CA Form 3563 Payment for Automatic Extension for Fiduciaries 2023

What is the CA Form 3563 Payment For Automatic Extension For Fiduciaries

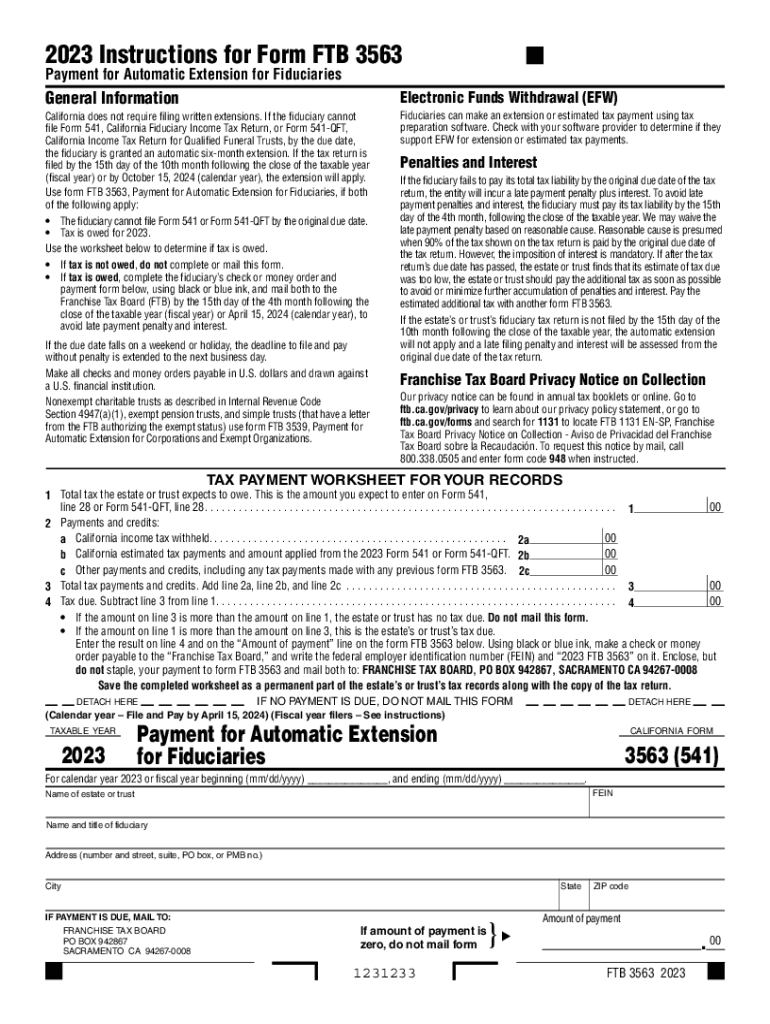

The CA Form 3563 is a state-specific document used by fiduciaries in California to request an automatic extension for filing their tax returns. This form is essential for ensuring that fiduciaries, such as executors or trustees, can manage their responsibilities without incurring penalties for late submissions. It allows for an extension of time to file the necessary tax documents while still requiring the payment of any owed taxes by the original due date.

How to use the CA Form 3563 Payment For Automatic Extension For Fiduciaries

To effectively use the CA Form 3563, fiduciaries should first determine their eligibility for an extension. Once confirmed, they need to complete the form accurately, ensuring all required information is provided. This includes the fiduciary's name, address, and the amount of tax owed. After filling out the form, it should be submitted along with the payment to the California Franchise Tax Board by the due date to avoid penalties.

Steps to complete the CA Form 3563 Payment For Automatic Extension For Fiduciaries

Completing the CA Form 3563 involves several key steps:

- Gather necessary information, including the fiduciary's details and tax information.

- Fill out the form, ensuring accuracy in all fields.

- Calculate the total payment due and include it on the form.

- Review the completed form for any errors or omissions.

- Submit the form and payment to the appropriate address by the deadline.

Filing Deadlines / Important Dates

The filing deadline for the CA Form 3563 typically aligns with the original due date of the fiduciary's tax return. It is crucial for fiduciaries to be aware of these dates to avoid late fees and penalties. Generally, forms must be submitted by the fifteenth day of the fourth month following the end of the taxable year. For example, if the tax year ends on December thirty-first, the form must be filed by April fifteenth of the following year.

Penalties for Non-Compliance

Failure to file the CA Form 3563 by the deadline can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal repercussions for fiduciaries who do not comply with state tax laws. It is important for fiduciaries to understand these consequences and take timely action to avoid them.

Eligibility Criteria

To qualify for using the CA Form 3563, fiduciaries must be responsible for managing the estate or trust and must have a valid reason for needing an extension. This includes situations where additional time is necessary to gather financial information or complete tax calculations accurately. It is important to review the specific eligibility criteria outlined by the California Franchise Tax Board to ensure compliance.

Quick guide on how to complete ca form 3563 payment for automatic extension for fiduciaries

Effortlessly Prepare CA Form 3563 Payment For Automatic Extension For Fiduciaries on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to quickly create, modify, and electronically sign your documents without delays. Handle CA Form 3563 Payment For Automatic Extension For Fiduciaries across any platform with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Easiest Way to Modify and eSign CA Form 3563 Payment For Automatic Extension For Fiduciaries with Ease

- Obtain CA Form 3563 Payment For Automatic Extension For Fiduciaries and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using the tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign CA Form 3563 Payment For Automatic Extension For Fiduciaries and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 3563 payment for automatic extension for fiduciaries

Create this form in 5 minutes!

How to create an eSignature for the ca form 3563 payment for automatic extension for fiduciaries

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I pay $800 minimum franchise tax for an S corp?

The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21. The amount due for the current return can be paid via the PMT screen or with voucher CA 3586-V.

-

How do I pay my CA extension?

You can make a California extension payment online, by credit card, or by check with Form FTB 3519. California Tax Extension Tip: If your California tax liability is zero or you're owed a state tax refund, California will automatically grant you a filing extension.

-

What is the extended due date for filing CA fiduciary return?

The due date to file your California Individual or Fiduciary income tax return and pay any balance due is April 15, 2024. However, California grants an automatic extension until October 15, 2024, to file your return, although your payment is still due by April 15, 2024.

-

How do I pay my California corporation tax?

How to Make Tax Payments to the California Franchise Tax Board Web Pay – Individual and Business taxpayers. Mail – Check, Money Order. In-Person at Franchise Tax Board Field Offices. Credit Card – Online through Official Payments Corporation at: .officialpayments.com.

-

Do you have to pay the $800 California C corp fee the first year?

A. The annual tax for C corporations is the greater of 8.84% of the corporation's net income or $800. Note: As of January 1, 2000, newly incorporated or qualified corporations are exempt from the annual minimum franchise tax for their first year of business (see below.)

-

How do I pay my $800 corporation fee?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

-

How do I pay a $800 LLC fee?

Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ' Select 'LLC' as entity type and enter your CA LLC entity ID. Pay the annual fee for the full calendar year (1/1 to 12/31) using your business bank account.

-

What is the form 3539 extension payment?

Use form FTB 3539, Payment for Automatic Extension for Corporations and Exempt Organizations, only if both of the following apply: • The corporation or exempt organization cannot file its 2022 California tax return by the original due date. The corporation or exempt organization owes tax for the 2022 taxable year.

Get more for CA Form 3563 Payment For Automatic Extension For Fiduciaries

- Zahlungsauftrag im auslandsverkehr netbank ag form

- Land division application latah county latah id form

- Orthocarolina online forms

- Condominiumpud questionnaire not to be used for nyshcr form

- Sepa lastschriftmandat hdi boss assekuranz vertriebsservice hdi gerling form

- Attorneys relationship form

- Act 247 referral application chester county form

- Federal consistency assessment form fcaf new york state

Find out other CA Form 3563 Payment For Automatic Extension For Fiduciaries

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile