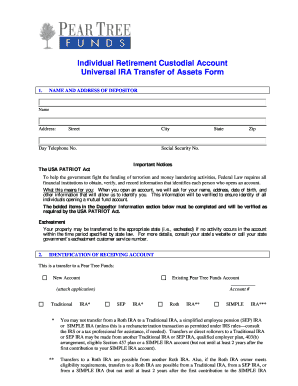

Individual Retirement Custodial Account Universal IRA Transfer of Form

What is the Individual Retirement Custodial Account Universal IRA Transfer Of

The Individual Retirement Custodial Account Universal IRA Transfer Of is a financial form used to facilitate the transfer of assets from one individual retirement account (IRA) to another. This process allows account holders to move their retirement funds without incurring tax penalties, provided they adhere to IRS regulations. The form serves as a formal request for the transfer, ensuring that all necessary details are documented and processed correctly. It is essential for individuals looking to consolidate their retirement savings or change custodians while maintaining the tax-advantaged status of their accounts.

Steps to complete the Individual Retirement Custodial Account Universal IRA Transfer Of

Completing the Individual Retirement Custodial Account Universal IRA Transfer Of involves several key steps:

- Gather necessary information, including account numbers and details of both the current and new custodians.

- Fill out the transfer form accurately, ensuring all required fields are completed.

- Submit the form to the new custodian, who will initiate the transfer process.

- Confirm with both custodians that the transfer is in progress and track its status.

By following these steps, individuals can ensure a smooth and compliant transfer of their retirement assets.

Required Documents

To successfully complete the Individual Retirement Custodial Account Universal IRA Transfer Of, several documents may be required. These typically include:

- A completed transfer request form.

- Proof of identity, such as a driver's license or Social Security card.

- Account statements from the current IRA custodian.

- Any additional documentation requested by the new custodian.

Having these documents ready can help expedite the transfer process and ensure compliance with IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines regarding the transfer of retirement accounts. It is crucial to adhere to these rules to avoid tax penalties. Key points include:

- Transfers must be direct to avoid tax implications.

- Account holders can only perform one rollover per year for each IRA account.

- Documentation must be maintained to prove compliance with IRS regulations.

Understanding these guidelines can help individuals navigate the transfer process more effectively.

Eligibility Criteria

To utilize the Individual Retirement Custodial Account Universal IRA Transfer Of, individuals must meet certain eligibility criteria. Generally, these include:

- Being the account holder of an existing IRA.

- Having a valid reason for the transfer, such as changing custodians or consolidating accounts.

- Adhering to IRS rules regarding the type of IRA being transferred.

Meeting these criteria is essential for a successful transfer without incurring penalties.

Form Submission Methods

The Individual Retirement Custodial Account Universal IRA Transfer Of can typically be submitted through various methods, including:

- Online submission via the new custodian's platform.

- Mailing the completed form directly to the new custodian.

- In-person submission at the new custodian’s office.

Choosing the right submission method can help ensure that the transfer process is initiated promptly and efficiently.

Quick guide on how to complete individual retirement custodial account universal ira transfer of

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents quickly and without hassle. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest method to alter and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Retirement Custodial Account Universal IRA Transfer Of

Create this form in 5 minutes!

How to create an eSignature for the individual retirement custodial account universal ira transfer of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens to custodial IRA when a child turns 18?

What happens to a custodial IRA when the minor turns 18? If you manage a custodial IRA for your child, they will assume complete control over the account when they turn 18 (or 21 in some states) once they've completed the necessary paperwork.

-

What is the age of termination for a custodial IRA?

When does ownership of the account transfer to my child? As the custodian, you control the assets in the Custodial IRA until your child signNowes the age of 18 (or 25 in some states). At that time, you must turn the assets over to the minor.

-

What are the disadvantages of a custodial IRA?

Key Disadvantages of Custodial Roth IRAs Loss of Control Over the Account. ... Contribution Limits and Eligibility. ... Impact on Financial Aid. ... Tax Consequences and Penalties.

-

When can you cash out a custodial IRA?

Both Roth IRAs and custodial Roth IRAs are funded with post-tax money. This setup means that your contributions can always be withdrawn at any time, tax-free and penalty-free. Earnings on the account, however, will be subject to penalty and taxes, if taken out before age 59 ½.

-

How do I transfer my IRA from one custodian to another?

If you want to move your individual retirement account (IRA) balance from one provider to another, simply call the current provider and request a “trustee-to-trustee” transfer. This moves money directly from one financial institution to another, and it won't trigger taxes.

-

What is an individual retirement custodial account?

A custodial IRA is a retirement account managed by an adult for a child, allowing the child to save early and learn financial habits until they signNow adulthood. Updated September 16, 2024.

-

What happens to a custodial account when the child turns 18?

Will I have any control over the account after the child signNowes the age of majority? When the custodianship ends, the account holder (formerly a child, now legally an adult) will have complete control over the account, and the custodian's access to the account may be restricted.

-

Can a custodial account be transferred to an IRA?

Switching to a regular Roth IRA While your child is still under age 18, the custodian will need to manage the account's assets. But when your child signNowes the legal age in your state (usually 18 or 21), the custodial Roth IRA will need to be converted to a regular Roth IRA in their name.

Get more for Individual Retirement Custodial Account Universal IRA Transfer Of

- Instructions for completion ok form

- Council on law enforcement education and ok gov ok form

- Office use only ok gov ok form

- Individual household personal property tax ok form

- E verify webinar training ok form

- Application for construction in process oregon gov oregon form

- Application for approval of brokerage oregon form

- Oregon board of naturopathic medicine 800 ne oregon st suite oregon form

Find out other Individual Retirement Custodial Account Universal IRA Transfer Of

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation