Form INT 2 Bank Franchise Tax Return

What is the Form INT 2 Bank Franchise Tax Return

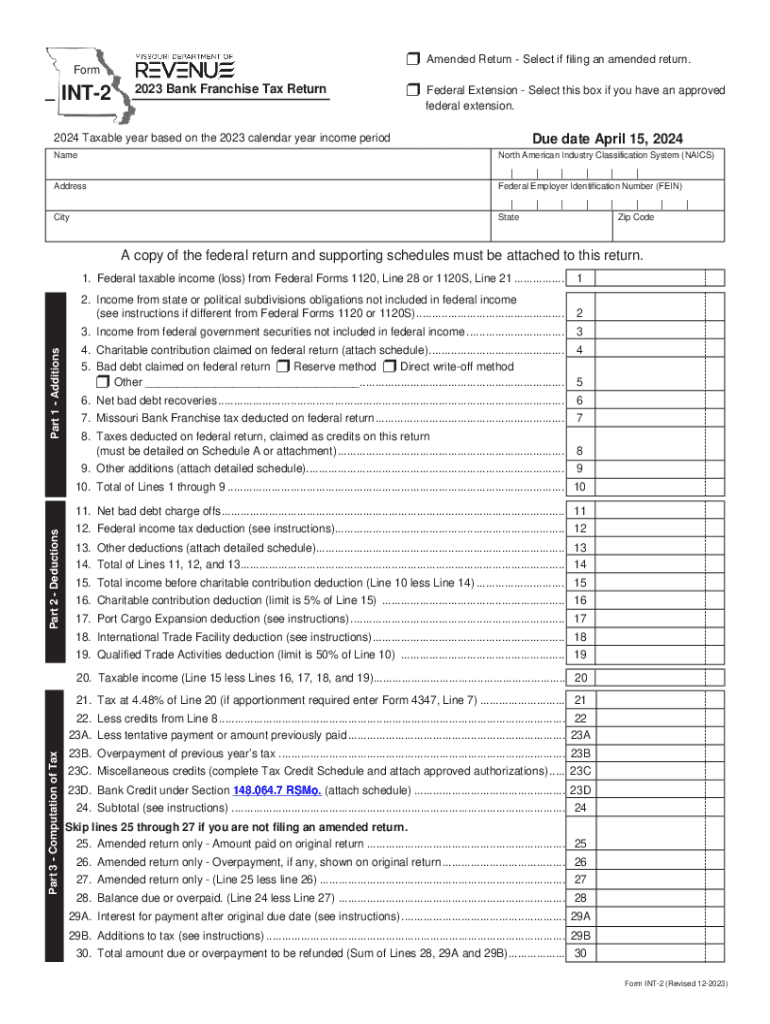

The Form INT 2 Bank Franchise Tax Return is a specific tax form used by banks and financial institutions to report their franchise tax obligations to the state. This form is essential for determining the amount of franchise tax owed based on the institution's income and other financial metrics. The franchise tax is typically assessed on the net worth or capital of the bank, making it a crucial component of the financial reporting process for these entities.

How to use the Form INT 2 Bank Franchise Tax Return

Using the Form INT 2 involves several key steps. First, gather all necessary financial information, including income statements, balance sheets, and any relevant tax documents. Next, accurately fill out each section of the form, ensuring that all figures are correct and correspond to the financial data. After completing the form, review it for accuracy before submission. This form can be submitted electronically or via traditional mail, depending on state guidelines.

Steps to complete the Form INT 2 Bank Franchise Tax Return

Completing the Form INT 2 requires careful attention to detail. Follow these steps for successful completion:

- Collect all required financial documents, including previous tax returns and current financial statements.

- Fill in the identification section with the bank's name, address, and tax identification number.

- Report total income and expenses accurately in the designated sections.

- Calculate the franchise tax based on the provided instructions, ensuring compliance with state regulations.

- Double-check all entries for accuracy and completeness before finalizing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form INT 2 can vary by state. Generally, banks must submit their franchise tax returns by a specified date each year. It is crucial to check with the relevant state tax authority for the exact deadlines to avoid penalties. Additionally, some states may offer extensions, but these must be requested in advance and may require additional documentation.

Key elements of the Form INT 2 Bank Franchise Tax Return

The Form INT 2 includes several key elements that must be accurately reported. These typically include:

- Bank identification details, such as name and address.

- Financial data, including total assets, total liabilities, and net income.

- Calculation of the franchise tax owed based on the bank's financial performance.

- Signature of an authorized representative, certifying the accuracy of the information provided.

Legal use of the Form INT 2 Bank Franchise Tax Return

The legal use of the Form INT 2 is governed by state tax laws, which outline the requirements for filing and the consequences of non-compliance. Banks are obligated to submit this form accurately to avoid legal repercussions, including fines or penalties. Understanding the legal framework surrounding the franchise tax is essential for compliance and to ensure that the institution meets all regulatory obligations.

Quick guide on how to complete form int 2 bank franchise tax return

Prepare Form INT 2 Bank Franchise Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed materials, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Form INT 2 Bank Franchise Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Form INT 2 Bank Franchise Tax Return with ease

- Find Form INT 2 Bank Franchise Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form INT 2 Bank Franchise Tax Return and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form int 2 bank franchise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Did Oklahoma do away with franchise tax?

Oklahoma's franchise tax has been eliminated as part of a comprehensive tax reform plan.

-

What is the franchise tax limit in Oklahoma?

Important Notes for Filing for Tax Year 2023 The franchise tax was levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma up to a maximum of $20,000.00. Now that this franchise tax has been repealed, the above will no longer apply.

-

Who must file an Oklahoma partnership tax return?

Each partner having Oklahoma source income sufficient to make a return, shall make such return as required by law. Partnerships filing Federal Form 1065-B will file Form 514. The taxable year and method of accounting shall be the same as the taxable year and method of accounting used for federal income tax purposes.

-

What is a 1099 INT tax form from a bank?

What is a 1099-INT? A 1099-INT tax form is a record that a person or entity paid you interest during the tax year. If you earned $10 or more in interest from a bank, brokerage or other financial institution, you'll receive a 1099-INT. Simply receiving this tax form doesn't necessarily mean you owe taxes on that money.

-

What is the bank franchise tax in Missouri?

Chapter 148 of state law authorizes each tax, and each tax rate is 4.48 percent of net income as of 2020. All prior years are at a 7 percent tax rate. Banks and trust companies are also subject to a tax on assets computed the same, but instead of, the corporate franchise tax (Section 147.010).

-

What tax return does a franchise file?

Form 100S, California S Corporation Franchise or Income Tax Return, is due on the 15th day of the 3rd month after the close of the corporation's tax year.

-

Who needs to file OK franchise tax return?

Every corporation organized under the laws of this state or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies ...

-

Are LLCs subject to Oklahoma franchise tax?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

Get more for Form INT 2 Bank Franchise Tax Return

Find out other Form INT 2 Bank Franchise Tax Return

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free