Individual Consumer's Use Tax Form

What is the Individual Consumer's Use Tax

The Individual Consumer's Use Tax is a tax imposed on the purchase of goods and services that are used, stored, or consumed in Missouri. This tax applies when consumers buy items from out-of-state vendors who do not charge Missouri sales tax. The use tax ensures that local businesses are not disadvantaged by out-of-state competition and helps maintain a level playing field for all retailers.

How to use the Individual Consumer's Use Tax

Consumers can use the Individual Consumer's Use Tax to report and pay taxes on taxable purchases made outside of Missouri. This process involves calculating the total amount of purchases that are subject to use tax and reporting this amount on the appropriate tax return. It is essential for consumers to keep accurate records of their purchases to ensure compliance with tax regulations.

Steps to complete the Individual Consumer's Use Tax

To complete the Individual Consumer's Use Tax, follow these steps:

- Gather receipts and documentation for all out-of-state purchases.

- Determine the total amount of taxable purchases made during the tax year.

- Calculate the use tax owed based on the applicable tax rate.

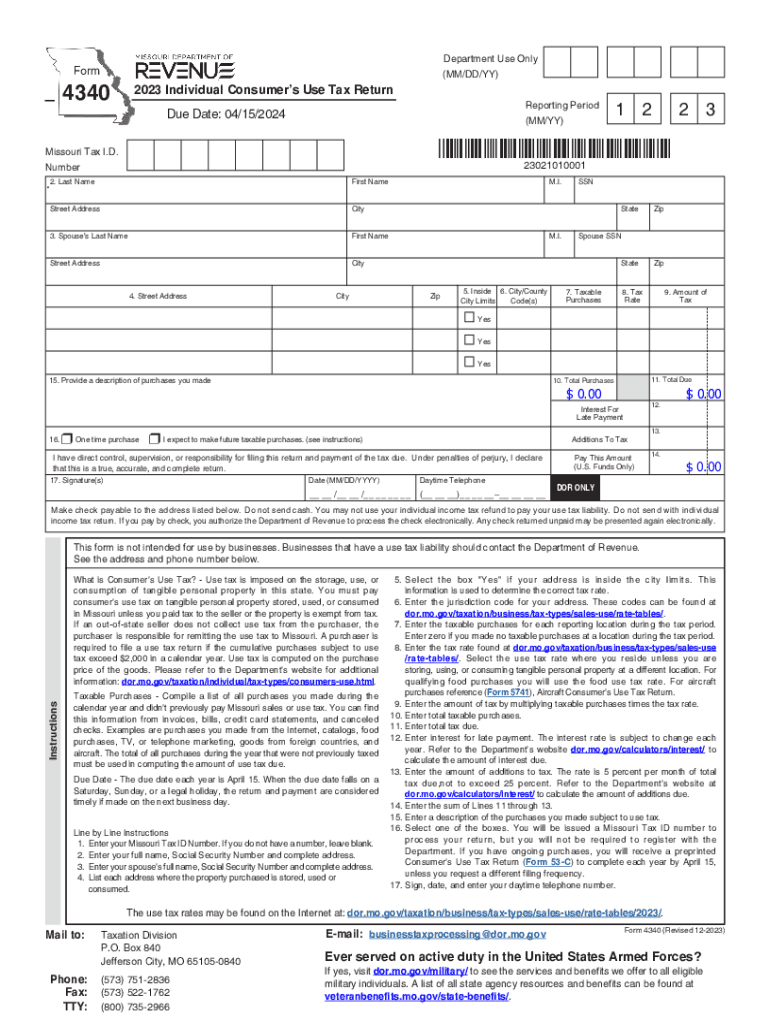

- Complete the Missouri Consumers Use Tax Return, typically Form 4340.

- Submit the completed form along with payment by the designated deadline.

Key elements of the Individual Consumer's Use Tax

Key elements of the Individual Consumer's Use Tax include:

- The tax rate, which is generally the same as the sales tax rate in Missouri.

- The types of purchases that are subject to the tax, including tangible personal property and certain services.

- Exemptions that may apply, such as purchases made for resale or certain agricultural items.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Consumer's Use Tax typically align with the annual income tax return deadlines. Consumers should ensure that they file their use tax return by April fifteenth of each year to avoid penalties. It is important to stay informed about any changes to tax laws that may affect filing dates.

Required Documents

When filing the Individual Consumer's Use Tax, consumers should have the following documents ready:

- Receipts for all out-of-state purchases.

- Completed Form 4340, the Missouri Consumers Use Tax Return.

- Any supporting documentation that may be required to substantiate claims for exemptions.

Quick guide on how to complete individual consumers use tax

Complete Individual Consumer's Use Tax seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Handle Individual Consumer's Use Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Individual Consumer's Use Tax effortlessly

- Obtain Individual Consumer's Use Tax and click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Consumer's Use Tax and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual consumers use tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri consumers use tax return?

The Missouri consumers use tax return is a tax form that individuals and businesses must file to report and pay taxes on items purchased out of state for use in Missouri. This tax ensures that consumers contribute to the state's revenue, similar to sales tax. Understanding this process is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Missouri consumers use tax return?

airSlate SignNow simplifies the process of preparing and submitting your Missouri consumers use tax return by allowing you to eSign documents securely and efficiently. With our platform, you can easily manage your tax documents and ensure they are filed on time. This saves you time and reduces the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your Missouri consumers use tax return. These tools help streamline the filing process and ensure that all necessary documents are organized and accessible. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for filing tax returns?

Yes, airSlate SignNow is a cost-effective solution for filing your Missouri consumers use tax return. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your investment. By reducing the time spent on paperwork, you can focus more on your business operations.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Missouri consumers use tax return alongside your financial records. This integration helps streamline your workflow and ensures that all your documents are in one place, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for your Missouri consumers use tax return offers numerous benefits, including enhanced security, faster processing times, and improved document management. Our platform allows you to eSign documents from anywhere, ensuring that you can file your taxes on time, even when you're on the go. This flexibility is crucial for busy professionals.

-

How secure is airSlate SignNow for handling tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your sensitive information, including your Missouri consumers use tax return. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access.

Get more for Individual Consumer's Use Tax

- Violation ticket statement written form

- Home rehabilitation reconstruction loan application form

- Gp referral form for obstetric and gynaecology patients gpbuddy

- Pakistan non judicial paper form

- Opencorporates comcompaniespkthe gujrat chamber of commerce ampamp industry gujrat pakistan form

- To amend consolidate and unify laws relating to the conduct of elections form

- Health history and entrance form massage addict

- Student hardship application form aberystwyth university aber ac

Find out other Individual Consumer's Use Tax

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF