Regulated Industries Kansas City Mo 64106 Fill Out & Sign 2023-2026

Key elements of the Kansas liquor license application

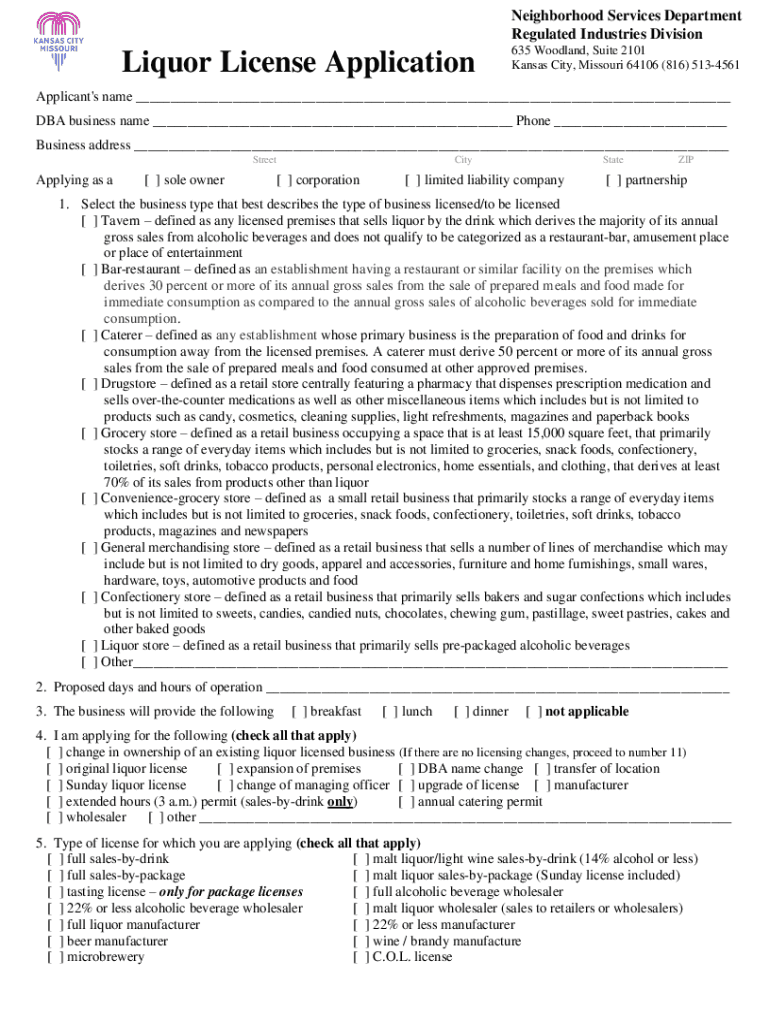

The Kansas liquor license application requires several key components to ensure compliance with state regulations. Applicants must provide detailed personal information, including full name, address, and contact details. Additionally, the application requires information about the business entity, such as the legal structure (e.g., LLC, corporation, partnership) and the physical location of the business where alcohol will be sold.

Furthermore, applicants must disclose any prior criminal history or violations related to alcohol sales, as this can impact eligibility. Financial disclosures, including proof of financial stability and tax identification numbers, may also be necessary. Understanding these key elements is crucial for a successful application process.

Eligibility criteria for the Kansas liquor license application

To qualify for a Kansas liquor license, applicants must meet specific eligibility criteria. Applicants must be at least twenty-one years old and possess a valid form of identification. Additionally, they should have no felony convictions related to alcohol or drug offenses within the past five years.

Business entities must also comply with local zoning laws and regulations, ensuring that the proposed location for alcohol sales is permitted. It is important for applicants to familiarize themselves with both state and local laws to ensure full compliance throughout the application process.

Application process and approval time

The application process for a Kansas liquor license involves several steps. First, applicants must complete the necessary forms, ensuring all information is accurate and complete. After submission, the application will be reviewed by the appropriate state or local authority, which may include background checks and inspections of the proposed business location.

The approval time can vary, typically ranging from a few weeks to several months, depending on the jurisdiction and the complexity of the application. It is advisable for applicants to follow up with the local regulatory agency to check on the status of their application and address any potential issues promptly.

Required documents for the Kansas liquor license application

When applying for a Kansas liquor license, several documents must be submitted alongside the application form. These documents often include proof of age, such as a driver's license or state ID, and a copy of the business entity's formation documents, like articles of incorporation or partnership agreements.

Additionally, applicants may need to provide a criminal background check, proof of financial stability (such as bank statements or tax returns), and a zoning approval letter from local authorities. Gathering these documents in advance can streamline the application process and help avoid delays.

Form submission methods for the Kansas liquor license application

Applicants for a Kansas liquor license have several options for submitting their application forms. The most common methods include online submission through the state’s regulatory agency website, mailing the completed forms to the appropriate office, or delivering them in person. Each method has its advantages and may affect the processing time.

Online submissions are often faster and allow for immediate confirmation of receipt. However, some applicants may prefer to submit by mail or in person to ensure all documents are correctly received and to ask any questions directly to agency staff.

Legal use of the Kansas liquor license

Once obtained, a Kansas liquor license allows businesses to legally sell alcoholic beverages within the state. However, it is essential for license holders to adhere to all state and local laws regarding the sale and distribution of alcohol, including hours of operation, age verification for customers, and responsible serving practices.

Failure to comply with these regulations can result in penalties, including fines or revocation of the liquor license. License holders should stay informed about any changes in legislation that may affect their operations to maintain compliance and ensure the continued legality of their business activities.

Quick guide on how to complete regulated industries kansas city mo 64106 fill out ampamp sign

Complete Regulated Industries Kansas City Mo 64106 Fill Out & Sign effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Regulated Industries Kansas City Mo 64106 Fill Out & Sign across any platform with airSlate SignNow Android or iOS applications and streamline your document processes today.

How to modify and eSign Regulated Industries Kansas City Mo 64106 Fill Out & Sign effortlessly

- Locate Regulated Industries Kansas City Mo 64106 Fill Out & Sign and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that require reprinting papers. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Regulated Industries Kansas City Mo 64106 Fill Out & Sign and ensure outstanding communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct regulated industries kansas city mo 64106 fill out ampamp sign

Create this form in 5 minutes!

How to create an eSignature for the regulated industries kansas city mo 64106 fill out ampamp sign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the new alcohol laws in Missouri?

A law was passed and took effect on August 28, 2021, allowing the sale of alcohol on Sundays between the hours of 6 AM and 1:30 AM on Sundays. Old law states that the selling of alcohol could only take place on Sundays between 9 AM and 12 AM.

-

Does Kansas City, MO require a business license?

Business licenses are required for all businesses in Kansas City. Certain other licenses are required for certain industries. You will also need a business license if you choose to work with the City of KCMO.

-

What are the alcohol laws in Kansas City MO?

New Alcohol Laws in Missouri Starting August 28, 2021, that law became permanent. Alcohol must be in a sealed, tamper-proof container. Missouri also changed Sunday alcohol sales from 9 a.m. to midnight to 6 a.m. to 1:30 a.m.

-

Can you walk around with alcohol in Kansas City Missouri?

Missouri does not have open container laws prohibiting alcohol on the street, though certain neighborhoods and principalities do not allow it. Likewise, no open container rule exists in the greater state of Missouri (though local areas may have specific rules).

-

What are the liquor laws in Kansas City MO?

Most municipalities, including St. Louis and Kansas City have enacted local laws following the state law, which prohibit the retail sale of liquor between 1:30 AM and 6:30 AM Tuesday through Saturday, and between midnight on Sunday and 9:00 AM the following morning.

-

How much is a business license in Kansas City MO?

For instance, if you're planning on starting a retail business in the city of Kansas City, you would need to apply for a business license (Form RD-100) through the Revenue Division of the City of Kansas City, Missouri. The cost for a general business license is around $50 annually, with a $25 application fee.

-

Do I need a liquor license for a private event in Missouri?

To ensure that alcohol sales at your event are legal, you must have two permits – a permit from Kansas City and a permit from the State of Missouri. Here is a better look at the types of permits you may need to acquire to be able to sell alcohol at your event.

-

Can you buy alcohol 24 7 in Missouri?

Liquor law in Missouri allows on- and off-premises sales from 6am to 1:30am every day of the year. Some bars and nightclubs with special licenses can serve until 3am with a special license, most of which are located in Kansas City, St. Louis, and Lake of the Ozarks.

Get more for Regulated Industries Kansas City Mo 64106 Fill Out & Sign

Find out other Regulated Industries Kansas City Mo 64106 Fill Out & Sign

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document