IRA Distribution Form Farmbureaubank Com

What is the IRA Distribution Form Farmbureaubank com

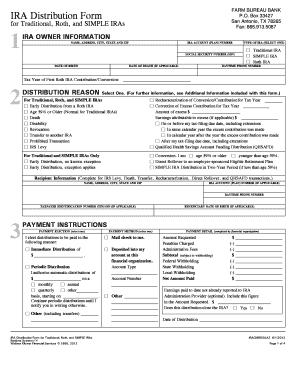

The IRA Distribution Form from Farm Bureau Bank is a document used by account holders to request distributions from their Individual Retirement Accounts (IRAs). This form is essential for managing retirement funds, allowing individuals to withdraw money according to their specific needs and financial plans. It is designed to comply with IRS regulations and ensure that distributions are processed accurately and efficiently.

How to use the IRA Distribution Form Farmbureaubank com

To use the IRA Distribution Form effectively, individuals should first download the form from the Farm Bureau Bank website. After obtaining the form, fill it out with the necessary personal information, including account details and the type of distribution requested. Once completed, the form must be submitted according to the instructions provided, ensuring that all required signatures and documentation are included to facilitate a smooth processing experience.

Steps to complete the IRA Distribution Form Farmbureaubank com

Completing the IRA Distribution Form involves several key steps:

- Download the form from the Farm Bureau Bank website.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the type of distribution you are requesting, such as a full withdrawal or a partial distribution.

- Specify the amount you wish to withdraw and the method of payment.

- Review the form for accuracy and completeness before signing.

- Submit the form as instructed, either online or via mail.

Key elements of the IRA Distribution Form Farmbureaubank com

The key elements of the IRA Distribution Form include personal identification information, account details, distribution type, and payment method. Additionally, the form may require the signature of the account holder, along with any necessary documentation to validate the request. Understanding these elements is crucial for ensuring that the form is filled out correctly and in compliance with IRS guidelines.

Required Documents

When submitting the IRA Distribution Form, certain documents may be required to support the request. These may include:

- A copy of a government-issued ID for identity verification.

- Any previous account statements that may be relevant.

- Documentation of the reason for the distribution, if applicable.

Having these documents ready can expedite the processing of your distribution request.

Eligibility Criteria

Eligibility to use the IRA Distribution Form typically depends on factors such as age and the type of IRA account held. Generally, individuals must be at least fifty-nine and a half years old to make penalty-free withdrawals. However, specific circumstances, such as financial hardship or disability, may allow for earlier distributions. It is important to review your account terms and IRS regulations to determine your eligibility.

Quick guide on how to complete ira distribution form farmbureaubank com

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRA Distribution Form Farmbureaubank com

Create this form in 5 minutes!

How to create an eSignature for the ira distribution form farmbureaubank com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRA beneficiary distribution account?

An Inherited IRA, or a Beneficiary IRA, is an account that is opened when someone inherits an IRA or employer-sponsored retirement account after the original owner's death. As a beneficiary, you can't make additional contributions.

-

What is IRA distribution income?

Distributions are allowed to be taken from an individual retirement account (IRA) at any time. A distribution from a traditional IRA will be included in the owner's income as ordinary income and, depending on the owner's age, may also be subject to a 10% early distribution penalty.

-

How do I get an IRA distribution?

For your withdrawal to be considered qualified, you must: own your Roth for 5 years AND. withdraw under one of the following circumstances: Age 59½ First-time home purchase (up to $10,000) Disability. Death.

-

What form shows IRA distributions?

You will receive a Form 1099-R when you make a withdrawal from a IRA, 401(k) or other retirement account. This form includes information such as: the amount you withdrew, how much is taxable (if that was determined), any taxes that were withheld, and a code that shows what type of distribution it was.

-

How do I get an IRA distribution?

For your withdrawal to be considered qualified, you must: own your Roth for 5 years AND. withdraw under one of the following circumstances: Age 59½ First-time home purchase (up to $10,000) Disability. Death.

-

What form do I use for IRA distribution home purchase tax?

Regardless of whether the IRA withdrawal is a qualified one, you'll need to report any taxable income from the distribution on your 1040. If you have to pay a 10% tax penalty for a nonqualified distribution, you may need to fill out IRS Form 5329.

-

What is the IRA distribution form?

The IRA Distribution Form for Traditional (including SEP), Roth, and SIMPLE IRAs is used to document and instruct us of your distribution related decisions. Additional Documents. Applicable law or policies of the IRA custodian/trustee may require additional documentation.

-

What is the difference between an IRA contribution and an IRA distribution?

Contributions to a Roth IRA aren't deductible (and you don't report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren't subject to tax. To be a Roth IRA, the account or annuity must be designated as a Roth IRA when it's set up.

Get more for IRA Distribution Form Farmbureaubank com

- Family law notice of matter to be taken off calendar form

- Writ of habeas corpus ad testificandum superior court sacramento saccourt ca form

- Petition to relocate form

- Form 1 998 final disposition form florida rules of civil

- We also try to assist tenants who complain that a landlord failed to return the rent security when the tenant moved out form

- Services cookcountyclerkofcourt org forms formssmall estate affidavit services cookcountyclerkofcourt org

- Receipt on behalf of minor franklin county ohio franklincountyohio form

- State of north carolina capital charge file no in the form

Find out other IRA Distribution Form Farmbureaubank com

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement