IRA Transfer Form US Global Investors

What is the IRA Transfer Form US Global Investors

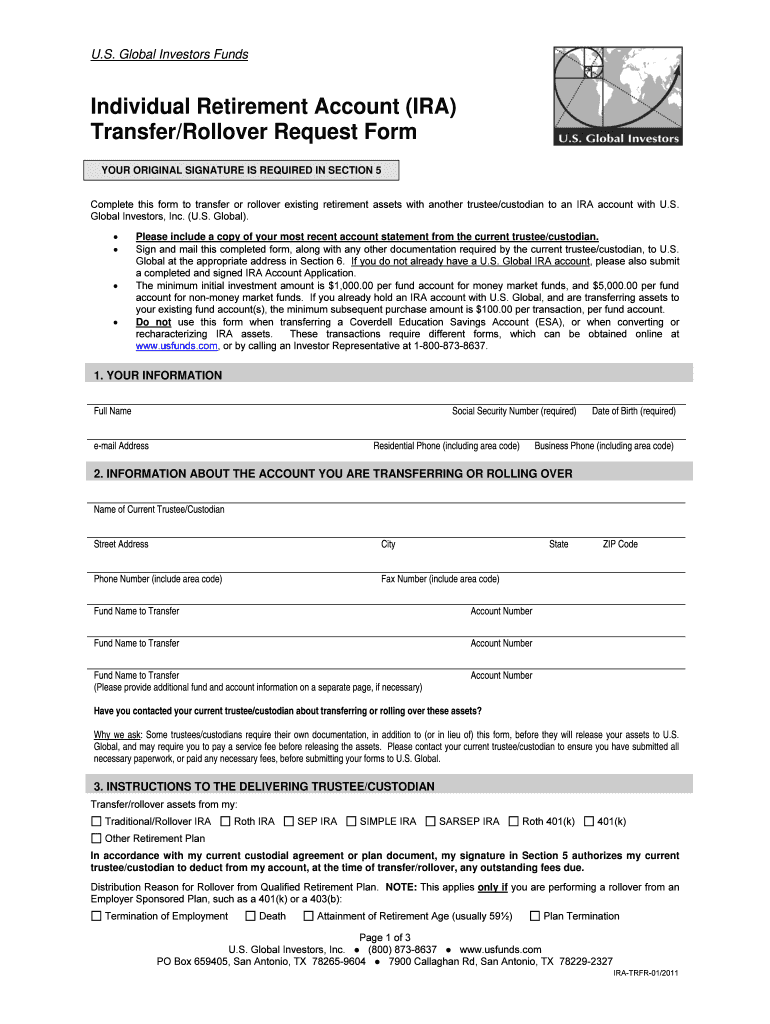

The IRA Transfer Form US Global Investors is a document used to facilitate the transfer of assets from one Individual Retirement Account (IRA) to another. This form is essential for individuals looking to move their retirement savings without incurring tax penalties. It ensures that the transfer is executed according to IRS regulations, maintaining the tax-deferred status of the funds throughout the process.

How to use the IRA Transfer Form US Global Investors

To use the IRA Transfer Form US Global Investors, individuals must first complete the form with accurate information regarding both the current and receiving financial institutions. This includes account numbers, the names of the institutions, and the type of IRA being transferred. Once filled out, the form should be submitted to the current IRA custodian to initiate the transfer process. It is advisable to keep a copy of the completed form for personal records.

Steps to complete the IRA Transfer Form US Global Investors

Completing the IRA Transfer Form US Global Investors involves several key steps:

- Gather necessary information, including your current IRA account details and the receiving institution's information.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to your current IRA custodian, either by mail or electronically, as per their requirements.

- Confirm with both institutions that the transfer is in process and track the status until completion.

Key elements of the IRA Transfer Form US Global Investors

The IRA Transfer Form US Global Investors contains several key elements that are crucial for a successful transfer. These include:

- Account Information: Details about both the current and new IRA accounts.

- Signature: Required signatures from the account holder to authorize the transfer.

- Transfer Amount: Specification of the amount or percentage of assets being transferred.

- Instructions: Clear guidelines on how to complete the transfer process.

Required Documents

When submitting the IRA Transfer Form US Global Investors, certain documents may be required to facilitate the process. These typically include:

- A copy of the current IRA account statement.

- Identification documents, such as a driver's license or Social Security card, to verify identity.

- Any additional forms requested by the current or receiving institution.

Form Submission Methods

The IRA Transfer Form US Global Investors can be submitted through various methods, depending on the policies of the current IRA custodian. Common submission methods include:

- Online Submission: Many institutions allow for electronic submission through their secure portals.

- Mail: The form can be printed and mailed to the current IRA custodian.

- In-Person: Some institutions may accept the form in person at their local branches.

Quick guide on how to complete ira transfer form us global investors

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRA Transfer Form US Global Investors

Create this form in 5 minutes!

How to create an eSignature for the ira transfer form us global investors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where can I move my IRA without penalty?

After the 2-year period, you can make tax-free rollovers from SIMPLE IRAs to other types of non-Roth IRAs, or to an employer-sponsored retirement plan. You can also roll over money into a Roth IRA after the 2-year period, but must include any untaxed money rolled over in your income.

-

Can I transfer an IRA myself?

If you have an existing IRA set up at a bank or brokerage, you can complete an IRA-to-IRA transfer to move the funds directly into your new Self-Directed IRA. A transfer is a direct transfer from your bank or brokerage directly into your Self-Directed IRA.

-

How do I transfer stock to IRA?

IRA Contributions can only be made in cash and not with positions. However, you may make a cash contribution from a non-IRA account by filling out an Internal Transfer to IRA Request . You can access that form by visiting our Forms and Agreements page.

-

How to transfer IRA from one financial institution to another?

Trustee-to-trustee transfer – If you're getting a distribution from an IRA, you can ask the financial institution holding your IRA to make the payment directly from your IRA to another IRA or to a retirement plan. No taxes will be withheld from your transfer amount.

-

Can I move my IRA from one bank to another?

An IRA transfer can be made directly to another account, and IRA transfers can also involve the liquidation of funds for depositing capital in a new account. The Internal Revenue Service (IRS) has established IRA transfer rules. You must have earned income to contribute to an IRA.

-

How to transfer one IRA to another financial institution without tax penalty?

If you want to move your individual retirement account (IRA) balance from one provider to another, simply call the current provider and request a “trustee-to-trustee” transfer. This moves money directly from one financial institution to another, and it won't trigger taxes.

Get more for IRA Transfer Form US Global Investors

- Design build contract wsdot wsdot wa form

- Wvdchwv state museum home west virginia division of culture form

- Plate detail total fee west virginia department of transportation transportation wv form

- Used by new employees transferring employees and retiring employees peia wv form

- June05newsletter pub wvbom wv form

- 2484c eval 2484c wpd wv department of environmental protection dep wv form

- Specifications committee dates west virginia department of transportation wv form

- Wisconsin hemophilia home care program application instructions dhs wisconsin form

Find out other IRA Transfer Form US Global Investors

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free