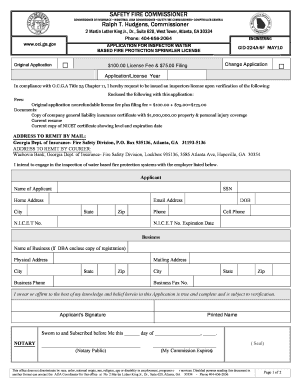

Georgia Insurance Commissioner Form

What is the Georgia Insurance Commissioner

The Georgia Insurance Commissioner is a state-level official responsible for overseeing the insurance industry within Georgia. This role involves regulating insurance companies, ensuring compliance with state laws, and protecting consumers from unfair practices. The commissioner also manages the licensing of insurance agents and brokers, as well as the approval of insurance products and rates. This office plays a critical role in maintaining the integrity and stability of the insurance market in Georgia.

How to Use the Georgia Insurance Commissioner

Utilizing the services of the Georgia Insurance Commissioner can be beneficial for both consumers and insurance professionals. Consumers can file complaints against insurance companies, seek assistance with claims, and access resources related to insurance policies. Insurance agents and brokers can find information on licensing requirements, continuing education, and regulatory updates. The commissioner's office provides various online resources, including forms and guidelines, to facilitate these processes.

Steps to Complete the Georgia Insurance Commissioner Process

To engage with the Georgia Insurance Commissioner, follow these steps:

- Visit the official website of the Georgia Insurance Commissioner.

- Determine the specific service you need, such as filing a complaint or applying for a license.

- Gather all required documentation related to your request.

- Complete the necessary forms, ensuring all information is accurate and up-to-date.

- Submit your forms online, by mail, or in person, depending on the service.

- Monitor the status of your submission through the provided tracking options.

Legal Use of the Georgia Insurance Commissioner

The legal framework governing the Georgia Insurance Commissioner encompasses various statutes and regulations that guide its operations. This includes the authority to enforce insurance laws, investigate consumer complaints, and impose penalties for non-compliance. Understanding these legal parameters is essential for both consumers and insurance providers to ensure adherence to state regulations and protect their rights.

Required Documents

When interacting with the Georgia Insurance Commissioner, specific documents may be required based on the nature of your request. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Insurance policy documents for claims or complaints.

- Completed application forms for licensing or product approval.

- Any supporting documents relevant to your case or inquiry.

Eligibility Criteria

Eligibility criteria for various services offered by the Georgia Insurance Commissioner can vary. For instance, individuals seeking to file a complaint must be policyholders or affected parties. Similarly, insurance agents must meet specific qualifications, including educational and experience requirements, to obtain a license. It is important to review the eligibility guidelines specific to your situation to ensure compliance and successful processing of your request.

Quick guide on how to complete georgia insurance commissioner

Effortlessly Prepare Georgia Insurance Commissioner on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, alter, and electronically sign your documents swiftly and without delays. Manage Georgia Insurance Commissioner on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to Edit and eSign Georgia Insurance Commissioner with Ease

- Obtain Georgia Insurance Commissioner and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or mask sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information, then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Georgia Insurance Commissioner to guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia insurance commissioner

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who do you report an insurance company to in Georgia?

The Consumer Services Division may be able to help you resolve your insurance complaint. The Consumer Services Division is the investigative arm of OCI. Our job is to ensure fair and equitable dealings between insurers, agents, and policyholders.

-

What does the Georgia Insurance and Safety Fire Commissioner do?

The Office of Insurance and Safety Fire Commissioner licenses and regulates insurance companies; ensures that insurance rates, rules, and forms comply with state law; investigates suspicions of insurance fraud; and conducts inspections of buildings and houses to prevent fire outbreak.

-

Who do you report an insurance company to in Georgia?

The Consumer Services Division may be able to help you resolve your insurance complaint. The Consumer Services Division is the investigative arm of OCI. Our job is to ensure fair and equitable dealings between insurers, agents, and policyholders.

-

Who regulates insurance rates in Georgia?

Office of Insurance and Safety Fire Commissioner The Office of the Commissioner of Insurance handles questions and complaints regarding specific insurance providers, insurance rates or policies, and the licensing of companies and agents.

-

What is the purpose of the Georgia Department of Insurance?

The mission of the Office of the Insurance and Safety Fire Commissioner (OCI) is to protect Georgia families by providing access to vital insurance products and safe buildings through fair regulation that creates economic opportunities for all Georgians.

-

How much does the Georgia Insurance Commissioner make?

Georgia Insurance and Safety Fire Commissioner Office Type: Partisan Office website: Official Link Compensation: $160,000 2024 FY Budget: $222,184,57614 more rows

-

Who is the Insurance Commissioner in Georgia?

Georgia Insurance and Safety Fire Commissioner Current Officeholder John King Elections Next election: November 3, 202614 more rows

Get more for Georgia Insurance Commissioner

- Speech therapy case history form

- Oklahoma legal last will and testament form for divorced and remarried person with mine yours and ours children

- Speed credit pte ltd form

- Vps sample logic form

- Customer agreement form for new land line telephone connection

- Sea scout quartermaster form

- Club bylaws for aktion club pdf kiwanis international form

- Magician contract template form

Find out other Georgia Insurance Commissioner

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer