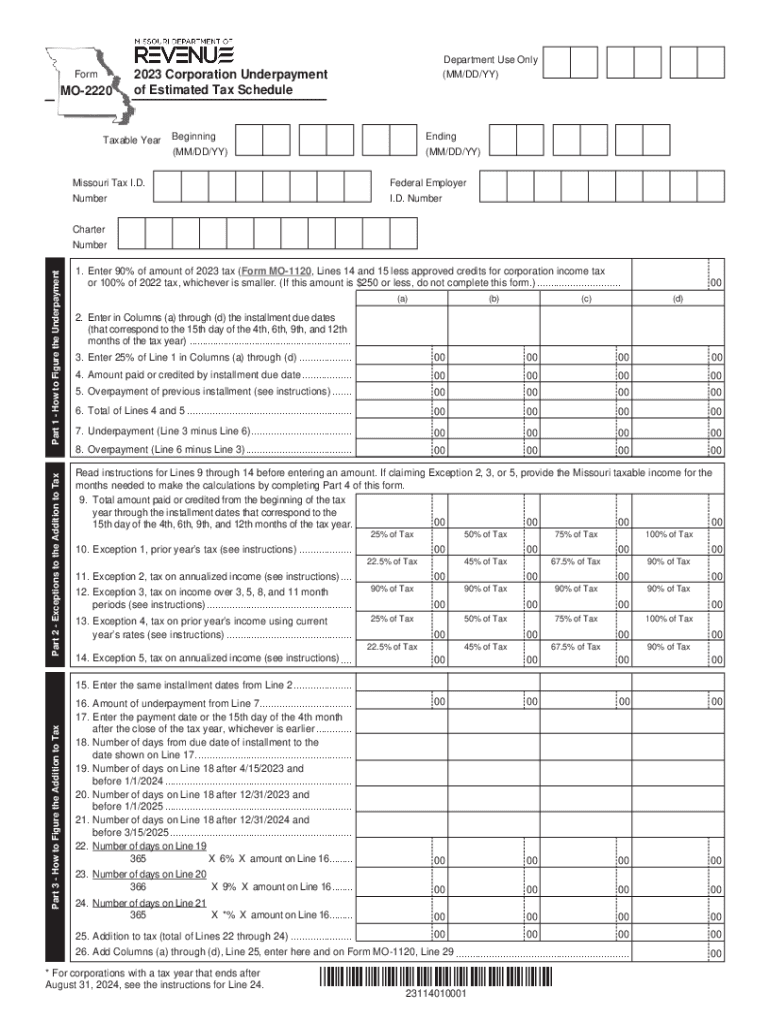

Part 2 Exceptions to the Addition to Tax Form

Understanding the Part 2 Exceptions to the Addition to Tax

The Part 2 Exceptions to the Addition to Tax refers to specific circumstances under which taxpayers may be exempt from additional tax penalties. These exceptions are designed to provide relief for individuals who may have faced unusual circumstances impacting their tax obligations. Understanding these exceptions is crucial for ensuring compliance and avoiding unnecessary penalties.

How to Utilize the Part 2 Exceptions to the Addition to Tax

To effectively use the Part 2 Exceptions, taxpayers should first determine if they meet the eligibility criteria outlined by the IRS. This often includes reviewing personal circumstances, such as medical emergencies or natural disasters that may have hindered timely tax filing or payment. Taxpayers must document their situation thoroughly and provide supporting evidence when claiming these exceptions.

Steps to Complete the Part 2 Exceptions to the Addition to Tax

Completing the Part 2 Exceptions involves several key steps:

- Review IRS guidelines to identify applicable exceptions.

- Gather necessary documentation that supports your claim.

- Complete the relevant sections of your tax return, indicating your eligibility for the exception.

- Submit your tax return by the deadline, ensuring all required documents are included.

Legal Use of the Part 2 Exceptions to the Addition to Tax

Legally, the Part 2 Exceptions must be claimed in accordance with IRS regulations. Taxpayers should ensure that their claims are valid and supported by appropriate documentation. Misuse of these exceptions can lead to penalties or audits, emphasizing the importance of adhering to legal guidelines when filing.

Examples of Using the Part 2 Exceptions to the Addition to Tax

Common examples of situations that may qualify for the Part 2 Exceptions include:

- Experiencing a serious illness that prevented timely tax filing.

- Facing natural disasters, such as hurricanes or floods, that disrupted normal financial activities.

- Being a victim of identity theft, which complicated tax reporting.

Filing Deadlines and Important Dates

Taxpayers must be aware of specific filing deadlines to ensure they can claim the Part 2 Exceptions. Generally, tax returns are due on April 15, but extensions may be available. It is crucial to stay informed about any changes to deadlines, especially in light of natural disasters or significant events that may affect filing schedules.

Required Documents for the Part 2 Exceptions to the Addition to Tax

When claiming the Part 2 Exceptions, taxpayers should prepare the following documents:

- Proof of the circumstances leading to the exception, such as medical records or disaster declarations.

- Copies of previous tax returns, if applicable, to establish a filing history.

- Any correspondence with the IRS regarding your tax situation.

Quick guide on how to complete part 2 exceptions to the addition to tax

Manage Part 2 Exceptions To The Addition To Tax effortlessly on any device

Web-based document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed files, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and efficiently. Handle Part 2 Exceptions To The Addition To Tax on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and electronically sign Part 2 Exceptions To The Addition To Tax with ease

- Locate Part 2 Exceptions To The Addition To Tax and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Part 2 Exceptions To The Addition To Tax to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the part 2 exceptions to the addition to tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax penalty on IRA withdrawal?

Generally, the amounts an individual withdraws from an IRA or retirement plan before signNowing age 59½ are called "early" or "premature" distributions. Individuals must pay an additional 10% early withdrawal tax unless an exception applies.

-

How are IRA distributions taxed in the UK?

UK/US citizens resident in the UK are taxable on their IRA interest in the UK. IRA's are treated differently from Roth IRA's, in that they are taxable in the UK under foreign interest. The gross interest would be declared in the self assessment tax return, using the supplementary page SA106.

-

Do Roth IRA withdrawals count as income?

Earnings that you withdraw from a Roth IRA don't count as income as long as you meet the rules for qualified distributions. Typically, you will need to have had a Roth IRA for at least five years and be at least 59½ years old for a distribution to count as qualified, but there are some exceptions.

-

Do I have to pay estimated taxes on IRA withdrawals?

Tax withholding and estimated tax Federal income tax withholding is required for distributions from IRAs unless you elect out of withholding on the distribution. If you elect out of withholding, you may have to make estimated tax payments.

-

How much additional tax on early distributions is Luther required to pay?

More In Retirement Plans Generally, the amounts an individual withdraws from an IRA or retirement plan before signNowing age 59½ are called "early" or "premature" distributions. Individuals must pay an additional 10% early withdrawal tax unless an exception applies.

-

Are fees paid from an IRA taxable?

While IRA fees paid from the account are not taxable and reduce the balance in an individual's retirement account, the overall tax advantages of IRAs remain signNow for long-term investing. Unfortunately, the deductibility of miscellaneous itemized deductions is on hiatus for tax years 2018 through 2025.

Get more for Part 2 Exceptions To The Addition To Tax

Find out other Part 2 Exceptions To The Addition To Tax

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document