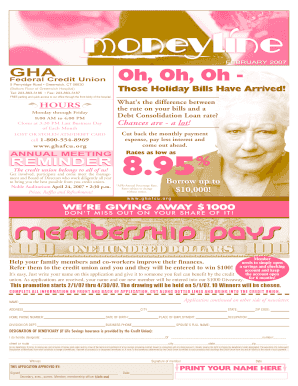

February GHA Federal Credit Union Form

What is the February GHA Federal Credit Union

The February GHA Federal Credit Union is a member-focused financial institution that provides a range of banking services tailored to meet the needs of its members. As a credit union, it operates on a not-for-profit basis, which allows it to offer competitive rates on loans and savings accounts. Members benefit from personalized service and a community-oriented approach, making it a trusted choice for individuals and families seeking financial stability.

How to use the February GHA Federal Credit Union

Using the February GHA Federal Credit Union involves several straightforward steps. Members can access their accounts online or through mobile banking applications. Services include checking and savings accounts, loans, and credit cards. Members can also visit local branches for in-person assistance. To utilize these services, members need to create an account, which requires providing personal information and identification.

Steps to complete the February GHA Federal Credit Union

To complete transactions or applications with the February GHA Federal Credit Union, follow these steps:

- Gather necessary documentation, such as identification and proof of income.

- Visit the credit union's website or a local branch.

- Fill out the required forms for the specific service you need, such as a loan application or account opening.

- Submit the completed forms either online or in person.

- Await confirmation and follow up if necessary.

Eligibility Criteria

Eligibility for membership in the February GHA Federal Credit Union typically requires individuals to meet specific criteria. This may include residing, working, or having family connections within the credit union's defined community. Additionally, some services may have age or income requirements. It is advisable for potential members to review the eligibility guidelines on the credit union's website or contact customer service for detailed information.

Required Documents

When applying for membership or services at the February GHA Federal Credit Union, certain documents are generally required. These may include:

- Government-issued identification (e.g., driver's license, passport).

- Social Security number or tax identification number.

- Proof of address (e.g., utility bill, lease agreement).

- Income verification (e.g., pay stubs, tax returns).

Having these documents ready can streamline the application process and ensure compliance with the credit union's requirements.

Form Submission Methods

Members of the February GHA Federal Credit Union can submit forms through various methods to accommodate their preferences. Options typically include:

- Online submission via the credit union's secure website.

- Mailing completed forms to the designated address.

- In-person submission at a local branch.

Each method has its advantages, and members should choose the one that best suits their needs.

Quick guide on how to complete february gha federal credit union

Manage [SKS] easily on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight essential parts of your documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries exactly the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to February GHA Federal Credit Union

Create this form in 5 minutes!

How to create an eSignature for the february gha federal credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What credit union is in all 50 states?

PenFed Credit Union PenFed Credit Union serves over 2 million members worldwide and operates across all 50 states. It offers a wide range of financial services helping with loans, savings and credit cards.

-

What is the second largest credit union in Utah?

Mountain America Credit Union is the second largest credit union in Utah.

-

What is the most trusted credit union?

Compare the Best Credit Unions Financial InstitutionWhy We Picked It Blue Federal Credit Union Best Overall Liberty Federal Credit Union Best for Checking Alliant Credit Union Best for a Savings Account Service Credit Union Best for Military Individuals & Families1 more row

-

What is the largest natural member credit union in the United States?

1. Navy Federal Credit Union. Founded in 1933, Navy Federal Credit Union is the largest national credit union in terms of both assets and membership.

-

What is the best federal credit union to join?

Compare the Best Credit Unions Financial InstitutionWhy We Picked It Blue Federal Credit Union Best Overall Liberty Federal Credit Union Best for Checking Alliant Credit Union Best for a Savings Account Service Credit Union Best for Military Individuals & Families1 more row

-

What are the top 5 largest credit unions in the US?

The largest credit unions in the U.S. include Navy Federal, State Employees', PenFed, Boeing Employees', SchoolsFirst, Golden 1, America First and Alliant.

-

Do credit unions affect your credit?

Because credit unions are not-for-profit, they can offer members numerous benefits that can directly and indirectly build an individual's credit score.

-

What is the hardest credit union to join?

Progressive Credit Union - You must be recommended by another member. This might be the most unique credit union requirement, and it also seems to be the toughest.

Get more for February GHA Federal Credit Union

- 2 doing business 2 1 visa and stay in korea home invest korea investkorea form

- Immd gov form

- Montana voter registration application sos mt form

- Arizona voter registration form solicitud de inscripcin para votar en arizona calvoter

- Maryland voter registration application a b smcm form

- Montana voter registration form montanaprolifecoalition

- Mail in application for voter registration hamblencountygovernment form

- 6 msweb03 co wake nc form

Find out other February GHA Federal Credit Union

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile