For Year Ending February 29, 20 Form

Understanding the 2023 205 Form

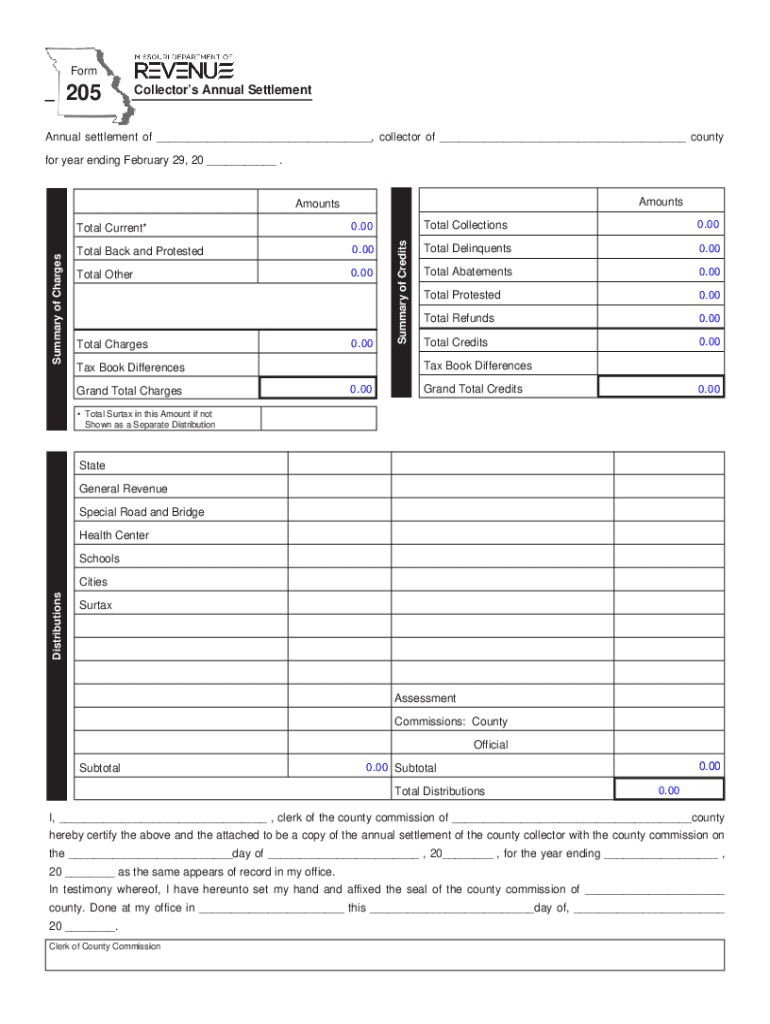

The 2023 205 form, also known as the Missouri 205, is a crucial document used for various tax-related purposes within the state of Missouri. This form is primarily utilized by businesses and individuals to report specific financial information to the Missouri Department of Revenue. It is essential for ensuring compliance with state tax regulations and for accurate financial reporting. Understanding the form's purpose and requirements is vital for anyone who needs to file it.

Steps to Complete the 2023 205 Form

Filling out the 2023 205 form requires careful attention to detail. Here are the general steps to complete it:

- Gather necessary financial documents, including income statements and expense reports.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and deductions accurately in the designated sections.

- Review your entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Legal Use of the 2023 205 Form

The 2023 205 form is legally binding once it is signed and submitted. It is crucial to ensure that all information provided is truthful and accurate, as any false statements can lead to legal repercussions. This form serves as a formal declaration of your financial status for the year ending February 29, 2023, and is used by the Missouri Department of Revenue to assess your tax obligations.

Filing Deadlines and Important Dates

Timely submission of the 2023 205 form is essential to avoid penalties. The filing deadline typically aligns with the state tax deadlines, which may vary. It is advisable to check the Missouri Department of Revenue's official calendar for specific dates related to the 2023 tax year. Late submissions can incur fines and interest on any taxes owed.

Required Documents for the 2023 205 Form

To complete the 2023 205 form accurately, you will need several documents, including:

- Income statements from all sources.

- Records of deductions and credits you plan to claim.

- Previous tax returns for reference.

- Any correspondence from the Missouri Department of Revenue.

Form Submission Methods

The 2023 205 form can be submitted in various ways to accommodate different preferences. You may choose to file it online through the Missouri Department of Revenue's website, mail it to the appropriate office, or deliver it in person. Each method has its own processing times and requirements, so it is essential to select the one that best suits your needs.

Quick guide on how to complete for year ending february 29 20

Complete For Year Ending February 29, 20 smoothly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle For Year Ending February 29, 20 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign For Year Ending February 29, 20 with ease

- Obtain For Year Ending February 29, 20 then click Get Form to initiate.

- Make use of the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Decide how you want to distribute your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over missing or lost files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign For Year Ending February 29, 20 and ensure excellent communication at any phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for year ending february 29 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How many years until February has 29 days?

The years 2024, 2028, 2032, 2036, and so on will have 29 days in February, which makes the month longer than is typical, but the second month will still remain the shortest of the year. The Earth's orbit around the sun gives our planet its four seasons.

-

When was the last year February has 29 days?

The last time the calendar read February 29 was in 2020. If you've been keeping up, it's pretty simple to figure out the next round of leap years. After 2024, the next time February will have 29 days will be in 2028 and then again in 2032.

-

Why does Feb have 29 days in 2024?

February has 28 days, unlike any other month in our calendar. But 2024 is a leap year, meaning this year, February will have 29 days. It's all to do with Earth's orbit around the Sun and the calculations that led to the Gregorian calendar in use today.

-

What is the rule for leap year in February?

Each leap year, the month of February has 29 days instead of 28. Adding one extra day in the calendar every 4 years compensates for the fact that a period of 365 days is shorter than a tropical year by almost 6 hours.

-

How come February has 29 days in 2024?

February has 28 days, unlike any other month in our calendar. But 2024 is a leap year, meaning this year, February will have 29 days. It's all to do with Earth's orbit around the Sun and the calculations that led to the Gregorian calendar in use today.

-

Did February 2000 have 29 days?

In the Gregorian calendar, the standard civil calendar used in most of the world, February 29 is added in each year that is an integer multiple of four, unless it is evenly divisible by 100 but not by 400. For example, 1900 was not a leap year, but 2000 was.

-

When did February last have 29 days?

2024 is a leap year, meaning Thursday, Feb. 29 is a once-in-every-four-year event. Since leap years typically happen every four years (although there are some exceptions), our last leap days were in 2020 and 2016, and the next leap year will happen in 2028.

-

How do you call a year with February 29?

February 29 is a leap day (or "leap year day")—an intercalary date added periodically to create leap years in the Julian and Gregorian calendars. It is the 60th day of a leap year in both Julian and Gregorian calendars, and 306 days remain until the end of the leap year.

Get more for For Year Ending February 29, 20

- Canada application british columbia form

- Scientific games and bclc sign five year extension form

- Guarantee and inspection service policy and procedures form

- Www mapquest comcanadaalbertatreaty 7 urban housing authority 234 12c st n lethbridge ab form

- Team topic form

- Or email special form

- Fill fillable student registration form peel schools

- Complaintwitness statement general town of bashaw form

Find out other For Year Ending February 29, 20

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors