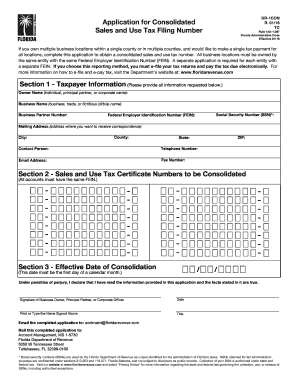

Form DR 1N Florida Department of Revenue

Understanding the Form DR 1N from the Florida Department of Revenue

The Form DR 1N is a crucial document issued by the Florida Department of Revenue. It is primarily used for tax registration purposes, allowing businesses to register for various tax accounts. This form is essential for ensuring compliance with state tax laws and for obtaining the necessary permits to operate legally within Florida. Understanding its purpose is vital for any business owner or taxpayer in the state.

Steps to Complete the Form DR 1N

Completing the Form DR 1N involves several key steps:

- Gather necessary information, including your business name, address, and federal Employer Identification Number (EIN).

- Identify the type of business entity you are registering, such as a sole proprietorship, partnership, or corporation.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

Following these steps will help ensure a smooth registration process with the Florida Department of Revenue.

Obtaining the Form DR 1N

The Form DR 1N can be obtained directly from the Florida Department of Revenue's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, businesses can visit local Department of Revenue offices to request a physical copy of the form. Ensuring you have the latest version of the form is important for compliance.

Legal Use of the Form DR 1N

The legal use of the Form DR 1N is primarily for tax registration. Businesses must complete this form to comply with Florida's tax regulations, which include sales tax, corporate income tax, and other applicable taxes. Failure to properly register can lead to penalties, making it essential for business owners to understand their responsibilities under Florida law.

Filing Deadlines and Important Dates

When filing the Form DR 1N, it is crucial to be aware of specific deadlines. Generally, businesses should submit their registration form before they begin operations or before the first tax return is due. This ensures compliance and avoids any potential fines or penalties. Keeping track of important dates related to tax filings can help maintain good standing with the Florida Department of Revenue.

Required Documents for Submission

When submitting the Form DR 1N, certain documents may be required to accompany the form. These can include:

- Federal Employer Identification Number (EIN) confirmation.

- Proof of business registration, such as articles of incorporation or partnership agreements.

- Identification documents for the business owner or responsible party.

Having these documents ready can streamline the registration process and ensure compliance with state requirements.

Quick guide on how to complete form dr 1n florida department of revenue

Effortlessly Prepare Form DR 1N Florida Department Of Revenue on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environment-friendly alternative to conventional printed and signed papers, allowing you to locate the suitable template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without any hold-ups. Manage Form DR 1N Florida Department Of Revenue from any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest method to alter and eSign Form DR 1N Florida Department Of Revenue without any hassle

- Locate Form DR 1N Florida Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Point out important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form DR 1N Florida Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dr 1n florida department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What form do I use for FL sales tax refund?

To request a tax refund, file an Application for Refund - Sales and Use Tax (Form DR-26S) or Application for Refund - All Other Taxes (Form DR-26). An application form may be completed to request moneys paid into the State Treasury for a tax overpayment, payment when tax was not due, or payment made in error.

-

What is a Florida Department of Revenue Notice of Final Assessment?

RT-17 Notice of Final Assessment It is a list of amounts due, including missing reports, which must be filed immediately. The back of the form lists the tax/assessment due, interest due, penalty due, fee due, and total due for each reporting period. A taxpayer has 20 days to file a protest to the assessment.

-

Why did the Department of Revenue send me a letter?

We may send you a notice or letter if: You have a balance due. Your refund has changed. We have a question about your return.

-

What is the purpose of the Florida Department of Revenue?

An agency that is accessible and responsive to citizens, provides fair and efficient tax and child support administration, and achieves the highest levels of voluntary compliance.

-

Why am I getting a letter from Florida Department of Revenue?

Florida DOR is usually for sales tax or possibly child support. Someone may have also given them an old or incorrect number. They are also working from home though I believe it does show up as DOR.

-

What is a Florida Department of Revenue Notice of Final Assessment?

RT-17 Notice of Final Assessment It is a list of amounts due, including missing reports, which must be filed immediately. The back of the form lists the tax/assessment due, interest due, penalty due, fee due, and total due for each reporting period. A taxpayer has 20 days to file a protest to the assessment.

-

What is a Florida DR 1 form?

Complete Form DR-1 to register to collect, report, and pay the following taxes, surcharges, and fees: • Sales and use tax. • Communications services tax. • Gross receipts tax on electrical power and gas. • Prepaid wireless E911 fee.

-

What is reasonable cause Florida Department of Revenue?

To establish reasonable cause based upon reliance on the advice of a competent advisor, the taxpayer shall demonstrate: (a) That the taxpayer sought timely advice of a person who was competent in Florida tax matters; (b) That the taxpayer provided the advisor with all of the necessary information and withheld nothing; ...

Get more for Form DR 1N Florida Department Of Revenue

Find out other Form DR 1N Florida Department Of Revenue

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online