Form 8880 Fill in Version Credit for Qualified Retirement Savings Contributions

What is the Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

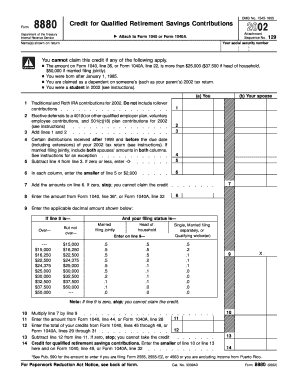

The Form 8880 is a tax form used to claim the Credit for Qualified Retirement Savings Contributions. This credit is designed to encourage individuals to save for retirement by providing a tax incentive. Eligible taxpayers can receive a credit based on their contributions to retirement accounts, such as IRAs or 401(k) plans. The amount of the credit varies depending on the taxpayer's filing status and adjusted gross income (AGI).

How to use the Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

To effectively use the Form 8880, taxpayers must first determine their eligibility based on income and filing status. Once eligibility is confirmed, individuals can fill out the form by providing necessary information about their retirement contributions. It is important to follow the instructions carefully to ensure accurate reporting. After completing the form, it should be submitted along with the taxpayer's federal income tax return.

Steps to complete the Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

Completing the Form 8880 involves several key steps:

- Gather documentation related to retirement contributions, including account statements.

- Determine your filing status and AGI to assess eligibility for the credit.

- Fill out the form by entering personal information and contribution details.

- Calculate the credit amount based on the provided instructions.

- Attach the completed form to your tax return before submission.

Eligibility Criteria

Eligibility for the Credit for Qualified Retirement Savings Contributions is determined by several factors, including:

- Filing status: Single, married filing jointly, married filing separately, or head of household.

- Adjusted gross income (AGI): Must fall below specified limits based on filing status.

- Age: Taxpayers must be at least eighteen years old.

- Retirement contributions: Must have made eligible contributions to a qualified retirement plan.

IRS Guidelines

The IRS provides specific guidelines for using the Form 8880, including detailed instructions on eligibility, calculation of the credit, and submission procedures. Taxpayers should refer to the IRS instructions for the most current information and any updates that may affect their filing. Adhering to these guidelines ensures compliance and maximizes potential benefits from the credit.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 8880. The form can be filed electronically through tax software, which often simplifies the process by automatically calculating the credit. Alternatively, individuals can print the completed form and mail it to the appropriate IRS address. In-person submission is typically not available for this form, as it is primarily processed through electronic or postal methods.

Quick guide on how to complete form 8880 fill in version credit for qualified retirement savings contributions

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or hide sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your amendments.

- Decide how you wish to share your form—via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

Create this form in 5 minutes!

How to create an eSignature for the form 8880 fill in version credit for qualified retirement savings contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the retirement savings contributions credit on form 8880?

You use IRS Form 8880 to calculate and claim the Saver's Credit, a tax benefit designed to encourage lower-income individuals to save for retirement. The credit is a percentage of your contributions to qualified retirement plans like IRAs and 401(k)s, ranging from 10% to 50%, depending on your income.

-

Do I have to claim the savers credit on my taxes?

Taxpayers who contribute to qualified employer-sponsored retirement plans, IRAs, or ABLE plans are required to complete IRS Form 8880 to claim the Saver's Tax Credit.

-

How do you calculate retirement savings contributions credit?

Depending on your adjusted gross income and tax filing status, you can claim the credit for 50%, 20% or 10% of the first $2,000 you contribute during the year to a retirement account. Therefore, the maximum credit amounts that can be claimed are $1,000, $400 or $200.

-

How do I know if I qualify for retirement savings contribution credit?

You're eligible for the credit if you're: Age 18 or older, Not claimed as a dependent on another person's return, and. Not a student.

-

What is the form 8880 credit for qualified retirement savings contributions?

Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). The maximum amount of the credit is $1,000 ($2,000 if married filing jointly). claimed on Schedule 1 (Form 1040), line 20.

-

How do I know if I qualify for retirement savings contribution credit?

You're eligible for the credit if you're: Age 18 or older, Not claimed as a dependent on another person's return, and. Not a student.

-

Can I opt out of retirement savings contribution credit?

If you are eligible for the Saver's credit it cannot be removed. The Form 8880, Credit for Qualified Retirement Savings Contributions is created by the TurboTax software.

-

Does the savers credit increase your refund?

It is a dollar-for-dollar reduction of your federal income tax liability, and can reduce the amount you owe or increase your refund for taxes already paid. This tax credit is in addition to tax deductions and tax-deferred growth on retirement savings — a triple tax benefit.

-

Can I skip form 8880?

Preparing Form 8880 To claim the credit, you must complete IRS form 8880 and include it with your tax return.

-

Why don't I qualify for retirement savings contribution credit?

To be eligible for the retirement savings contribution credit/Saver's Credit, you must meet all of these requirements: You make voluntary contributions to a qualified retirement plan for 2023. You're at least age 18 by the end of 2023. You weren't a full-time student during any part of five calendar months in 2023.

-

How to claim retirement savings contribution credit?

How do I claim the Savers Credit? To claim the credit, use Form 8880, "Credit for Qualified Retirement Savings Contributions" as an addition to your Form 1040. Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service.

-

Should I fill out form 8880?

Do I need to file Form 8880? Yes, if you have made eligible contributions to your retirement savings account and you meet the income and other eligibility criteria, you should file Form 8880 to claim the Saver's Credit.

Get more for Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

- 3rd party requestor recovery certificate agreement form

- Faa academy faa form

- Part 3 faa faa form

- Pfc update 47 04 faa faa form

- Application for certificate faa faa form

- Department of transportation faa faa form

- Sn dey mathematics class 12 solutions pdf download form

- Standard bank learnership application form pdf image

Find out other Form 8880 Fill in Version Credit For Qualified Retirement Savings Contributions

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple