Form 2823 Credit Institution Tax Return

What is the Form 2823 Credit Institution Tax Return

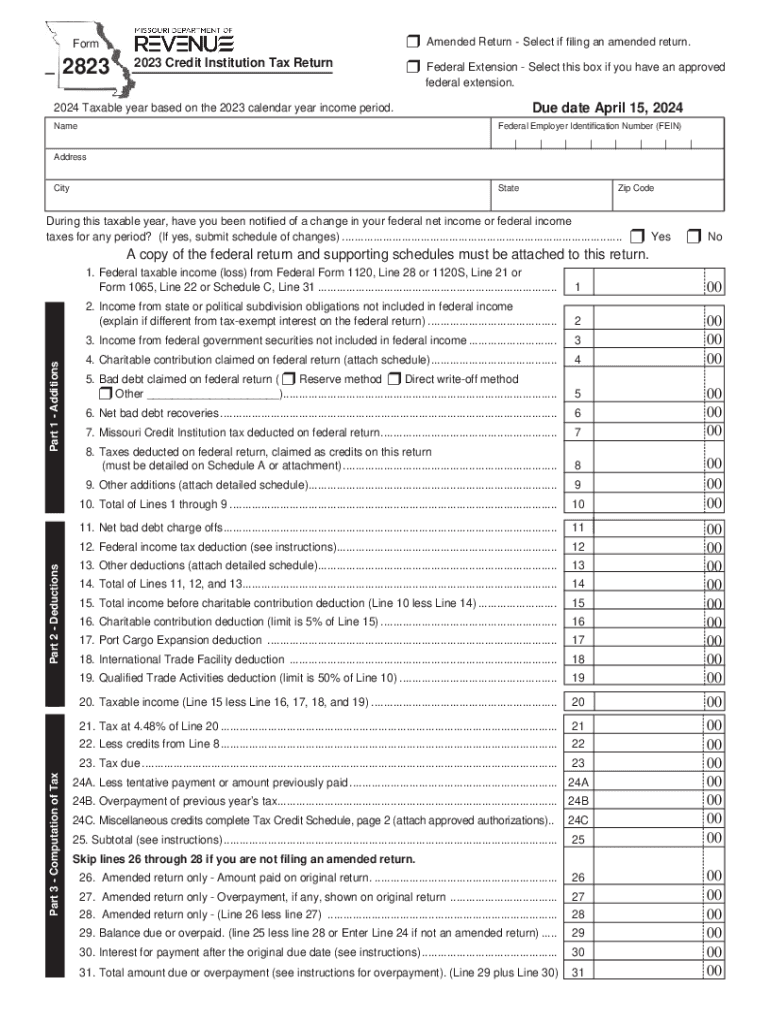

The Form 2823, known as the Credit Institution Tax Return, is a specific tax form used by credit institutions in the United States to report their income, expenses, and tax liabilities. This form is essential for ensuring compliance with federal tax regulations and is designed to capture the unique financial activities of credit institutions, which may differ from standard business entities. The data reported on this form helps the Internal Revenue Service (IRS) assess the tax obligations of these institutions accurately.

How to use the Form 2823 Credit Institution Tax Return

Using the Form 2823 involves several steps to ensure accurate reporting of financial information. First, credit institutions must gather all relevant financial records, including income statements and expense reports. Next, the institution fills out the form by entering details about its revenue, deductions, and any applicable tax credits. It is crucial to review the completed form for accuracy before submission, as errors can lead to penalties or delays in processing. Once finalized, the form can be submitted to the IRS through the appropriate channels.

Steps to complete the Form 2823 Credit Institution Tax Return

Completing the Form 2823 requires careful attention to detail. Here are the steps involved:

- Gather financial documents, including income and expense statements.

- Fill in the institution's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income earned during the tax year.

- List all allowable deductions, ensuring they are well-documented.

- Calculate the total tax liability based on the reported income and deductions.

- Review the form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the Form 2823 Credit Institution Tax Return

The legal use of the Form 2823 is governed by IRS regulations, which stipulate that credit institutions must file this form annually to report their financial activities. Failing to file the form or submitting inaccurate information can result in penalties, including fines or additional scrutiny from the IRS. It is imperative for institutions to understand the legal implications of their reporting obligations and to maintain accurate records to support their submissions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2823 are critical for compliance. Typically, credit institutions must submit their tax return by the fifteenth day of the fourth month following the end of their fiscal year. For institutions operating on a calendar year, this means the deadline is April 15. It is essential to be aware of these dates to avoid late fees or penalties, and institutions should also consider any extensions that may be available if they anticipate needing additional time to prepare their return.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 2823 can lead to significant penalties. The IRS may impose fines for late filing, which can increase the longer the form remains unfiled. Additionally, inaccuracies in reporting can result in further penalties, including interest on unpaid taxes. Credit institutions must prioritize compliance to avoid these financial repercussions and maintain good standing with the IRS.

Quick guide on how to complete form 2823 credit institution tax return

Complete Form 2823 Credit Institution Tax Return seamlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as a superior eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Form 2823 Credit Institution Tax Return on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 2823 Credit Institution Tax Return effortlessly

- Find Form 2823 Credit Institution Tax Return and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or overlooked files, tedious form hunts, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 2823 Credit Institution Tax Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2823 credit institution tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who do I write the check to for Missouri state taxes?

Your check or money order (U.S. funds only), payable to the Missouri Department of Revenue, should be mailed to the Department of Revenue, PO Box 385, Jefferson City, MO 65105-0385. By submitting payment by check, you authorize the Department to process the check electronically upon receipt.

-

What address do I send my Missouri tax payment to?

MAKE CHECK PAYABLE TO MISSOURI DEPARTMENT OF REVENUE. MAIL FORM MO-1040V AND PAYMENT TO THE MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 371, JEFFERSON CITY, MO 65105-0371.

-

Where do I send my Missouri federal tax return?

Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014.

-

What address do I mail my Missouri tax return to?

For individuals who are due a refund or owe nothing, send the return to: Missouri Department of Revenue, P.O. Box 500, Jefferson City, MO 65105-0500.

-

What is the tax form for the foreign tax credit?

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Corporations file Form 1118, Foreign Tax Credit—Corporations, to claim a foreign tax credit.

-

How do I send in my tax payment?

Payments can be made using Automated Clearing House Debit, Credit Cards, EFT , and by Check or Money Order. For more information on how to make a payment, visit the CDTFA website or call 1-800-400-7115. Customer service representatives are available Monday through Friday, 8 a.m. to 5 p.m., excluding State holidays.

-

Where do I mail my Missouri estimated tax payments?

Return this form with check or money order payable to the Missouri Department of Revenue P . O . Box 555, Jefferson City, MO 65105-0555 . If you pay by check, you authorize the Department to process the check electronically . Any returned check may be presented again electronically .

-

What forms to include with a Missouri tax return?

2023 Missouri Tax Forms Form MO-1040. Missouri Individual Income Tax Return - Long Form. Form MO-A. Individual Income Tax Adjustments. Form MO-CR. Credit for Income Taxes Paid to Other States or Political Subdivisions. Form MO-NRI. Missouri Income Percentage. Form MO-WFTC. ... Form MO-PTS. ... Form MO-CRP. ... Form 5695.

Get more for Form 2823 Credit Institution Tax Return

- Business registration application for income tax edpnc com form

- Otc 921 tax year 2024 revised 11 name form

- Alt w 9 form

- Tax year personal income tax formsdepartment of taxes

- Gdc application form

- Request for mutual exchange form bdc non bdc tenant

- License application form 462367737

- M6 toll disabled form

Find out other Form 2823 Credit Institution Tax Return

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization