Form 3528

What is the Form 3528

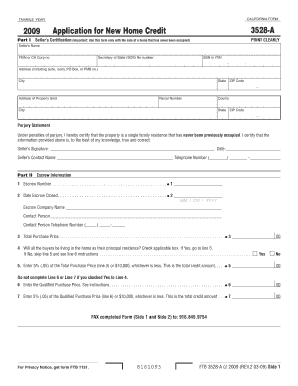

The Form 3528 is a document used primarily for reporting certain tax-related information to the Internal Revenue Service (IRS). It serves as a means for taxpayers to disclose specific financial details, ensuring compliance with federal tax regulations. This form is particularly relevant for individuals and businesses that need to report income, deductions, or other financial transactions that may affect their tax liabilities.

How to use the Form 3528

Using the Form 3528 involves a few straightforward steps. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the IRS. Proper use of this form helps to avoid potential penalties and ensures that your tax obligations are met.

Steps to complete the Form 3528

Completing the Form 3528 requires attention to detail. Begin by entering your personal information, including your name, address, and taxpayer identification number. Follow this by detailing your income sources and any applicable deductions. Make sure to double-check all figures for accuracy. Once filled out, sign and date the form. Finally, submit it to the IRS by the specified deadline to ensure compliance.

Legal use of the Form 3528

The legal use of the Form 3528 is crucial for maintaining compliance with IRS regulations. This form must be completed truthfully and submitted on time to avoid any legal repercussions. Failure to use the form correctly can result in penalties, including fines or audits. Understanding the legal implications of this form ensures that taxpayers fulfill their obligations and protect themselves from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3528 are essential to keep in mind. Typically, this form must be submitted by the tax filing deadline, which is usually April fifteenth for most taxpayers. However, if you are unable to meet this deadline, it is important to check for any extensions that may apply. Staying informed about important dates helps ensure that you remain compliant and avoid penalties associated with late submissions.

Required Documents

To complete the Form 3528 accurately, certain documents are required. These typically include income statements, such as W-2s or 1099s, and any receipts or records related to deductions you plan to claim. Having these documents on hand simplifies the process and helps ensure that all information reported is accurate, which is vital for compliance with IRS regulations.

Quick guide on how to complete form 3528 5108411

Effortlessly Prepare Form 3528 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Form 3528 on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The Easiest Way to Edit and Electronically Sign Form 3528 Seamlessly

- Obtain Form 3528 and then click Get Form to commence.

- Employ the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes needing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 3528 while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3528 5108411

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does a foreign grantor trust need an EIN?

A Form 7004 for a foreign trust cannot be processed if it has the U.S. owner's Social Security number (SSN). Use EINs to identify the foreign trust. Only an EIN should be used to identify the foreign trust in Part I, Line 1b of Form 3520-A. If the foreign trust does not have an EIN, refer to How to apply for an EIN.

-

Can a foreign trust be a grantor trust?

A foreign trust is also considered a grantor trust for US income tax purposes when a US grantor makes a gratuitous transfer to a foreign trust which has one or more US beneficiaries or potential US beneficiaries of any portion of the trust.

-

Does a grantor trust need an EIN number?

An EIN functions like a social security number. Generally, revocable trusts do not need an EIN as they are grantor trusts and the trust's income is reported on the tax return of the trust creator. If you have created a revocable trust, you may revoke the trust at any time and “regain” possession of the trust assets.

-

Do I need to file form 3520 with my tax return?

A U.S. person must file Form 3520 if that person receives as a gift during the tax year either of the following: More than $100,000 from a nonresident alien individual or a foreign estate. More than a threshold amount from a foreign corporation or foreign partnership ($17,339 for gifts made in tax year 2022)

-

Do I need an EIN for a foreign entity?

Tax compliance: It's a legal requirement for foreign entities operating a business in the United States to have an EIN for tax reporting purposes.

-

What is the IRS form for foreign inheritance?

U.S. persons (and executors of estates of U.S. decedents) file Form 3520 with the IRS to report: Certain transactions with foreign trusts, Ownership of foreign trusts under the rules of sections 671 through 679, and. Receipt of certain large gifts or bequests from certain foreign persons.

-

Is an EIN required for a trust?

Note: Separate EINs are needed if one person is the grantor/maker of multiple trusts. For example, if you have a trust for each of your grandchildren, each trust must have a separate EIN and file a separate tax return. However, a single trust with several beneficiaries requires only one EIN.

-

What form do I need to report foreign gifts?

Form 3520 is an informational return in which U.S. taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and receipts of large gifts from foreign entities. That word “certain” is key here — there are different reporting triggers depending on the nature of the foreign asset.

Get more for Form 3528

Find out other Form 3528

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF