IRA Certification for the Internal Conversion of a Traditional IRA to Form

Understanding IRA Certification For The Internal Conversion Of A Traditional IRA To

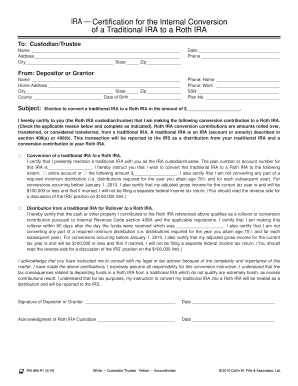

The IRA Certification for the internal conversion of a Traditional IRA to another type of IRA is a formal document that certifies the details of the conversion process. This certification is crucial for ensuring compliance with IRS regulations and for maintaining the tax-advantaged status of retirement accounts. The form typically requires information about the account holder, the type of IRA being converted to, and the amount being transferred. Understanding the specific requirements of this certification can help individuals navigate the conversion process smoothly.

Steps to Complete the IRA Certification For The Internal Conversion Of A Traditional IRA To

Completing the IRA Certification involves several key steps:

- Gather necessary information, including personal identification and details about the current Traditional IRA.

- Determine the type of IRA to which the conversion will be made, such as a Roth IRA or another Traditional IRA.

- Fill out the certification form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate financial institution or custodian handling the IRA.

Legal Use of the IRA Certification For The Internal Conversion Of A Traditional IRA To

The legal use of the IRA Certification is essential for compliance with IRS regulations. This certification serves as proof that the conversion meets all legal requirements, including eligibility criteria and tax implications. It is important to retain a copy of the certification for personal records and for any future tax reporting. Failure to properly complete and submit this certification can lead to penalties or unintended tax consequences.

Required Documents for the IRA Certification For The Internal Conversion Of A Traditional IRA To

When preparing to complete the IRA Certification, several documents are typically required:

- A copy of the current Traditional IRA account statement.

- Identification documents, such as a driver’s license or Social Security number.

- Details of the new IRA account, including the account number and institution.

- Any previous IRS forms related to the IRA, if applicable.

IRS Guidelines for IRA Certification For The Internal Conversion Of A Traditional IRA To

The IRS provides specific guidelines regarding the conversion of Traditional IRAs. These guidelines outline eligibility requirements, tax implications, and reporting obligations. It is important to review these guidelines to ensure compliance and to understand the potential tax consequences of the conversion. The IRS also specifies the time frame in which the conversion must occur to avoid penalties.

Eligibility Criteria for the IRA Certification For The Internal Conversion Of A Traditional IRA To

Eligibility for converting a Traditional IRA typically includes the following criteria:

- The account holder must be under the age of seventy and a half, as there are no required minimum distributions until this age.

- There should be no outstanding loans against the Traditional IRA.

- The account holder must meet income requirements if converting to a Roth IRA.

- The conversion must be completed within the tax year to avoid penalties.

Quick guide on how to complete ira certification for the internal conversion of a traditional ira to

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRA Certification For The Internal Conversion Of A Traditional IRA To

Create this form in 5 minutes!

How to create an eSignature for the ira certification for the internal conversion of a traditional ira to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What form do I need to report IRA conversion?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

-

Who must file form 8606?

An individual is responsible for filing Form 8606 each year that he/she: Makes a nondeductible contribution(s) to a traditional IRA, including a repayment of a qualified disaster, a qualified reservist, or a qualified birth or adoption distribution.

-

What is a traditional IRA certificate?

What is an IRA Certificate? An individual retirement account certificate, or IRA CD, is an IRA where your money is used to earn higher dividends in certificates of deposit, or CDs. The rates of return are more stable and less risky than other forms of investment.

-

How to transfer a traditional IRA to another traditional IRA?

Trustee-to-trustee transfer – If you're getting a distribution from an IRA, you can ask the financial institution holding your IRA to make the payment directly from your IRA to another IRA or to a retirement plan. No taxes will be withheld from your transfer amount.

-

What is the IRS form for IRA conversion?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs; Distributions from traditional, traditional SEP, or traditional SIMPLE IRAs, if you have a basis in these IRAs; Conversions from traditional, traditional SEP, or traditional SIMPLE IRAs to Roth, Roth SEP, or Roth SIMPLE IRAs; and.

-

How do I report an IRA conversion on my taxes?

To report a conversion properly, you must complete two steps: The taxpayer will be issued Form 1099-R showing the total distribution made from their Traditional IRA account. To report, go to: ... The full distribution does not need to be converted to a Roth IRA. Conversions must be reported on Form 8606, Part II.

-

Should I receive a 1099-R for a Roth conversion?

You should have received a Form 1099-R from your financial institution reporting the Roth conversion. It will be coded as a rollover (Code G). You'll use the information from that form to report your Roth conversion income on Form 8606 with the taxable portion of the conversion income reported on your Form 1040.

-

Is an IRA conversion taxable?

On a conversion In many cases, the traditional IRA or retirement plan being converted will consist of pretax contributions and earnings. In such cases, the entire amount converted — contributions plus earnings — will be taxable as ordinary income.

Get more for IRA Certification For The Internal Conversion Of A Traditional IRA To

Find out other IRA Certification For The Internal Conversion Of A Traditional IRA To

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document