Traditional Rollover or Roth IRA Application PDF Form

Understanding the Traditional Rollover Or Roth IRA Application PDF

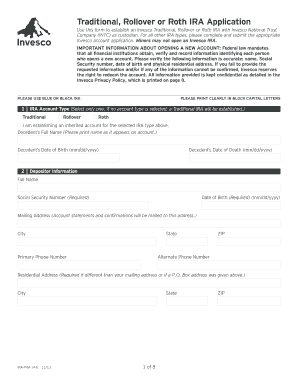

The Traditional Rollover Or Roth IRA Application PDF is a crucial document for individuals looking to transfer funds from an existing retirement account into either a Traditional or Roth IRA. This application facilitates the rollover process, ensuring that funds are moved without incurring tax penalties. Understanding the differences between a Traditional IRA and a Roth IRA is essential before completing the application, as each type has distinct tax implications and eligibility criteria.

Steps to Complete the Traditional Rollover Or Roth IRA Application PDF

Completing the Traditional Rollover Or Roth IRA Application PDF involves several key steps:

- Gather necessary personal information, including Social Security number, contact details, and employment information.

- Decide whether to open a Traditional IRA or a Roth IRA based on your financial goals and tax situation.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the application according to the specified method, whether online, by mail, or in person.

Required Documents for the Traditional Rollover Or Roth IRA Application PDF

When completing the Traditional Rollover Or Roth IRA Application PDF, certain documents are necessary to facilitate the process:

- Proof of identity, such as a driver's license or passport.

- Current retirement account statements to verify account balances and details.

- Any previous tax documents that may be relevant, particularly for Roth conversions.

Eligibility Criteria for the Traditional Rollover Or Roth IRA Application PDF

Eligibility for a Traditional Rollover or Roth IRA depends on several factors:

- Individuals must have earned income to contribute to a Roth IRA.

- There are income limits for Roth IRA contributions, which may affect eligibility.

- Funds must come from a qualified retirement plan for rollovers to be tax-free.

Form Submission Methods for the Traditional Rollover Or Roth IRA Application PDF

The submission of the Traditional Rollover Or Roth IRA Application PDF can be done through various methods:

- Online submission via the financial institution's secure portal.

- Mailing the completed form to the designated address provided by the institution.

- In-person submission at a local branch of the financial institution.

IRS Guidelines for the Traditional Rollover Or Roth IRA Application PDF

It is essential to adhere to IRS guidelines when completing the Traditional Rollover Or Roth IRA Application PDF. The IRS outlines specific rules regarding rollovers, including:

- Rollover contributions must be completed within sixty days to avoid tax penalties.

- Individuals can only perform one rollover per twelve-month period for each IRA account.

- Proper documentation must be maintained to verify the rollover transaction.

Quick guide on how to complete traditional rollover or roth ira application pdf

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method of form delivery, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes necessitating new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Traditional Rollover Or Roth IRA Application PDF

Create this form in 5 minutes!

How to create an eSignature for the traditional rollover or roth ira application pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why does TurboTax ask for Roth IRA contributions?

Turbo Tax is asking for your prior year Roth IRA contributions in order to track your basis in your Roth IRA. Withdrawals from a Roth IRA are always basis/contribution first. Entering the prior year contributions will allow the program to show that your 2023 withdrawal is a return of basis, not a taxable withdrawal.

-

How do I choose a Roth IRA or traditional IRA?

How do I choose an IRA if I qualify for both accounts? A general guideline is that if you think your tax bracket will be higher when you retire than it is today, you may want to consider a Roth IRA—especially if you're younger and have yet to signNow your peak earning years.

-

Should I use a rollover IRA or traditional IRA?

Are rollover IRAs a good idea? If you're moving to a new job that doesn't offer a 401(k) or striking out on your own as a freelancer, a rollover IRA can help you manage your retirement funds and maintain an active retirement planning strategy regardless of your work situation.

-

What IRS form do I use for traditional IRA contributions?

IRA contributions will be reported on Form 5498: IRA contribution information is reported for each person for whom any IRA was maintained, including SEP or SIMPLE IRAs. An IRA includes all investments under one IRA plan. The institution maintaining the IRA files this form.

-

Is it better to put money into Roth or traditional IRA?

Roth IRA has more investment choices, potentially lower fees (if you choose a low cost broker and low expense ratio funds), and access to contributions tax and penalty free (good in a real financial emergency or early retirement.)

Get more for Traditional Rollover Or Roth IRA Application PDF

- Physicals specialist abilene tx my urgent care clinic form

- Application for employment as school bus drivermonitor form

- Motionobjection to motion 481267282 form

- Labor md govformspaidleavecomplaintmaryland earned sick and safe leave complaint form

- Proposal for artist performance at weekend woodsetter com

- Employment application osso healthcare network form

- Employer and retirement coordinator verification form opers ok

- Biweekly time sheet for employees office of economic and durhamnc form

Find out other Traditional Rollover Or Roth IRA Application PDF

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement