Should I Claim Scholarships & Other Awards on My Taxes 2021-2026

Understanding the ASL Claim Center

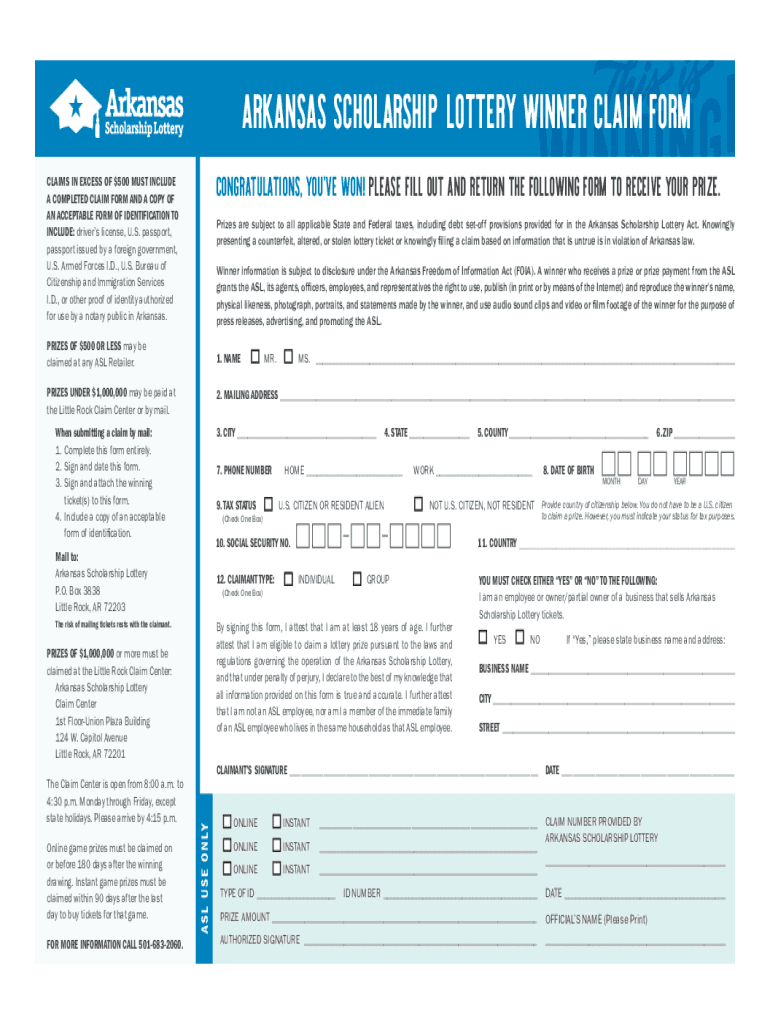

The ASL Claim Center is a designated facility that processes claims related to the Arkansas Lottery. It serves as a central hub for individuals who have won lottery prizes and need to claim their winnings. This center ensures that all claims are handled efficiently and in accordance with state regulations. It is important for winners to understand the procedures and requirements involved in claiming their prizes to avoid any potential delays.

Eligibility Criteria for Claiming Prizes

To successfully claim lottery winnings through the ASL Claim Center, individuals must meet specific eligibility criteria. Generally, claimants must be at least eighteen years old and possess a valid lottery ticket that has not been altered or damaged. Additionally, winners should ensure that their ticket is not a duplicate or has been reported lost or stolen. Understanding these criteria is crucial for a smooth claiming process.

Required Documents for Claim Submission

When visiting the ASL Claim Center, claimants need to bring certain documents to facilitate the claiming process. Essential documents typically include:

- A valid government-issued photo ID

- The original lottery ticket

- Any additional forms required by the lottery commission

Having these documents ready can significantly expedite the processing of claims and help prevent any complications.

Steps to Complete Your Claim

Claiming your lottery winnings at the ASL Claim Center involves several key steps. First, ensure that you have all required documents. Next, visit the center during its operating hours. Upon arrival, present your ticket and identification to the staff. They will verify your ticket and process your claim. Finally, you will receive your winnings, either as a lump sum or through a check, depending on the amount and your preference.

Legal Use of Lottery Winnings

It is important for winners to understand the legal implications of claiming lottery prizes. Lottery winnings are considered taxable income by the Internal Revenue Service (IRS). Therefore, winners should be prepared to report their earnings on their tax returns. Additionally, some states may have specific regulations regarding the anonymity of lottery winners, which can affect how claims are processed and reported.

IRS Guidelines for Lottery Winnings

The IRS has established guidelines for reporting lottery winnings. Winners must report the full amount of their winnings, regardless of whether they choose to take a lump sum or annuity payments. It is advisable for winners to consult with a tax professional to understand their obligations and to ensure compliance with federal tax laws.

Quick guide on how to complete should i claim scholarships ampamp other awards on my taxes

Complete Should I Claim Scholarships & Other Awards On My Taxes with ease on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Should I Claim Scholarships & Other Awards On My Taxes on any platform using airSlate SignNow’s Android or iOS applications and enhance your document-related processes today.

How to alter and electronically sign Should I Claim Scholarships & Other Awards On My Taxes effortlessly

- Obtain Should I Claim Scholarships & Other Awards On My Taxes and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks, from any device you prefer. Modify and electronically sign Should I Claim Scholarships & Other Awards On My Taxes and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct should i claim scholarships ampamp other awards on my taxes

Create this form in 5 minutes!

How to create an eSignature for the should i claim scholarships ampamp other awards on my taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do scholarships affect tax credits?

Students may choose whether to treat their scholarships as used for tuition and related fees (tax-free, but reduces expenses for credits) or as used for living expenses (taxable, but does not reduce expenses for credits).

-

Do scholarships count as awards on a resume?

DO INCLUDE AWARDS - List any awards, scholarships, or related commendations under the appropriate section of your resume. Fraternal affiliations and elected positions can also be included, where appropriate, under Education or under the specific job title where you received the awards.

-

What is considered an award?

It can also be a object such as a certificate, diploma, championship belt, trophy or plaque. The award may also be accompanied by a title of honor, and an object of direct cash value, such as prize money or a scholarship.

-

Are financial aid awards taxable?

Most students are not required to report student aid on their Free Application for Federal Student Aid (FAFSA®) form because most scholarships and grants are not taxable, unless those award amounts exceed the total amount the student paid for tuition, fees, books, supplies, and required equipment.

-

Are scholarships considered awards?

Scholarships are merit-based, need-based, and non-need-based monetary awards.

-

Do scholarships count as awards?

In terms of listing it on your college applications, a scholarship can be considered both an award and an honor.

-

What counts as awards and honors in college?

Examples of college awards and honors? National Merit Scholar or Commended Student. AP Scholar (with distinction, honor, etc.) Honor Roll or Principal's List. State or regional academic competition awards (e.g., Science Olympiad, MathCounts) Subject-specific awards (e.g., school Chemistry or History awards)

-

Should you report scholarships on taxes?

Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If filing Form 1040 or Form 1040-SR, include the taxable portion in the total amount reported on Line 1a of your tax return.

Get more for Should I Claim Scholarships & Other Awards On My Taxes

- Cfa official show entry form cat fanciers39

- Property contract template form

- Property investment contract template form

- Property maintenance contract template form

- Property management contract template form

- Property manager contract template form

- Property purchase contract template form

- Property option contract template form

Find out other Should I Claim Scholarships & Other Awards On My Taxes

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online