Form 511 Oklahoma Resident

What is the Form 511 Oklahoma Resident

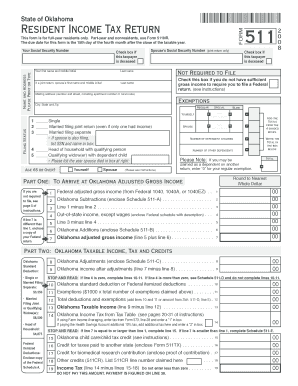

The Form 511 Oklahoma Resident is a state tax form used by residents of Oklahoma to report their income and calculate their state income tax liability. This form is essential for individuals who earn income within the state and need to fulfill their tax obligations. It is specifically designed for residents, ensuring that the tax calculations reflect the unique tax laws and rates applicable in Oklahoma.

How to use the Form 511 Oklahoma Resident

To use the Form 511 Oklahoma Resident effectively, individuals must gather all necessary financial information, including income details, deductions, and credits. The form requires taxpayers to input their total income, which includes wages, salaries, and other earnings. After calculating the total tax due, taxpayers can determine if they owe additional taxes or are eligible for a refund. It is important to follow the instructions carefully to ensure accurate completion.

Steps to complete the Form 511 Oklahoma Resident

Completing the Form 511 Oklahoma Resident involves several key steps:

- Gather all required documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report total income from all sources accurately.

- Calculate allowable deductions and credits to reduce taxable income.

- Determine the total tax liability based on the income and applicable tax rates.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Form 511 Oklahoma Resident to avoid penalties. Typically, the deadline for filing is April fifteenth of each year, coinciding with the federal tax deadline. If taxpayers require additional time, they may request an extension, but they must still pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents

When completing the Form 511 Oklahoma Resident, individuals must have several documents on hand to ensure accuracy:

- W-2 forms from employers for reporting wages.

- 1099 forms for any additional income, such as freelance work.

- Receipts for deductible expenses, including medical expenses and charitable contributions.

- Records of any tax credits that may apply.

Form Submission Methods

The Form 511 Oklahoma Resident can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file their form electronically through approved e-filing services, which can expedite processing and refunds. Alternatively, taxpayers can print the completed form and mail it to the appropriate Oklahoma tax office. In-person submissions are also an option at designated tax offices.

Quick guide on how to complete form 511 oklahoma resident

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

The easiest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 511 oklahoma resident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nonresident filing threshold for Oklahoma?

An Oklahoma return will be required to file if you had gross income from Oklahoma of $1,000 or more During the Period of non-residency.

-

What is the form for Oklahoma non-resident withholding?

A Form 500-B must be completed for each nonresident member to whom the pass-through entity has made an Oklahoma taxable distribution and paid withholding to Oklahoma.

-

Do I have to pay Oklahoma state taxes on gambling winnings?

Promotional Credits: In Oklahoma, promotional credits are taxed as normal revenue. Withholding Tax on Gambling Winnings: winnings are taxed as supplementary wages under state tax law.

-

Does Oklahoma have a state income tax form?

E-file your Oklahoma personal income tax return online with 1040.com. These 2023 forms and more are available: Oklahoma Form 511 – Personal Income Tax Return for Residents. Oklahoma Form 511 Schedule B or 511NR Schedule A – Additions to Federal AGI.

-

What are the residency requirements for tax purposes in Oklahoma?

A Resident is an individual that is domiciled in the state for the entire year. A Nonresident is an individual that was not domiciled in the state at any time during the tax year. A Part-Year Resident is an individual whose domicile was in Oklahoma for less than 12 months during the tax year.

-

How do I get my Oklahoma form 511?

To obtain Form 511-CR, visit tax.ok.gov. The option to receive a refund as a paper check was added to Form 511-NR. A minimum refund of $10.00 is required to receive a paper check. If you request a paper check for an amount less than $10.00, a debit card will be issued.

-

What is the Oklahoma state tax form 511nr?

Form 511-NR is an Oklahoma (OK) tax return specifically designed for nonresidents and part-year residents who have filing obligations within the state. It allows them to report their Oklahoma source income and calculate their tax liability.

-

What is the nonresident filing threshold for Oklahoma?

An Oklahoma return will be required to file if you had gross income from Oklahoma of $1,000 or more During the Period of non-residency.

Find out other Form 511 Oklahoma Resident

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile