institution to an IRA at another. A rollover, on the other hand, is the transfer of money to an IRA from a different type of retirement account, like a 401(k).

-

What is the difference between a Roth rollover and a transfer?

What is the difference between a transfer and a rollover? A transfer is used to move funds from one institution to another without changing the account type. A direct rollover is used to move funds from an employer plan to another account type like an IRA, without having to pay taxes.

-

What is the difference between tsp transfer and rollover?

Transfers (or direct rollovers) are sent from an employer-sponsored retirement plan to the TSP, while indirect rollovers are made by the plan participant following receipt of a distribution from the plan.

-

What is the difference between rollover and transfer Vanguard?

A rollover is moving your assets from an employer-sponsored plan—like a 401(k) plan, 403(b) plan, or more—to an individual retirement account (IRA). An investment account transfer moves your financial assets from an existing external account or Vanguard account to another.

-

What is a direct rollover request?

Direct rollover – If you're getting a distribution from a retirement plan, you can ask your plan administrator to make the payment directly to another retirement plan or to an IRA.

-

What is the difference between rollover and conversion?

Differences Between IRA Rollover and IRA Conversion IRA rollovers are usually tax free, assuming the rollover is completed within 60 days from its initiation. However, IRA conversions are generally taxable with the amount converted subject to income taxes in the tax year of the conversion.

-

What is the difference between transfer and rollover 401k to IRA?

In a Transfer you are usually moving an IRA to another IRA directly. In a Rollover you are usually moving an employer sponsored plan like a 401(k) to an IRA, and this can be directly or indirect.

-

Is a direct rollover the same as a trustee to trustee transfer?

In the world of “transfers”, a direct rollover might also be called a trustee-to-trustee transfer. This is another way of saying the funds are moving directly from one retirement plan to another. Generally, direct rollovers and trustee-to-trustee transfers are fairly straightforward.

Get more for Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

Find out other Request For Transfer Of Assets, Direct Rollover Or Roth Conversion

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF