Supplemental Retirement Plan Salary Reduction Agreement 403b Form

What is the Supplemental Retirement Plan Salary Reduction Agreement 403b

The Supplemental Retirement Plan Salary Reduction Agreement 403b is a legal document that allows employees to allocate a portion of their salary towards a retirement savings plan. This plan is specifically designed for employees of public schools, certain non-profit organizations, and some government entities. By signing this agreement, employees can reduce their taxable income, as contributions made to the 403b plan are typically made before taxes are deducted. This can lead to significant tax savings and help employees build a more secure financial future.

How to use the Supplemental Retirement Plan Salary Reduction Agreement 403b

Using the Supplemental Retirement Plan Salary Reduction Agreement 403b involves several steps. First, employees need to review their employer's retirement plan options and determine how much of their salary they wish to contribute. Next, they should obtain the agreement form from their employer or the plan administrator. After filling out the necessary information, including the contribution amount and personal details, employees must sign the form. Finally, submit the completed agreement to the appropriate department within the organization to ensure that the salary reduction is processed correctly.

Steps to complete the Supplemental Retirement Plan Salary Reduction Agreement 403b

Completing the Supplemental Retirement Plan Salary Reduction Agreement 403b requires careful attention to detail. Follow these steps:

- Review the plan details provided by your employer.

- Decide on the percentage or dollar amount of your salary you want to contribute.

- Obtain the Salary Reduction Agreement form from your employer.

- Fill out the form with accurate personal information and contribution details.

- Sign and date the agreement to validate your request.

- Submit the completed form to your HR department or plan administrator.

Key elements of the Supplemental Retirement Plan Salary Reduction Agreement 403b

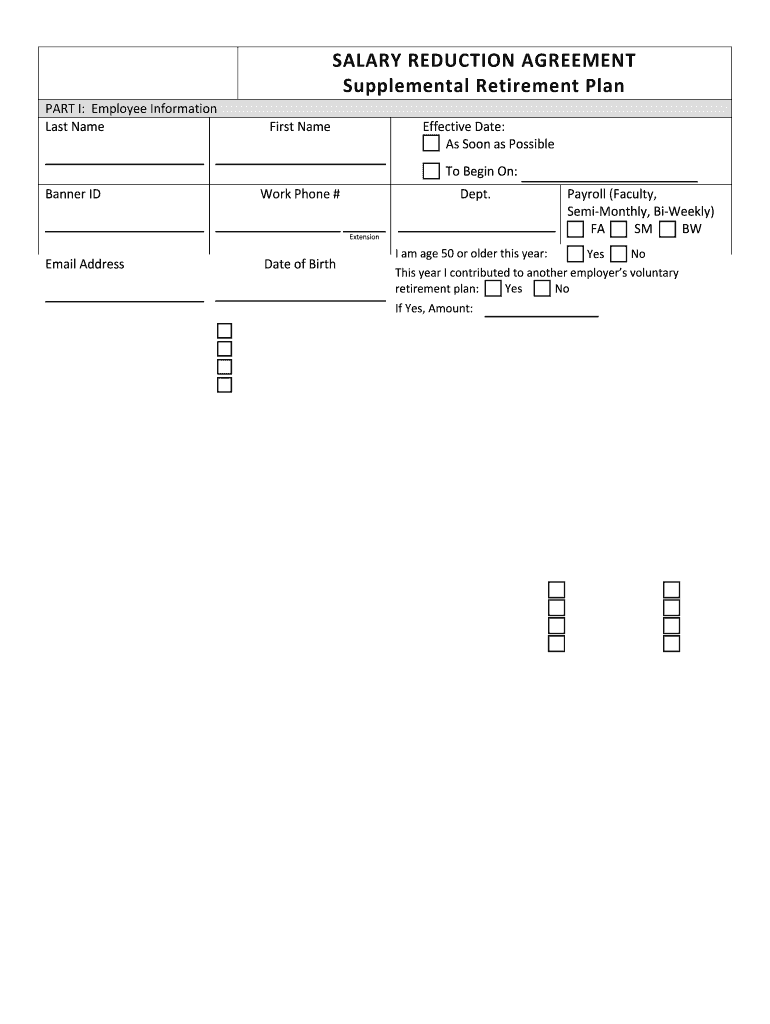

The key elements of the Supplemental Retirement Plan Salary Reduction Agreement 403b include the employee's personal information, the specified salary reduction amount, and the effective date of the agreement. It is also important to include any additional instructions or preferences regarding investment options within the 403b plan. Understanding these elements ensures that the agreement is correctly processed and that contributions are allocated as intended.

Eligibility Criteria

Eligibility for participating in a Supplemental Retirement Plan Salary Reduction Agreement 403b typically includes being an employee of an eligible organization, such as a public school or a non-profit entity. Additionally, there may be age requirements or minimum service periods that employees must meet. It is important for employees to check with their employer or plan administrator to confirm their eligibility before submitting the agreement.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the Supplemental Retirement Plan Salary Reduction Agreement 403b. These guidelines outline contribution limits, tax implications, and withdrawal rules. For example, employees can contribute a maximum amount set by the IRS each year, which may vary based on age and other factors. Understanding these guidelines helps employees make informed decisions about their retirement savings and ensures compliance with tax regulations.

Form Submission Methods

Submitting the Supplemental Retirement Plan Salary Reduction Agreement 403b can typically be done through various methods, depending on the employer's policies. Common submission methods include:

- Online submission through the employer's HR portal.

- Mailing the completed form to the HR department.

- Delivering the form in person to the HR office.

Employees should confirm the preferred submission method with their employer to ensure timely processing of their agreement.

Quick guide on how to complete supplemental retirement plan salary reduction agreement 403b

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly and without issues. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Supplemental Retirement Plan Salary Reduction Agreement 403b

Create this form in 5 minutes!

How to create an eSignature for the supplemental retirement plan salary reduction agreement 403b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Supplemental Retirement Plan Salary Reduction Agreement 403b

- 98 052 effective july 1 department of consumer and business services workers compensation division oregon administrative rules form

- Revision marked copy bracketed 8 point text is deleted boldunderlined text is added effective april 1 oregon administrative form

- Department of consumer and business services workers compensation division oregon administrative rules chapter 436 division 009 form

- Medical assistance transportation program matp memorandum matp matp pa form

- 011108minutes doc pgcb pa form

- 081910minutes doc pgcb pa form

- Dental clearance letter 81896087 form

- Navigating the family glitch fix hurdles for consumers form

Find out other Supplemental Retirement Plan Salary Reduction Agreement 403b

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form