IAQualifiedPlanDirectRolloverAuthorization Pub Form

What is the IAQualifiedPlanDirectRolloverAuthorization pub

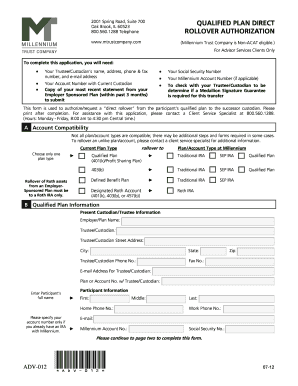

The IAQualifiedPlanDirectRolloverAuthorization pub is a specific form used in the United States to authorize the direct rollover of funds from one qualified retirement plan to another. This form is essential for individuals who wish to transfer their retirement savings without incurring taxes or penalties. It ensures that the funds are moved directly between financial institutions, maintaining the tax-deferred status of the retirement assets.

How to use the IAQualifiedPlanDirectRolloverAuthorization pub

To use the IAQualifiedPlanDirectRolloverAuthorization pub, individuals must first obtain the form from their current retirement plan provider or the receiving plan. Once the form is acquired, it should be filled out with accurate personal information, including the account numbers and the details of both the current and new retirement plans. After completing the form, it must be submitted to the current plan administrator for processing.

Steps to complete the IAQualifiedPlanDirectRolloverAuthorization pub

Completing the IAQualifiedPlanDirectRolloverAuthorization pub involves several clear steps:

- Obtain the form from your current retirement plan provider or the new plan.

- Fill in your personal details, including your name, Social Security number, and contact information.

- Provide information about the current plan, including the plan name and account number.

- Enter the details of the new plan, ensuring accuracy in the account information.

- Sign and date the form to authorize the rollover.

- Submit the completed form to your current plan administrator for processing.

Key elements of the IAQualifiedPlanDirectRolloverAuthorization pub

Several key elements must be included in the IAQualifiedPlanDirectRolloverAuthorization pub to ensure its validity:

- Personal Information: Full name, Social Security number, and contact information.

- Current Plan Details: Name of the current retirement plan and account number.

- New Plan Information: Name and account number of the receiving retirement plan.

- Authorization Signature: Signature of the account holder to authorize the transfer.

- Date: The date when the form is signed.

Legal use of the IAQualifiedPlanDirectRolloverAuthorization pub

The IAQualifiedPlanDirectRolloverAuthorization pub is legally recognized as a binding document that facilitates the transfer of retirement funds. It is important to ensure that the form is completed accurately to avoid any potential legal issues or delays in the rollover process. Both the sending and receiving financial institutions must comply with IRS regulations regarding rollovers, making this form crucial for maintaining compliance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the IAQualifiedPlanDirectRolloverAuthorization pub. These guidelines outline the eligibility criteria for rollovers, the tax implications of direct rollovers, and the necessary documentation required to complete the process. Adhering to these guidelines helps individuals avoid tax penalties and ensures that their retirement savings remain intact during the transfer.

Quick guide on how to complete iaqualifiedplandirectrolloverauthorization pub

Complete [SKS] effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without interruption. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iaqualifiedplandirectrolloverauthorization pub

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Are distributions to beneficiaries taxable?

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income. The trust doesn't pay the tax. Beneficiaries aren't subject to taxes on distributions from the trust's principal, however. The principal is the original sum of money that was placed into the trust.

-

What is the difference between a rollover and a direct rollover?

A direct rollover is used to move funds from an employer plan to another account type like an IRA, without having to pay taxes. An indirect rollover entails taking a short-term distribution to move funds from one account type to another.

-

Do distributions count as taxable income?

You can take distributions from your IRA (including your SEP-IRA or SIMPLE-IRA) at any time. There is no need to show a hardship to take a distribution. However, your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you're under age 59 1/2.

-

What is a direct rollover of a distribution to a qualified plan?

A direct rollover can also be a distribution from an IRA to a qualified plan, 403(b) plan, or a governmental 457 plan. A direct rollover effectively allows you to transfer funds from one retirement account to another without penalty and without creating a taxable event.

-

Are distributions taxable in chapter 1 of pub 590 b?

Distributions from a traditional IRA are taxed as ordinary income, but if you made nondeductible contributions, not all of the distribution is taxable. See Are Distributions Taxable? in chapter 1. Distributions from a Roth IRA aren't taxed as long as you meet certain criteria.

-

How do I know if my distribution is taxable?

When you take a distribution from your 401(k), your retirement plan will send you a Form 1099-R. This tax form shows how much you withdrew overall and the federal and state taxes withheld from the distribution if applicable. This tax form for 401(k) distribution is sent when you've made a distribution of $10 or more.

-

What part of 401k distribution is taxable?

The age at which 401(k) withdrawals become tax-free is generally 59 ½. Once you signNow this age, you can withdraw funds from their 401(k) without incurring the 10% early withdrawal penalty. However, all withdrawals from your 401(k), even those taken after age 59½, are subject to ordinary income taxes.

-

What is a qualified plan 401k rollover?

A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan.

Get more for IAQualifiedPlanDirectRolloverAuthorization pub

Find out other IAQualifiedPlanDirectRolloverAuthorization pub

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy