SUB CONTRACTOR SHEET REFEREE Form

Understanding the Subcontractor Information Sheet

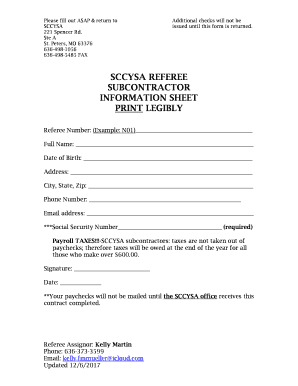

The subcontractor information sheet is a vital document used by businesses to collect essential details from subcontractors. This form typically includes personal identification information, business details, and tax-related data. It serves as a foundational tool for establishing a working relationship between a contractor and subcontractor, ensuring compliance with tax regulations and facilitating smooth payment processes.

Key Elements of the Subcontractor Information Sheet

When filling out the subcontractor information sheet, several key elements must be included:

- Contact Information: This includes the subcontractor's name, address, phone number, and email.

- Business Structure: Indicate whether the subcontractor operates as a sole proprietor, LLC, corporation, or partnership.

- Tax Identification Number: The subcontractor must provide their Social Security Number (SSN) or Employer Identification Number (EIN).

- Payment Information: Details regarding payment preferences, including bank account information for direct deposits.

- Services Offered: A brief description of the services the subcontractor will provide.

Steps to Complete the Subcontractor Information Sheet

Completing the subcontractor information sheet involves several straightforward steps:

- Gather necessary documents, such as identification and tax information.

- Fill out personal and business contact information accurately.

- Specify the business structure and provide the tax identification number.

- Detail payment preferences and services offered.

- Review the completed form for accuracy before submission.

Legal Use of the Subcontractor Information Sheet

The subcontractor information sheet must be used in accordance with applicable laws and regulations. It is crucial for ensuring compliance with IRS guidelines, as it provides necessary information for tax reporting purposes. Businesses should retain these forms for their records, as they may be required during audits or financial reviews.

Required Documents for Submission

When submitting the subcontractor information sheet, certain documents may be required to validate the information provided. These typically include:

- Proof of identity, such as a driver's license or passport.

- Tax documentation, including a W-9 form if applicable.

- Business registration documents, if the subcontractor operates under a business entity.

Form Submission Methods

The subcontractor information sheet can be submitted through various methods, depending on the preferences of the contractor or the subcontractor:

- Online Submission: Many businesses offer digital forms that can be filled out and submitted electronically.

- Mail: Completed forms can be printed and sent via postal service.

- In-Person: Subcontractors may also deliver the form directly to the contractor's office.

Quick guide on how to complete sub contractor sheet referee

Complete SUB CONTRACTOR SHEET REFEREE seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and efficiently. Manage SUB CONTRACTOR SHEET REFEREE on any device using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

How to modify and eSign SUB CONTRACTOR SHEET REFEREE effortlessly

- Find SUB CONTRACTOR SHEET REFEREE and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Adjust and eSign SUB CONTRACTOR SHEET REFEREE to guarantee outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sub contractor sheet referee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for SUB CONTRACTOR SHEET REFEREE

- Application for temporary beer wine permit indiana form

- Application for reinsurance intermediary broker or in form

- Indian emancipation forms

- Employee permit form

- Indiana cosmetologist restoration form

- Form 42946 indiana permit application for construction

- National id mma card form

- State of indiana alcohol permit type 900 form

Find out other SUB CONTRACTOR SHEET REFEREE

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free